The idea of getting rich quick appeals to everyone. Unfortunately, while there are folks who can ride a bubble from bottom to top, not everyone profits when the market for something gets overheated.

This is not a new phenomenon. If you were awake during history class, you may recall mention of tulpenmanie, which is Dutch for tulip mania. Tulips arrived in Holland for the first time in the late 16th century. They were unusual, pretty, popular, and pricey.

A few years after they were introduced, a minor virus started to cause the bulbs to change color and display flame-like decorations. This caused the value of the already pricey and desired flowers to increase considerably.

Because prices and demand were going up, some of the usual sales channels (the 17th century equivalent of retail garden centers) bought up the available supply. The supply of tulips subsequently dried up, and we all know how supply and demand works.

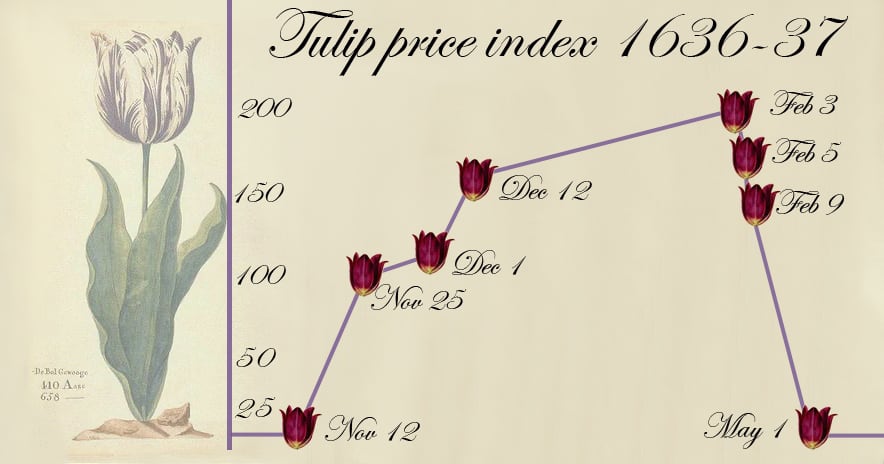

As the fiery tulips became even harder to come by, the price shot up even more. At the height of tulip demand in Holland, in 1637, a lucky investor could trade a single tulip for the title to an entire estate.

Once the tulip bubble reached ridiculous levels, many of the speculators decided to sell their holdings and cash out. As more and more speculators dumped their holdings, the value of the tulip dropped. Within a very short time, the tulips that were once worth as much as a country estate were worth little more than the cost of an ordinary onion.

While the idea that people would put their life savings into tulips seems preposterous, the result of the tulip craze was that many folks lost their shirts (and everything else). People put all their money and property into tulips, and when the market crashed, they were left with… tulips. Not exactly something you can live on.

So now, let’s talk about cryptocurrency. The big name in all this is Bitcoin, but you may have heard of Ethereum, Litecoin, Ripple, Zcash, Dogecoin, and even Potcoin. All of these are built out of a storage structure known as blockchain. They are all, fundamentally, software… files on computers and servers.

They’re not backed by silver or gold, or by anything, in fact, except enthusiasm and the willingness of enough people to trade in them. In a sense, they’re like any other currency in that the value of an economic system is based on the idea that a large enough group of people are willing to share the fantasy that there’s value in the item being traded. If you’ve ever traded a piece of paper (say, a $20 bill) for a steak, you can see the relationship between shared value and real goods.

Most nations’ currencies are backed by items of what can be considered real value. For example, the US dollar is backed by gold (unless you listen to Ron Paul, who has long maintained that Fort Knox is empty). But here’s the thing: Where’s the value in gold and silver? They, too, are valuable only because we believe them to be. They’re tangible and hard to come by. You can hold silver and gold coins in your hand or bury them in the ground, and they actually serve some purpose in manufacturing and production.

But cryptocurrencies? They’re really just code. They’re even less tangible than tulips.

Governments are wary of cryptocurrencies, because they bypass all the usual regulation, taxation, and “follow-the-money” capabilities of law enforcement. This, of course, is why such currencies are valuable to certain criminal elements, as well as activists and others who want to trade money and avoid government scrutiny. When PayPal and credit card providers wouldn’t provide services to Bitcoin, the rogue archive turned to Bitcoin.

In the past few days, we’ve seen a substantial market “correction” in the soaring values of Bitcoin and most other cryptocurrencies. Both South Korea and China have started to crack down on cryptocurrency trading, and it’s inevitable that other governments will take action, either regulating or banning these new currencies.

All that leads us to the single most important thing you need to know about Bitcoin, Ethereum, and all those other cryptocurrencies: You could lose your shirt (and everything else).

If you’re careful and cautious and only invest what you can afford to lose, it’s certainly OK to make a speculative investment.

But when we’re starting to hear that folks like the housekeeper profiled in this New York Times article are investing their entire life savings into cryptocurrencies, with no recourse if the market crashes, it’s really important to repeat the warning: You could lose your shirt.

Who knows, that housekeeper could someday buy CBS. But the more likely eventual result, if not for her than for many others, is that money put into some of these cryptocurrencies is money that will turn to dust, much like those tulips from the 1600s are now merely dust in the wind.