Earnings season is just about over and some companies blew it, with their shares dropping after reporting results. But that drop could be an opportunity.

CNBC combed through Wall Street research to find stocks that analysts defended after the market knocked down their stock.

So far this earnings season, 73% of the S&P 500 companies have beaten earnings estimates, according to Refinitiv. Earnings for the S&P 500 are up 2.9% in the second quarter.

The U.S.-China trade war, market volatility, and global growth fears continue to weigh on the minds of companies and investors alike as earnings season comes to a close. But many Wall Street analysts are advising clients there is still plenty of value to be found among the growing sea of uncertainty.

The names include companies like Victory Capital Holdings, MercadoLibre, Fastly, World Wrestling Entertainment, and Bloom Energy.

Global investment management firm Victory Capital reported earnings on Tuesday that missed on the topline and fell short of expectations, according to analysts at William Blair.

The stock tanked due to what an analyst called “a timing issue, with inflows coming in late in the quarter rather than being spread evenly across the quarter.” Inflows refers to the amount of cash coming into the business.

The firm went on to say in a note that the stock reaction was “overblown” and “we would be buyers on weakness,.”

Shares of the company are down 8% on the week.

Earlier this week, Argentina’s stock market tanked after the country’s president suffered an election upset against the opposition candidate.

Argentinean company MercadoLibre also reported earnings this week and while analysts at Deutsche Bank said they were “strong,” the e-commerce retailer may have also been the victim of bad timing due to the ongoing events in the country.

“Given robust underlying fundamentals, large total addressable market, and MELI’s track record at weathering both regulatory and FX challenges in the past, we think the dip is largely an overreaction which has created a buying opportunity for investors who can withstand short term volatility,” they said.

The stock is down 9% on the week.

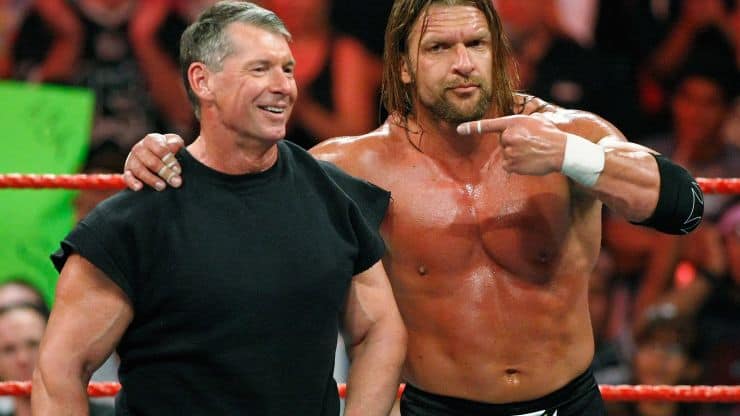

World Wrestling Entertainment reported strong bottom-line results in late July. Shares of the company took a bit of a beating as of late but have quickly rallied back.

The company has also been the subject of several buy initiations and upgrades recently, including one from Rosenblatt analysts on Thursday.

“Our thesis on the media industry is content is king and view WWE as one of the best public market ways to benefit from this theme,” they wrote. “We see the recent pullback in shares driven by concerns over ratings and quarterly estimate revisions as a buying opportunity.”

Here’s what else analysts are saying about stocks to buy after an earnings pullback:

William Blair: Victory Capital Holdings, outperform rating

We are buyers on weakness. We believe the stock reaction to the second-quarter earnings miss is overblown and would be buyers on weakness. .. .The blended average fee rate of 61.0 basis points was actually a touch above our estimate of 60.8, so we believe the revenue miss was largely a timing issue, with inflows coming in late in the quarter rather than being spread evenly across the quarter.

Deutsche Bank: MercadoLibre, buy rating

With more costs denominated in Argentinian Pesos versus revenue, we think the impact of a currency depreciation could actually be a margin tailwind for the company. Additionally, from the perspective of increasing regulatory scrutiny upon a potential regime change, MELI may benefit from the fact that it is a large employer with ~3,000 employees in the country, and one of the few that is increasing headcount. Given robust underlying fundamentals, large TAM, and MELI’s track record at weathering both regulatory and FX challenges in the past, we think the dip is largely an overreaction which has created a buying opportunity for investors who can withstand short term volatility.

Baird: Fastly, outperform rating

[August 8] after the close FSLY reported slightly better Q2 revenue and provided 2019 guidance that was modestly higher than our previous estimates, with the adjusted operating loss also better than our estimate. However, capex was higher and gross margins slightly light, which seemed to raise concerns based on after-hours weakness, though capex was largely timing and gross margins are expected to improve in 2H′19. Overall, we were encouraged with the guidance and believe the story remains on track. ”

Rosenblatt: World Wrestling Entertainment, buy rating

Our thesis on the media industry is content is king and view WWE as one of the best public market ways to benefit from this theme. We see the recent pullback in shares driven by concerns over ratings and quarterly estimate revisions as a buying opportunity. Catalysts for shares over the next six months include an update on international TV rights renewals and capital allocation, both of which are contributors to our >20% FCF/share growth forecast in ’21 and beyond.

Raymond James: Bloom Energy, outperform rating

Stock Gets Hit in a Classic Overreaction: No, Natural Gas Is Not Disappearing in CA and NY. Bloom shares fell ~40% [yesterday], in the context of what has always been a volatile, polarizing, and sentiment-driven stock (recall, we upgraded it in February near the $9 level, as compared to the 52-week north of $30). While it is never easy to fight the tape and try “catching a falling knife”, we want to underscore that nothing in what management said yesterday was truly game-changing. Our thesis remains fundamentally intact, and days like today offer an opportunity to pick up shares with a medium-term perspective in mind, hence our Outperform rating.