U.S. stock-index futures were trading lower Thursday morning after a series of gains pushed the Nasdaq Composite to within 2% of its all-time high, as a gradual restart to the U.S. and world economies from coronavirus-induced closures helps support bullish sentiment.

Investors will be watching for a report on weekly U.S. jobless claims to gauge whether the worst of the impact of the viral outbreak has occurred, while a policy decision from the European Central Bank later in the morning could influence trading in U.S. assets.

How are benchmarks performing?

Futures for the Dow Jones Industrial Average YM00, -0.35% YMM20, -0.34% were 137 points, or 0.5%, lower at 26,091, those for the S&P 500 index ESM20, -0.42% ES00, -0.42% were off 16.45 points, or 0.5%, at 3,101.25, while Nasdaq-100 futures NQ00, -0.19% NQM20, -0.19% were trading 0.2% lower at 9,663.75, a decline of 21 points.

On Wednesday, the Dow DJIA, +2.04% advanced 527.24 points, or 2.1%, to close at 26,269.89, while the S&P 500 SPX, +1.36% rose 42.05 points, or 1.4%, to end at 3,112.87, the highest finish for both benchmarks since March 4, according to Dow Jones Market Data. The Nasdaq Composite Index COMP, +0.77% rose 74.54 points, or 0.8%, ending at 9,682.91, or 1.4% away from its all-time closing high of 9,817.18 in February.

What’s driving the market?

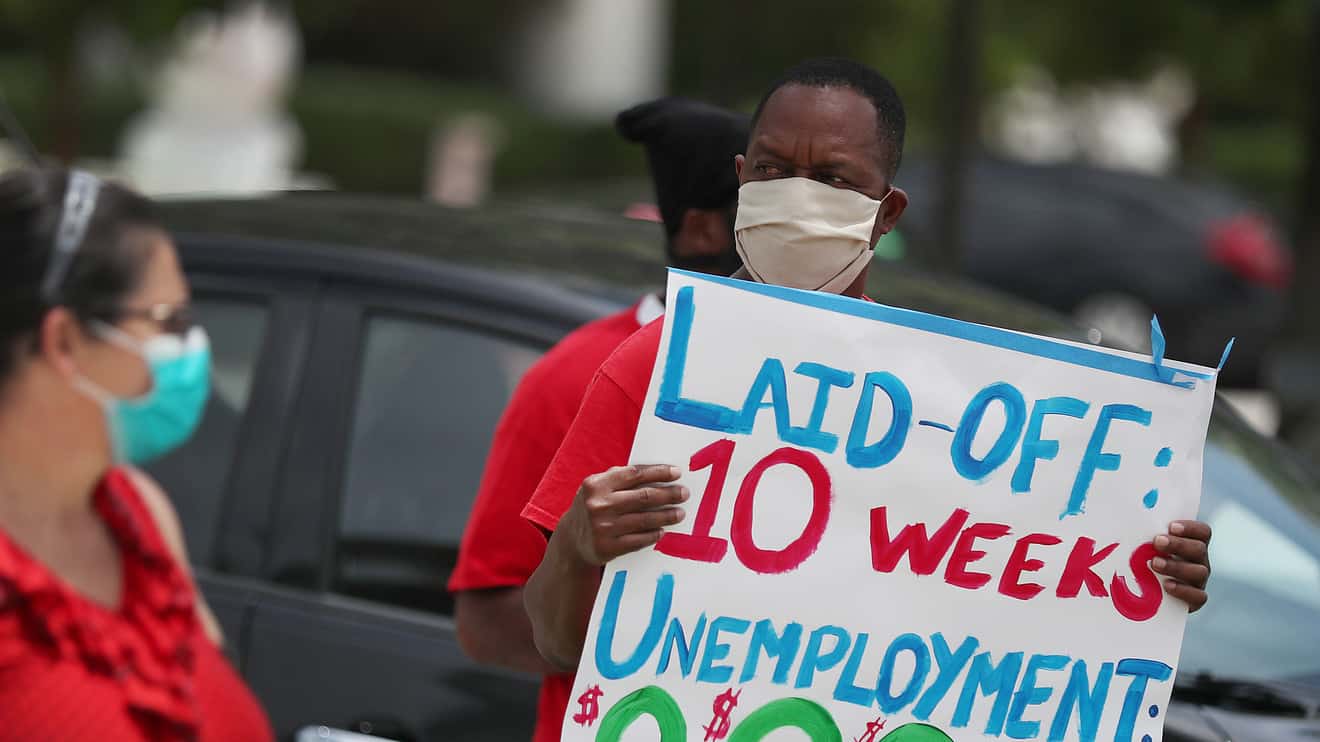

At least 1.8 million jobless workers are expected to have applied for unemployment benefits in the week ended May 30, according to economists polled by MarketWatch. That grim data however could underscore that the U.S. may be bottoming from the impact of the epidemic that has rocked the U.S. economy. The report is expected to be released at 8:30 a.m. Eastern.

