The market may have faced a brutal decline on Friday led by the stock of Apple, but CNBC’s Jim Cramer knows investors could handle a dip in the stock of the world’s largest company.

“And we can handle the yield on the 10-year Treasury surging ever closer towards 3 percent. But we can’t handle both in the same day,” the “Mad Money” host said. “Hence today’s shellacking.”

Cramer blamed the algorithmic processes that direct machines to sell stocks and buy bonds when Treasury yields approach 3 percent, noting the influx of good earnings reports that happened ahead of the weekend.

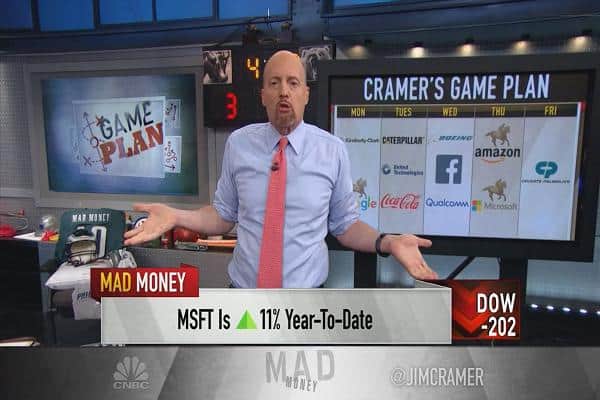

Monday: Kimberly-Clark, Alphabet

Kimberly-Clark: If Kimberly-Clark is anything like its consumer product companions, its stock is not going down despite being off 25 percent from its highs, Cramer said.

“The maker of Kleenex sits right at the epicenter of two of this market’s biggest problems: those consumer products companies are being slammed on pricing because of competition … and they’re also experiencing higher raw costs,” Cramer said.

“If Kimberly-Clark misses [earnings estimates on Monday], the negative saga continues for the whole group,” he continued.

Alphabet: Google parent Alphabet will also report earnings as it approaches Cramer’s arbitrary midpoint for the race to a $1 trillion market cap.

“Expectations have been lowered enough and the stock’s done little — it’s up 2 percent this year — that an actual in-line number may cause its stock to rally,” the “Mad Money” host said.

Tuesday: Caterpillar, United Technologies, Coca-Cola

Caterpillar: Cramer hoped to hear Caterpillar executives address rising raw costs and China worries on the conference call after the construction equipment giant reports earnings.

United Technologies: Ahead of the aircraft manufacturer’s Tuesday earnings report, Cramer wanted to hear more from United Technologies CEO Greg Hayes about the company’s widely anticipated breakup.

Coca-Cola: Beverage giant Coca-Cola could help stem the decline in the consumer products space with its earnings report, Cramer said.

“This company has made some critical changes in its structure to unlock more value and we’ll know if these moves are paying off when new CEO James Quincy gives us the skinny,” he said.

Wednesday: Boeing, Facebook, Qualcomm

Boeing: Aerospace colossus Boeing will report on Wednesday, and Cramer would feel much better about the company’s report if it weren’t for U.S.-China tensions.

“I expect a magnificent number, but it’s possible that investors just won’t pay up for Boeing’s earnings like they would have just … a few months ago before we got into this escalating trade dispute with China,” the “Mad Money” host said.

Facebook: Facebook’s earnings report will hopefully answer a slew of investors’ questions: How badly did the Cambridge Analytica scandal hurt business? Has growth drastically slowed? Have expenses gone up due to new cybersecurity measures?

“The stock’s real cheap now, and if there’s been no lasting impact, this is a bargain,” Cramer said. “Otherwise, though, expect a test of its lows, which would take it down 15 points from here.”

Qualcomm: After Chinese officials effectively blocked Qualcomm’s acquisition of NXP Semiconductors, Cramer wondered if Qualcomm would walk away or keep up the fight ahead of its quarterly report.

Thursday: Amazon, Microsoft

Amazon: The race to $1 trillion continues after Thursday’s closing bell with a report from Amazon, which recently reached 100 million Prime members, according to a shareholder letter penned by CEO Jeff Bezos.

“How much have they spent? How’s Amazon Web Services doing? How about Amazon advertising? The company tends to be pretty opaque,” Cramer said. “In fact, the disclosure that Amazon has 100 million Prime members was shocking given how little we really know about these kinds of numbers.”

Microsoft: Microsoft, another $1 trillion contender, will also report on its quietly fast-growing cloud operation and a possible uptick in its Windows segment thanks to renewed interest in laptops, Cramer said.

Friday: Colgate

For years, Colgate had some of the best growth in the consumer goods space, but Cramer worries that those days are now past it. He expected to see a business under pressure in Colgate’s Friday earnings report.

“The best thing that can happen? Fingers crossed that its stock gets hammered before the quarter so it can bounce on an in-line number,” he said.

Conclusions

“The bottom line? Next week’s chock-full of earnings,” the “Mad Money” host said. “Let’s hope that, unlike today, they actually matter. If they do, stocks are likely to go up, not down, when these companies report.”