Stocks most owned by hedge funds and mutual funds managing nearly $4 trillion are handily beating the market this year, according to Goldman Sachs.

“Both mutual funds and hedge funds have enjoyed strong YTD returns … Key sector overweights lead to outperformance,” strategist David Kostin wrote in a note to clients Friday. “High allocations to the Information Technology sector have boosted fund returns this year.”

Technology is by far the favorite industry. Both hedge funds and large-cap mutual funds allocated 26 percent of their assets to the sector, which is up 24 percent this year through Thursday compared with the S&P 500’s 8.9 (^GSPC) percent gain in the same time period.

“Popular technology stocks … remain an important part of hedge fund and mutual fund portfolios,” he wrote. “Facebook (FB) and Alphabet (GOOGL) are constituents of both our Hedge Fund VIP and Mutual Fund Overweight baskets.”

Kostin said the Goldman “Hedge Fund VIP” list and “Mutual Fund Overweight Positions” basket are up 18 percent and 16 percent this year, respectively. The lists consist of the stocks hedge fund and mutual fund managers are overweight versus the market indexes.

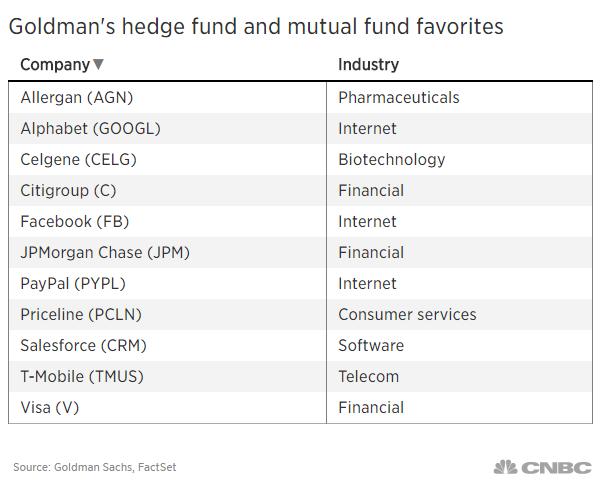

Here are the 11 stocks hedge funds and mutual funds are betting on according to the Goldman “Hedge Fund VIP” and “Mutual Fund Overweight Positions” lists. Goldman says its analysis covers $1.9 trillion in hedge fund assets and $2.0 trillion in mutual fund assets.

Correction: The S&P 500 was up 8.9 percent this year through Thursday. An earlier version misstated the figure.