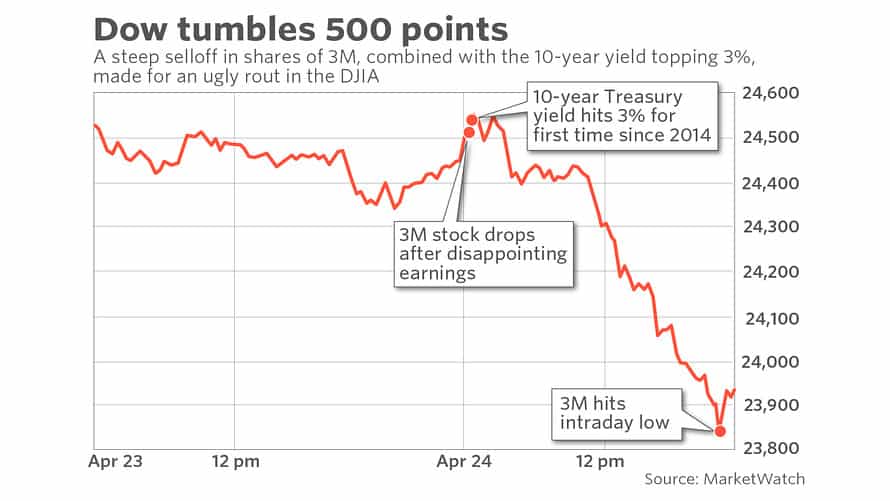

U.S. stocks closed sharply lower Tuesday, led by a selloff in industrials, materials and technology shares.

The selling pressure came after the 10-year Treasury yield briefly touched the psychologically important 3% level for the first time in four years, a move that comes as first-quarter earnings season was failing to excite investors, despite some strong results.

While the earnings season remained in full swing, the tone was generally negative, with several bellwether stocks slumping despite posting numbers that were ahead of analyst forecasts.

What are markets doing?

The Dow Jones Industrial Average DJIA, -1.74% slumped 424.56 points, or 1.7%, to 24,024.13, booking its fifth consecutive decline, the longest losing stretch since March 17, according to FactSet data.

The S&P 500 index SPX, -1.34% fell 35.73 points, or 1.3%, to 2,634.56, with eight of the 11 main sectors ending in negative territory.

The Nasdaq Composite Index COMP, -1.70% declined by 121.25 points, or 1.7%, to 7,007.35, ending with losses for a fourth straight session, its longest streak since February.

What is driving the market?

Trading in the stock market has been heavily influenced by U.S. Treasury yields, and that theme re-emerged as the 10-year Treasury yield TMUBMUSD10Y, -0.06% touched the psychologically important 3% handle on Tuesday and hit a four-year high. The 10-year yield subsequently pulled back to trade at 2.979%. Yields and debt prices move in opposite directions.

Earnings were also in focus, with a deluge of high-profile companies reporting results before the open. The season has so far been strong, and more than 80% of the S&P 500 companies reporting so far have beaten profit forecasts. While that’s above the 73% that beat in the fourth quarter of 2017, better-than-expected results often haven’t been enough to lift shares thus far this season.

What are strategists saying?

“We are at the point where good earnings are not good enough for the market,” said Maris Ogg, president at Tower Bridge Advisors.

Ogg played down the importance of 3% yield on 10-year Treasurys, however.

“10-year yields at 3% or even 3.5% is not that terrible since it’s a reflection of growing economy. But because there is so much uncertainty regarding inflation and Fed policy, investors may not pay the same multiples high for future earnings as they had done until now,” Ogg said.

Multiples, or price-to-earnings ratios based on future earnings, have come down in recent months, with 12-month forward PE at 16.5, down from 18.5 at the beginning of the year, according to FactSet.

“Crossing 3% on the 10-year is something that will certainly raise concerns, but at this stage of the cycle, higher yields aren’t antithetical to rising stock prices. For the time being I think we’re fine, but we’re certainly keeping an eye on the yield curve, especially if the Fed becomes more aggressive,” said Bruce McCain, chief investment strategist at Key Private Bank. “Ultimately earnings remain the primary driver, along with the fact that the economy is still in pretty good shape.”

What stocks are in focus?

United Technologies Corp. UTX, -1.10% raised its guidance for the full year after releasing first-quarter earnings that blew past estimates. Shares still fell 1.1%.

Coca-Cola Co. KO, -2.07% reported earnings that slightly beat expectations, but the stock fell 2.1%.

Caterpillar Inc. CAT, -6.20% reversed early gains and slumped 6.2%. The maker of construction and mining equipment reported first-quarter profit and sales that were well above expectations, but stocks sold off regardless.

3M Co. MMM, -6.83% fell 6.8% as the company said its full-year earnings would be lower than previously expected.

Shares of Alphabet Inc. GOOGL, -4.77% GOOG, -4.45% sank 4.5% even after the Google parent late Monday reported earnings ahead of analyst estimates.

Travelers Cos. Inc. TRV, -3.17% lost 3.2% after its first-quarter earnings missed forecasts.

Verizon Communications Inc.’s VZ, +2.08% stock rose 2.1% after the company announced better-than-expected results for its March quarter.

Freeport-McMoRan Inc. FCX, -14.51% plunged 14% after the company reported first-quarter earnings and revenue that missed expectations.

Harley-Davidson Inc. HOG, +2.44% reported revenue and earnings that came in above analyst expectations. Shares were up 2.4%.

PulteGroup Inc. PHM, +2.88% gained 2.9% after reporting strong first-quarter results.

Sanmina Corp. SANM, +14.62% rallied 15% after the electronics maker late Monday reported profit and sales above Wall Street estimates.

What economic data are in focus?

The S&P/Case-Shiller national index rose a seasonally adjusted 0.5% and was up 6.3% in February, compared with a year ago, hitting a four-year high.

U.S. consumer confidence index rose to 128.7 in April from 127, while new-home sales were at a seasonally adjusted annual rate of 694,000 in March, the Commerce Department said.

What are other markets doing?

Asian markets closed mostly higher, with Chinese stocks getting a lift from the government announcing deeper economic and market reforms.

Stocks in Europe closed lower, with the Stoxx Europe 600 index SXXP, -0.02% ending marginally lower at 383.11.

Oil prices reversed gains, with June West Texas Intermediate crude CLM8, -0.06% settling 94 cents, or 1.4%, lower at $67.70 a barrel

Gold futures GCM8, -0.41% broke their three-day decline, settling 0.7% higher at $1,333 an ounce. Meanwhile the ICE U.S. Dollar Index DXY, +0.18% weakened trading 0.2% lower at 90.749.