Private-sector employment data on Wednesday showed that a total of 2.76 million jobs were lost in May, Automatic Data Processing Inc. reported, but that loss was far less severe than the 8.66 million estimated by Econoday.

Equity benchmarks in the U.S. have rallied mightily from their March 23 lows, partly on the back of optimism surrounding the reopening efforts and evidence of a slowing spread of the deadly infection as the summer gets under way.

Trillions of dollars in stimulus from the Federal Reserve and the U.S. government, underpinning financial markets, also have helped to drive the value of assets considered risky sharply higher from their coronavirus nadirs.

Meanwhile, investors will be watching to see if Europe’s central bank delivers further stimulus to its battered economy. Led by Christine Lagarde, the ECB is expected to announce its intention to expand its €750 billion ($840 billion) Pandemic Emergency Purchase Program, or risk disappointing the market. Analysts expect that to happen when the Governing Council concludes its meeting on Thursday at 7:45 a.m. Eastern. Lagarde will host a news conference at 8:30 a.m. Eastern to discuss the ECB’s policy actions.

Such a move would come as German Chancellor Angela Merkel’s coalition agreed on a €130B economic stimulus package to boost consumer spending and business investment, according to Bloomberg News. Germany, which has a history of fiscal prudence, last month backed an agreement, along with France, for an upsized €750 billion coronavirus European Union-wide recovery fund.

“In light of the move by the Berlin administration and the high hopes for even more stimulus from the ECB, it is clear that dealers are a little cautious about buying into the market now, for fear the ECB’s actions won’t measure up to the great expectations,” wrote David Madden, market analyst at CMC Markets in a Thursday research note.

Thus far, civil unrest centered on the death of an unarmed black man at the hands of a white police officer in Minnesota hasn’t been reflected in stock-market trading, nor has rising tensions between China and the U.S.

The Trump administration suspended flights to the U.S. by Chinese airlines in apparent retaliation for Beijing halting American flights bound for China.

In other economic reports, investors will be looking out for a report on international trade at 8:30 a.m., a report on productivity costs at the same time and an update of the Fed’s balance sheet at 4:30 p.m.

Which stocks are in focus?

- Zoominfo Technologies Inc. ZI, said priced its initial public offering of 44.5 million shares at $21, topping an already-hiked range of $19 to $20.

- Three Amazon.com Inc. AMZN, +0.24% warehouse employees sued the retail giant on Wednesday in New York, alleging working conditions put them and their families at risk of contracting the coronavirus.

How are other assets trading?

Oil prices were under pressure Thursday amid uncertainties over a OPEC+ meeting, with West Texas Intermediate crude for July delivery CLN20, -1.47% off 57 cents, or 1.5%, to at $36.72 a barrel on the New York Mercantile Exchange.

In precious metals, August gold GCM20, +0.68% rose $8.20, or 0.5%, at $1,713 an ounce, after finishing Wednesday’s session at its lowest in more than three weeks, according to FactSet data.

In global equities, the Stoxx Europe 600 index SXXP, -0.49% traded 0.5% lower, while the FTSE 100 index UKX, -0.35% declined 0.2%.

In Asia, Japan’s Nikkei NIK, +0.36% rose 0.4%, the China CSI 300 000300, -0.03% finished nearly unchanged for a second straight day and Hong Kong’s Hang Seng Index HSI, +0.16% rose 0.2%. South Korea’s Kospi index 180721, +0.19% gained 0.2%, following a 2.9% surge in the previous session.

The 10-year Treasury note yield TMUBMUSD10Y, 0.745% retreated 1.6 basis points to 0.74%, after marking its highest level since April 8, according to Dow Jones Market Data. Bond prices move in the opposite direction of yields.

The greenback gained ground against its major rivals, with the ICE U.S. Dollar index DXY, 0.26% up 0.2%.