It launched on the CBOE Futures Exchange in Chicago at 23:00 GMT Sunday, allowing investors to bet on whether Bitcoin prices will rise or fall.

In the lead-up to its futures debut, the value of the digital currency has surged.

Bitcoin’s introduction to the CBOE has been seen by some as a step towards legitimising the currency.

The move is expected to be followed next week by a rival listing on the Chicago Mercantile Exchange.

Anticipation of the first mainstream listings have helped the controversial currency soar past $10,000 and then over $17,000 on Thursday before retreating. Bitcoin was trading at about $15,230 on Monday, according to Coindesk.com.

- What’s behind the Bitcoin gold rush?

- ‘I’m part of a crazy wave’

- Rory Cellan-Jones: risky bubble, or the future?

Nick Colas, of Data Trek research, said the futures listings gave Bitcoin “legitimacy – it recognises that it’s an asset you can trade”.

Futures are a type of derivative contract that allows trading based on movements in Bitcoin prices, without requiring ownership of the currency itself.

The start of the CBOE market was low key, with “no champagne”, an exchange insider said.

However, CBOE tweeted to warn that its website was running slowly and could be temporarily unavailable, but that all trading systems were operating normally.

What is Bitcoin?

- It is a digital “alternative” currency that mostly exists online and is not printed or regulated by central banks

- Bitcoins are created through a complex process known as “mining” and then monitored by a global network of computers

- About 3,600 new Bitcoins are created each day, with about 16.5 million now in circulation

- Like all currencies, its value is determined by how much people are willing to buy and sell it for

The CBOE and CME launches were made possible following approval by the US Commodities and Futures Trading Commission (CFTC).

However, the regulator has warned investors about the “potentially high level of volatility and risk in trading these contracts”.

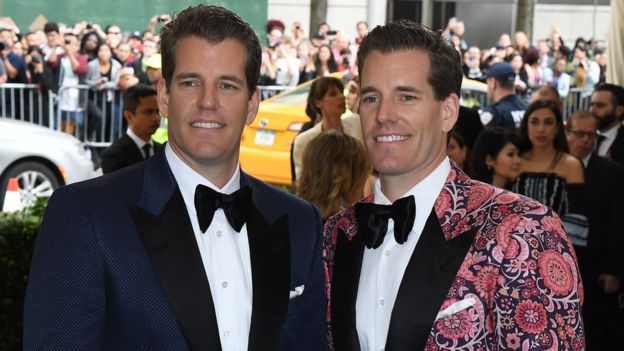

Its supporters include the Winklevoss twins, who have been called the first Bitcoin billionaires, while critics include CNBC financial commentator Jim Cramer.

He argues that futures trading opens the door to “short sellers” that bet on downward moves in asset prices.

Bitcoin is not regulated by any country’s central bank and has no universally recognised exchange rate.

CBOE said trading will be suspended for two minutes if Bitcoin prices rise or fall by 10% in a bid to reduce wild fluctuations.

“We are committed to continue to work closely with the CFTC to monitor trading and foster the growth of a transparent, liquid and fair Bitcoin futures market,” the CBOE said.

The Futures Industry Association, which includes some of the world’s biggest derivatives brokerages, has criticised the CFTC’s decision, arguing that insufficient attention has been paid to the risks involved.