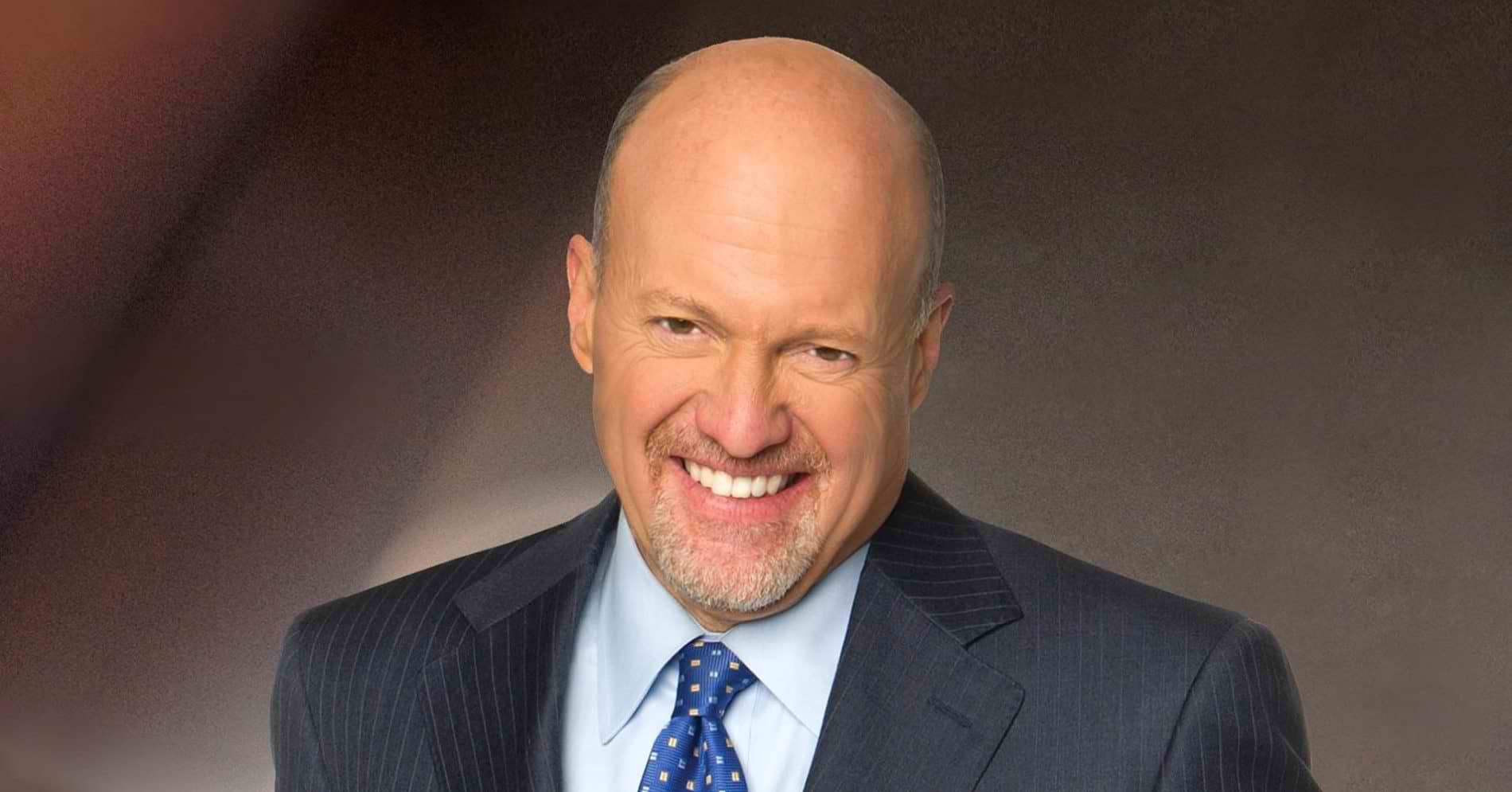

It used to be an unspoken rule for investors to sell stocks at the first sign of negative news, but sometimes, the rules have to change, CNBC’s Jim Cramer said Tuesday.

“This time is indeed different, which means you can’t take your cue from the playbook that worked in more troubled times,” the “Mad Money” host said. “We’ve developed a vicious tendency to want to give up on stocks of companies that slip up, especially after big moves … but you know what? These days, that tendency will lead you astray.”

In a market that brushes off weak earnings reports and formerly market-rattling events, Cramer said that having long-standing biases about certain companies and stocks can hurt investors.

One example of this was the recent action in Facebook’s stock after the company’s CEO, Mark Zuckerberg, announced sweeping changes to the social media website’s News Feed.

Zuckerberg wrote in a Facebook post that the move was meant to curb “sensationalism, misinformation and polarization” on the platform and promote “meaningful” user interactions.

Shares of Facebook instantly fell on the news, sliding from $187 a share to $177 in the days following the announcement.

But Cramer argued that Zuckerberg was making a smart move reacting to public opinion, much of which has soured on Facebook in favor of its more youthful platform, Instagram.

“Zuckerberg was responding to Facebook’s need to restore its reputation in order to stay off a potential deceleration in the business. This move he announced is a good thing and will most likely lead to higher ad rates as advertisers push for a better user experience and, therefore, exposure to the company’s precious worldwide audience,” Cramer said.

“Of course the stock has come back with a vengeance,” he contineud. “It’s up more than $1 from where it was when Zuckerberg made the pronunciation of death.”

Big tech companies aren’t the only ones falling victim to bias. Cramer pointed to two consumer goods companies also under undue pressure: Procter & Gamble and Johnson & Johnson.

With activist Nelson Peltz joining Procter & Gamble’s board and CEO David Taylor steadying the ship, the company’s weak quarter simply means the recovery is still ahead, Cramer argued, adding that investors are getting a good buying opportunity.

Johnson & Johnson’s post-earnings weakness was caused in part by a patent conflict over one of its key drugs, Remicade. But Cramer also attributed that decline to weak-handed sellers.

“This is precisely when you want to buy a stock like Johnson & Johnson,” Cramer said. “Sure, I know there will be some doofus that will cut numbers tomorrow and tell you to get out of the stock because of the loss of exclusivity. That’s what Wall Street does. … But this stock rarely ever comes down, and what is this management going to do other than find more ways to make you money?”

The “Mad Money” host acknowledged how shocking it can be to see these stocks fall, especially for people who remember a time when investors were more inclined to sell on a whim.

“This bull market is like nothing we’ve seen since the great rallies of the ’80s and ’90s,” Cramer said. “If you take your cue from the last decade, you’re going to miss out on some incredible opportunities. You’ll be blind to them. We’re now in a world where bad news is good news, because bad news is the only thing that gives you enough of a meaningful pullback that you can pull the trigger.”