If you want to manage your financial accounts without a full-featured and expensive program like Quicken, Microsoft has a solution called Money in Excel. This new option helps you integrate your bank accounts and other financial data so you can track your expenses, spending habits, investments, and more.

Access to your financial accounts is performed through a third-party plugin provided by Plaid, which handles permissions between you and Microsoft. You connect your financial data to Plaid, but Plaid does not share login credentials with Microsoft. (For more information about the security and privacy aspects of this feature, check out Microsoft’s Money in Excel FAQ.)

As a premium Excel template, Money in Excel is available to Microsoft 365 Personal and Family subscribers in the US only. The feature is also only on desktop; it won’t work on a mobile device. Here’s how to use Money in Excel to manage your personal finances right from a spreadsheet.

Get Money in Excel

Before you can start using Money in Excel, you must first add it to your instance of Excel. Grab the Money template by going to Microsoft’s Money in Excel page and signing in as a Microsoft 365 subscriber. Click Edit in Browser to add the template to the browser-based version of Excel or click Download to get it for the desktop version of the program. Both versions work the same way.

If you want to use Money in Excel anywhere from any computer, choose the browser-based version. If you want to restrict it to just specific computers on which Excel is installed locally, go with the download option.

After choosing the browser version, click the Continue button to add the template. With the download option, download and then open the downloaded XLTX file in Excel, then click Enable Editing to add the template. Once you have the template set up, click the Welcome and Instructions tabs at the bottom of the worksheet to learn more about Money in Excel.

In the right pane for New Office Add-in, click Trust this add-in, then click Get Started. Hit the Sign in button and log in with your Microsoft account.

Connect Your Financial Accounts

Now you must connect your financial accounts to Excel. The right pane will explain how Plaid will connect to your financial accounts and how Microsoft uses Plaid. Click Continue through each screen to proceed through the setup.

The next screen presents a list of banks. Choose the bank at which you have an account to incorporate your financial information. If you don’t see your bank listed, type its name in the Search field at the top and select it from the results.

Sign in with your bank account credentials and click Submit. Then choose how you want to receive a security code to authenticate your identity. You can select email, phone call, or text. Click Continue, then enter the code in the appropriate field and click Submit.

If you have more than one account at the bank you chose, click the accounts you want to view in Excel. After the data has been accessed, review the listed accounts.

Click the three-dot icon and select Hide account for any accounts you don’t wish to incorporate. Otherwise, click Update Workbook.

View and Filter Data

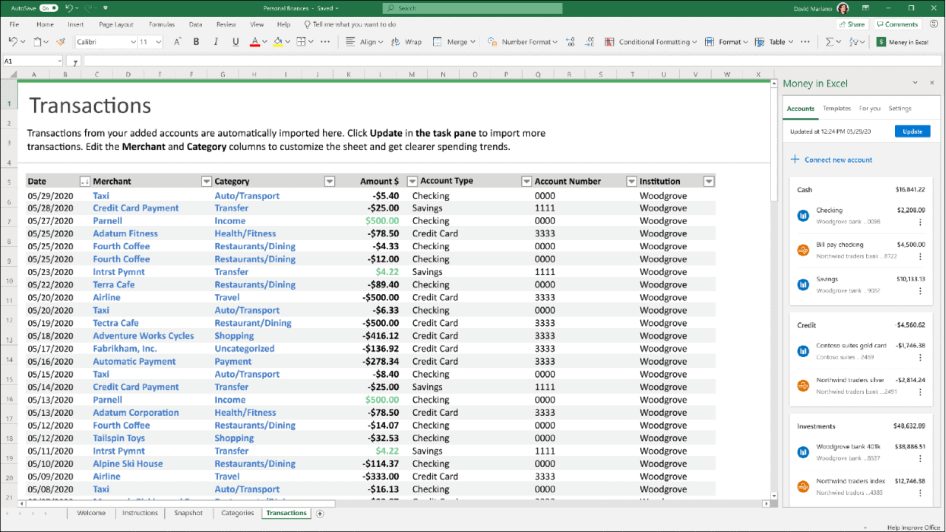

Your transactions from the accessed accounts then appear in the workbook, specifically in the Transactions worksheet. Click the tab for Transactions and scroll through each transaction to view the date, merchant, category, amount, account, account number, and institution.

Note that the necessary header row and data filtering are automatically turned on in the worksheet, allowing you to change the sort order in each column. Click the down arrow next to a column heading to change the order between: oldest and newest or newest and oldest; A to Z or Z to A; and smallest to largest or largest to smallest.

You can also filter the results to see only certain transactions. For example, click the down arrow for the column heading for Account and change the filter to show only checking or only credit card transactions.

Next, you can filter the results to show only transactions in a certain range. As an example, click the down arrow for the column heading for Amount, move to Number Filters, then select a criteria, such as Greater Than.

Type a number to see only amounts greater than the number you entered. Click the down arrow for the column heading and choose Clear Filter to remove the filter.

Charts and Categories

Click the Snapshot tab to view charts and graphs showing your spending for a certain month compared to the previous month. To view a specific month, click the down arrow for the month listed at the top and change it to a different month. You can also see where and how you spend your money for the month.

You can add your own custom categories to track specific transactions by clicking the Categories tab. Go to the section for Custom categories. In the first field in the Category Name column, type the name of the new category. Then in the Category Type column, select the type for your new category, such as Income or Expense.

Then go to the Transactions sheet. Click the down arrow next to a transaction to which you want to apply one of the new custom categories and select that category from the list.

Update Data and Change Settings

If you ever want to add or change any information in the workbook, check out the right-hand pane. Click the Update button to update your spreadsheet with the latest transactions. New financial accounts can always be added by clicking the Accounts tab and selecting Add an account.

Add supplementary templates to calculate net worth and recurring expenses under the Templates tab. The For You tab shows you the top merchant on which you spent money, and the Settings tab allows you to view and modify key settings.

Finally, be sure to save your workbook before you close it so you can open and update it each time you want to review your financial accounts, transactions, and spending pattern.