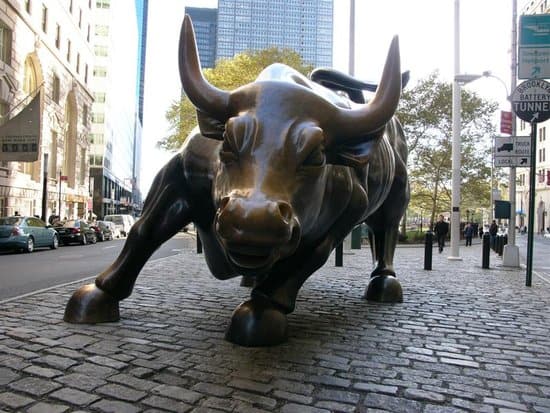

One of the market’s biggest bulls is urging investors to concentrate on fundamentals instead of the noise associated with geopolitical risks.

Oppenheimer’s John Stoltzfus notes stocks are showing “remarkable resilience” in an environment that bodes well for gains.

“Stocks have gotten through this period in relatively good shape considering we’ve had two separate 10 percent pullbacks with a short recovery pace in between,” the firm’s chief investment strategist said Friday on CNBC’s “Trading Nation.”

Stoltzfus was one of the first Wall Street strategists to enter the year with a S&P 500 Index year-end price target of 3000. With the index essentially flat for the year, that equates to around a 12 percent gain over the next 8 months.

Despite the gap between current levels and his price target, he contended blockbuster earnings and market fundamentals could breathe new life into stocks.

“We think that what it’ll be is continued improved earnings, improved revenues, and an economy that shows sustainability at a level around 2.5 percent to perhaps better,” Stoltzfus said, with that dynamic bolstered by “the effects of tax reform as it begins to flow into the economy.”

In the beginning of April, Stoltzfus told “Trading Nation” uncertainty would be swept away by a strong first quarter earnings season.

He believes a bullish catalyst next week could be “FANG” technology stocks, a group that’s been hammered recently over a government regulation threat. A blowout number by the group, which contains names such as Alphabet [Google], Facebook and Amazon, could further drive gains, according to Stoltzfus.

“We’d like to think earnings season has to be enough for now,” Stoltzfus said.