MELISSA Browne is an accountant and financial adviser, but that doesn’t mean she was brilliant with her own money. In fact, she learned the hard way how to sort out her own finances. She’s sharing her experience and tips in a new book Unf*ck your Finances, published by Allen & Unwin on 24 January. Below is an extract detailing the 10 ways she broke up with money.

1. Do a financial detox.

If you’re going to break up with someone you need space and time apart. You need to unfollow them on social media and start to separate your life from theirs. It’s no different with money. In order to break up with money I recommend you begin with a financial detox. This will enable you to realise how you act with money and press ‘reset’. A detox isn’t anything fancy or spiritual. It’s simply thirty days of buying nothing new or non-essential. And no, shoes are not essential.

2. Understand how you think and feel.

You may have heard about emotional eating — well, emotional spending is just as bad for your health. Thoughts like, ‘It’s been a tough month, I deserve something pretty’; or ‘I work hard, I deserve a $100,000 car’; or ‘My child won’t succeed without us spending $40,000 per year on schooling’ aren’t helpful for you, your family or your wallet. It’s also important to understand how you think about money. Perhaps you’ve been brought up to believe ‘a man always takes care of a woman financially’, ‘people with too much money are selfish’, or ‘money is the root of all evil’. If you don’t understand how you think about money you could be unconsciously sabotaging your relationship with it. It’s about taking the time now to become aware of the money messages you’ve either subconsciously or consciously received and are carrying around with you.

3 Understand your values.

If you want to transfer your feelings from money onto something more worthwhile, make a list of what you value in life. Maybe it’s freedom, family, security, influence or loyalty. Once you’ve worked out what your values are you’re going to take a look at your goals and decide whether they fit with your values. Sometimes we just parrot goals because they’re ones we think we should have. So ‘I want to own my own home’ is many people’s goal — but is it really true for you? Or is it just what you think you should want? If one of your values is the freedom to chase your dream job around the globe, then sure you may want to own property (such as an investment property), but owning your own home might not be right for you now.

4. Work out your goals.

At some point, a couple will work out together where their relationship is heading. If you want to start thinking about what your new relationship with money might look like, then it’s important to work out what your goals are in life. I appreciate it’s tough to look too far ahead but I believe twelvemonth and three-year goals are essential. Together we’re going to look at the best way to do this and, most importantly, we’re going to make sure they’re goals you’re actually excited about.

5. Work out a plan.

Sometimes goals and values can seem so far removed from your current situation that it’s easier to just buy a cocktail and continue as you are. Maybe go ahead and order the cocktail — but once you do we’re going to work out how much money it will take to effect the plan you’ve set, and how long it will take to action it. So, if your goal means you need $10,000 in twelve months’ time, that means you need to save $200 per week. In this step we’re going to turn money into something a little bit sexy and, perhaps, even something you might want to bring out on a date once in a while. Plans based on goals and values are attractive to us because they’re meaningful. We’re also going to look at different ways you can save money and different ways to invest your money. That’s because you may have a goal but absolutely no idea of the best way to get there. Which is where planning and strategy kicks in.

6. Understand how you’re spending.

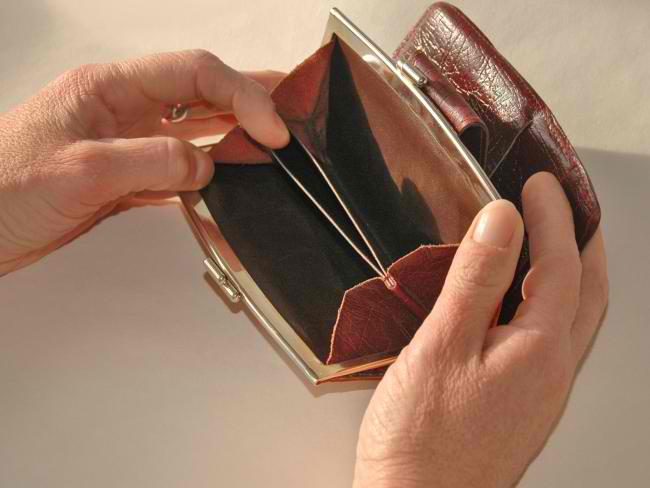

If you’re in a bad relationship you need to face up to exactly what’s going on and why it’s not working. It’s the same with money. After your financial detox it’s time to understand where your money is going by tracking your spending using one of the many Cloud-based solutions available. This means you can start to recognise the behaviours and decisions that have f *cked up your current relationship with money so you can do something about them with your new relationship. Now, before you start to itch, I didn’t mention the B word. I’m not talking about a budget here. Instead, it’s about becoming aware of how you’re spending your money and knowing exactly where it’s going.

7. Start to become a conscious consumer.

Working out a plan is great, but unless you’re monitoring it regularly it’s too easy to go off track. Together we’re going to work out a time (potentially every month) to check how you’re going, see if you’re on track and make any necessary adjustments. After all, it’s far easier to lose a kilo as soon as it sneaks on than to get rid of 20kg accumulated over time. By jumping on the scale with your money regularly you’ll be able to keep your eye on it and make adjustments before you feel as though it’s a lost cause.

8. Remove yourself from temptation.

I don’t have any chocolate in the house because I have absolutely no willpower. Sure, I could decide I want to get tougher and purposely keep it in the house, but I’d be beating myself up daily because I know I’d eat it. It’s the same with money. If you know you never window-shop but always window-buy, then don’t window-shop. If you know that brunch with girlfriends always ends up as a Saturday afternoon shopping trip, suggest to them that you move brunch to a retail-free location instead. In this step we’re going to look at removing temptation now that you know what you want, rather than continually waving a big stick at yourself.

9. Seek help from a relationship counsellor (aka money expert).

Sometimes relationships just end up toxic and messy and we can’t extract ourselves. It can be the same with money. You might have a go at all of the above and it just doesn’t work for you — or you might know yourself well enough to know you need help from the start. We’ll work out who you can talk to, what makes a great financial adviser and what they should offer to help you break up with money. It’s also figuring out who are the best people in your life to recruit as your potential money mentors, cheerleaders, supporters and coach to make the going easier.

10. Consistently monitor, gauge, adjust and track.

Establishing a healthy respect for money is a great thing to do. But just doing it once, giving yourself a big pat on the back and then getting back into the same old habits won’t get you anywhere. So that you don’t end up back in the same place you started (or worse), we’re going to figure out how to make this a lifetime quest to not only keep your money under control, but also create an amazing relationship with it so that it gives you more freedom, empowerment and options. Three things I know most people want more of.