It’s been a record-breaking year for the markets as the major indexes track for their best annual performances since 2013.

With the Dow sitting just a hair below yet another major milestone — 25,000 — Rich Ross of Evercore ISI says there are three names that could propel the index to new heights.

Oldies but goodies

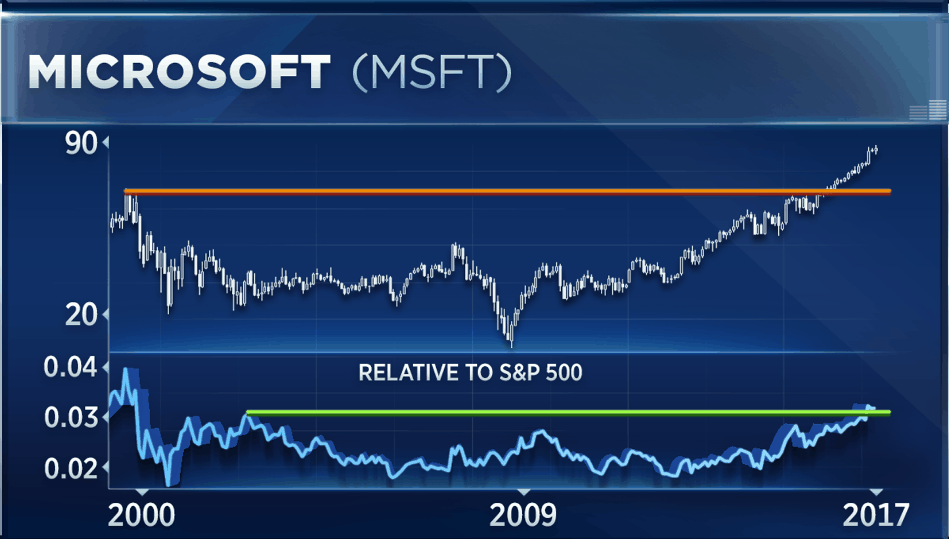

First, Ross pointed to a ’90s tech darling: Microsoft.

“It really doesn’t get any better than this,” he said Wednesday on CNBC’s “Trading Nation.”

According to the technician, the stock has just broken out of a 17-year base, which he says is a rare occurrence. But on top of that breakout, Microsoft has just recently become an outperformer relative to the market as a whole.

Another old-school tech play in the Dow that Ross believes is worth buying is chip stock Intel. “We’re looking at another multiyear base breakout here, an impulsive move coming out of the pattern [and into] a textbook bullish flag continuation pattern,” he said. “We bought the dip, now we’re going to buy the rip in Intel.”

Another old-school tech play in the Dow that Ross believes is worth buying is chip stock Intel. “We’re looking at another multiyear base breakout here, an impulsive move coming out of the pattern [and into] a textbook bullish flag continuation pattern,” he said. “We bought the dip, now we’re going to buy the rip in Intel.”

Feeling re-energized

Lastly, Ross looked at Chevron as the best play for investors looking to get into the energy space. The big oil name is only up about 6 percent year to date and Ross believes it is set for a rally going into 2018.

“You can see this big base that’s formed over the last year, kind of your classic cup and handle,” he said. “And once again, [you have a] textbook flag here.”

This, along with oil inching back toward $60 and possible rising inflation expectations in the air, leads Ross to see Chevron as a strong energy buy.

Chevron was up more than 3 percent Thursday.