U.S. stocks closed higher Friday but halted their multiweek gains, after investors shrugged off positive comments on a trade deal by President Donald Trump and his Chinese counterpart Xi Jinping.

How did major benchmarks fare?

The Dow Jones Industrial Average DJIA, +0.39% rose 109.33 points, or 0.39%, at 27,875.6, while the S&P 500 index SPX, +0.22% advanced 6.75 points, or 0.22%, at 3,110.29 and the Nasdaq Composite Index COMP, +0.16% added 13.67 points, or 0.16%, at 8,519.88.

On Thursday, the Dow fell 54.8 points, or 0.2%, to 27,766.29. The S&P 500 SPX, +0.22% retreated 4.92 points, or 0.2%, to 3,103.54. The Nasdaq Composite Index gave up 20.52 points, or 0.2%, to 8,506.21.

For the week, the Dow ended 0.5% lower, snapping a four-week winning streak, according to Dow Jones Market Data. The S&P shed 0.3%, halting six weeks of gains, while the Nasdaq retreated 0.3%, ending its seven-week advance.

What drove the market?

The initial optimism around trade gave way after the Federal Communications Commission voted on Friday to label Chinese telecom giants Huawei and ZTE as a national security risk, a move that bars them from accessing a government subsidy program.

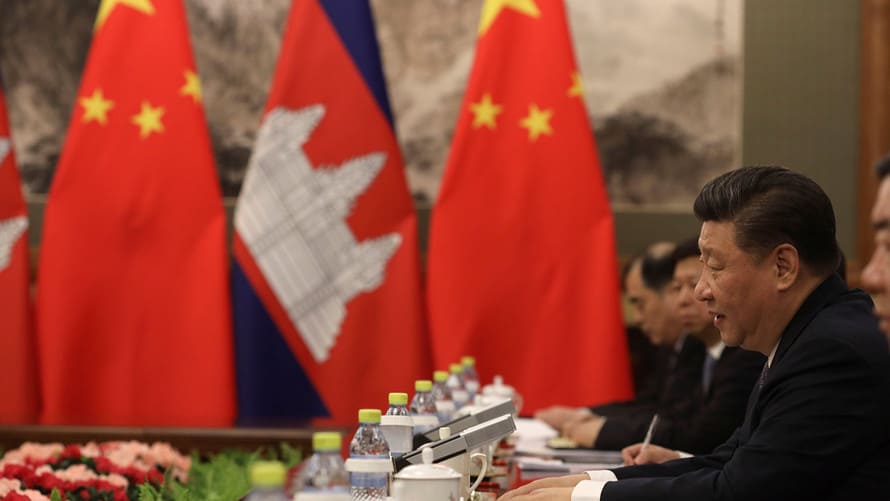

Earlier, President Xi had injected some measure of hope into a market that has grown more uncertain about a partial U.S.-China trade deal materializing. “We want to work for a Phase 1 agreement on the basis of mutual respect and equality,” he was quoted as saying, during a forum in Beijing attended by a delegation of foreigners. China’s chief trade negotiator Liu He remained optimistic about striking a trade deal and invited his U.S. counterparts for more talks.

On the U.S. side, President Donald Trump said there was a “good chance to make a deal,” and later suggested he needed to balance the needs of the U.S.-China relationship.

“Xi’s comments did not reveal anything new, but served as a reminder that China is also in need of a trade deal,” wrote Edward Moya, senior market analyst for OANDA.

Investors have been wrestling with shifting narratives around international trade all week, as well as a mixed picture in corporate earnings, highlighted by some of the biggest retailers in the country.

“The markets are getting accustomed to nothing happening,” said Nick Giacoumakis, New England Investment & Retirement Group, about progress on the U.S.-China trade front, in an interview with MarketWatch.

“The market has kind of yawned,” he said, but also pointed to the early “Santa Clause rally” seen in stocks which rose to record highs this month. “The rally is intact and with this will go into 2020,” he predicted.