-

Sterling finds support as U.K. PM seeks to prop up government

-

Treasury yields steady as Fed meeting starts; gold slips

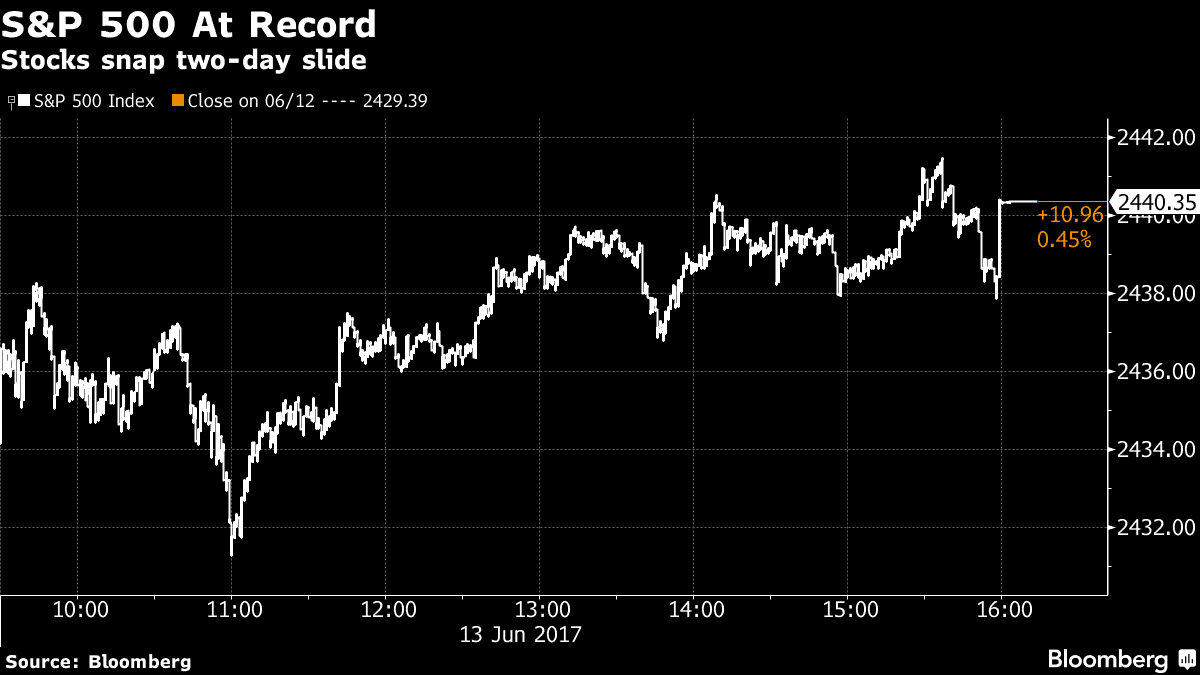

U.S. stocks snapped a two-day slide to close at fresh records as technology shares rebounded from the worst drop of the year. The dollar weakened and Treasuries were steady as the Federal Reserve policy meeting kicked off.

The Dow Jones Industrial Average and the S&P 500 Index ended at all-time highs, while the Nasdaq 100 Index bounced back from its biggest two-day drop since September. European and emerging-market equities advanced. Sterling rose for the first time since the U.K. election. Ten-year Treasury yields held near 2.21 percent and the dollar slipped versus major peers before the Fed is projected to raise rates Wednesday.

The rebound in tech shares carried through to U.S. trading, affording investors a break from the selloff as the sector resumed its rose as the key driver of global equity gains. Drama in Washington continued to demand attention, with U.S. Attorney General Jeff Sessions slated to testify to lawmakers.

He will likely face pressure to explain his role in the firing of James Comey and contacts that he and associates of President Donald Trump had with Russian officials, with markets looking for any indication that the administration’s business-friendly agenda will be delayed.

Here are the key events investors will be watching this week:

- Fed policy makers are expected to raise their benchmark interest rate for the second time this year on Wednesday. Since that’s widely anticipated, the more market-sensitive elements of the meeting will relate to signals on future policy — either the path for rates or plans to cut the $4.5 trillion balance sheet.

- Central banks in Japan, Switzerland and Britain are also scheduled to weigh in with policy decisions this week.

Here are the main moves in markets:

Stocks

- The S&P 500 added 0.5 percent to 2,440.35 as of 4 p.m. in New York. The Dow rose 92.80 points to 21,328.47.

- The Nasdaq 100 climbed 0.8 percent, rebounding from its worst two-day drop of the year. It’s still 2.3 percent below it’s all-time high.

- The Stoxx Europe 600 Index rose 0.6 percent, after dropping 1 percent on Monday. Tech shares rose 1.6 percent.

- MSCI’s Emerging Markets Index added 0.1 percent.

Currencies

- The pound strengthened 0.8 percent to $1.2755 after sliding 0.7 percent on Monday; it stayed higher as U.K. data showed inflation resumed its upward march last month.

- The euro was flat at $1.1209.

- The Bloomberg Dollar Spot Index fell by 0.2 percent.

- The yen dropped 0.1 percent to 110.05 per dollar, after Monday’s 0.3 percent gain.

Bonds

- The yield on 10-year Treasuries was little changed at 2.21 percent; before today it climbed for four straight sessions.

- German benchmark yields rose two basis points and French yields rose one basis point, while U.K. yields added seven basis points.

Commodities

- West Texas crude futures rose 0.8 percent to settle at $46.46, as OPEC reported rising production, offsetting expectations of a further decline in U.S. stockpiles.

- Gold slipped 0.1 percent to $1,268.50, its fifth day of losses and the longest losing streak in a month as investors anticipate a Fed rate hike.