The music business stinks, and that’s been great for consumers.

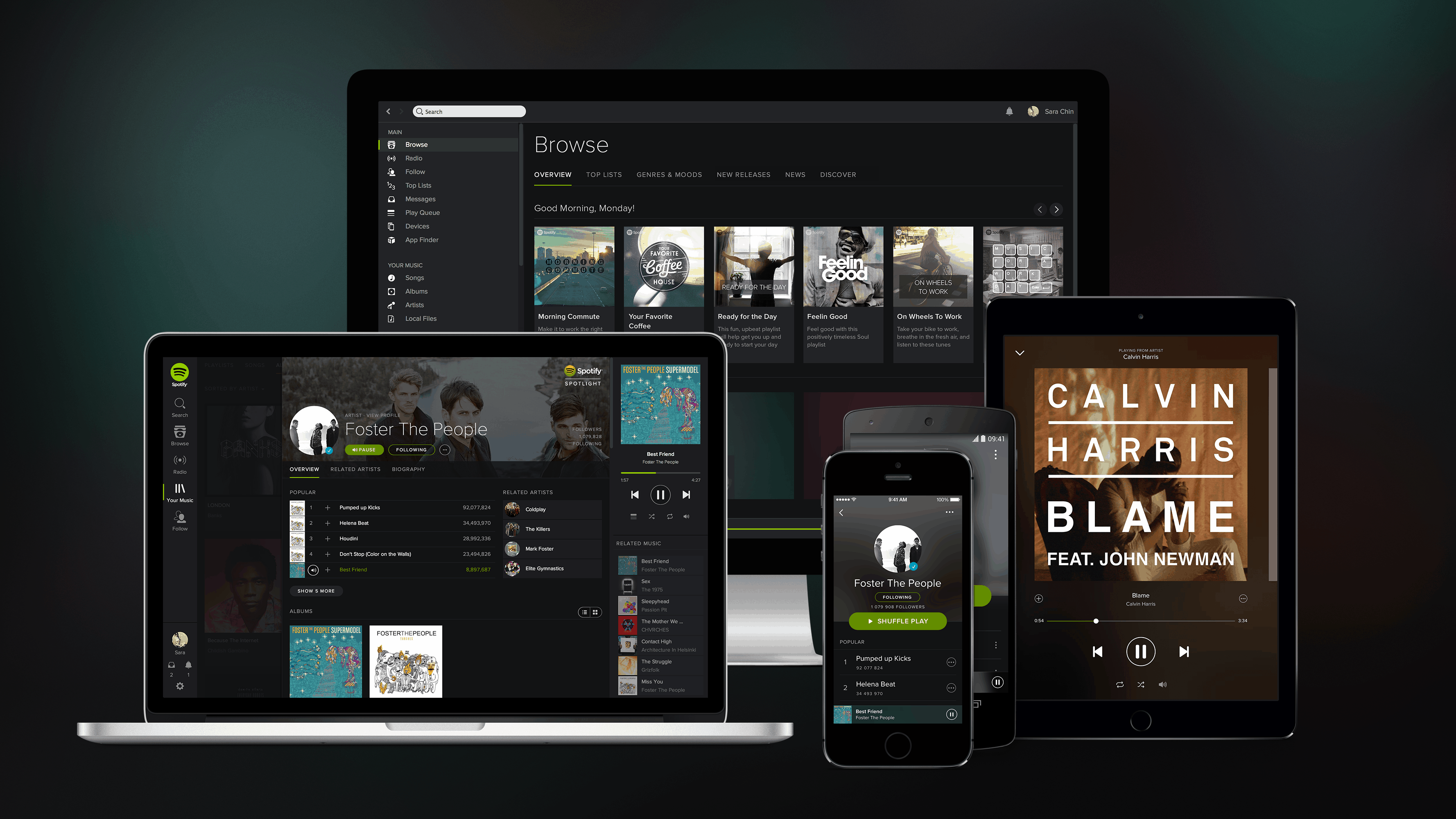

Tens of millions of listeners have been tuning into on-demand, ad-supported songs on music services such as Spotify. Millions more have been paying for music subscriptions, shelling out around $10 every month for unlimited music.

But the companies offering the services can’t turn a profit, and that means we might have to start looking at new ways to consume music in the coming years. So enjoy Pandora, Spotify and iHeartRadio while you’ve got them.

Spotify, which is the No. 1 music subscription service in the world, just filed papers to sell shares on Wall Street as SPOT.

The filing shed light on the economics of the streaming business, which has crushed traditional music sales, from CDs to downloads. The takeaway: lots of money comes in, but most goes straight out the door to record labels, artists and music publishers, who all have been saying for years that they don’t get enough. They want more.

Spotify has 71 million paying subscribers and has been able to fight off competitors like Apple, Google, Amazon and others, despite the many advantages the well-heeled rivals have. Apple, for instance, has sold over 1 billion iPhones. Every time an owner hits the music icon, Apple offers to sell them an Apple Music subscription.

Yet the gap between No. 1 Spotify at 71 million and No. 2 Apple at 36 million is quite wide.

In the end, will that be enough? Apple, Google and Amazon can afford to have loss leader music services, as another way to hold onto consumers and sell them other things, while Spotify doesn’t have another product to pitch.

Paul Resnikoff, the publisher of the Digital Music News blog, believes Spotify can start turning the corner financially at 100 million subscribers.

If it gets there, Spotify will still be looking at some very thin margins. Resnikoff says 73% of every subscription goes to the labels, music publishers and artists, which leaves just 27% for overhead, salaries and costs of doing business.

The labels want to see Spotify succeed, he says, and have a viable competitor to Amazon, Apple and Google. “I’m optimistic Spotify can pull it off,” he says.

But history isn’t promising. Pandora (P) has been struggling for years. The ad-supported radio service has been around since 2000, is on virtually every major consumer device you can name, from smartphones and connected speakers to smart TVs, but it can’t make money either.

It reported $1.4 billion in revenue for 2017 and a loss of $518 million.

Maybe Spotify could make up the difference with selling more ads? Fat chance.

Spotify said in its filing that despite having over 92 million monthly active users for its free service, some 90% of all revenues come from the paid subscriptions.

Spotify made about $511 million in revenues in 2017 from the ad service, vs. $4.5 billion for the premium service. So even if Spotify doubled its free audience, to 180 million, maybe it could get to $800 million in ad revenues. That certainly wouldn’t help much in denting that $1.5 billion in losses.

Certainly the future for Pandora is bleak, and Spotify didn’t do a great job in outlining ways to make money in its F1 filing. It basically said these are early days for digital music subscriptions and that there is much growth to be had.

Readers, enjoy the free and unlimited subscription music while you’ve got it. Remember the days of paying $10 and $15 for records and CDs? Music subscriptions are the best deal ever. Let’s hope they last.