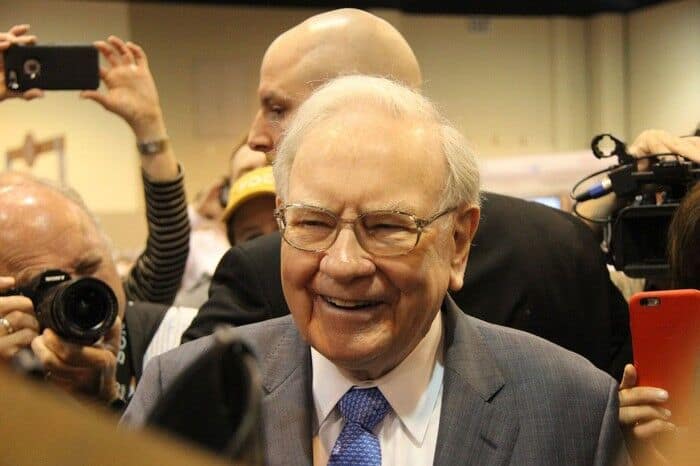

Warren Buffett, the investing legend, is turning 90 on Aug. 30. He’s achieved his fame through his phenomenal success with his company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), and his outstanding generosity. Have any doubts? Then consider this: If you had invested $1,000 in Berkshire’s Class A shares in 1964, it would have been up 2,744,062% by 2019 and worth about $21.6 million. Now THAT’s success.

But Buffett’s legacy isn’t limited to his investing prowess — he also has an uncanny knack for educating investors. Through his annual letters, numerous speeches, and interviews, he’s left a treasure trove of lessons that anyone — from beginner to advanced investors — can employ to become a better financial manager. Here are four that anyone at any stage of their journey can use to become wealthier.

1. Invest with index funds

Even though Buffett’s success has come through buying companies and shares of individual companies, he’s a big advocate of index funds for everyone. At his 2020 annual meeting, he said: “In my view, for most people, the best thing to do is owning the S&P 500 index fund.” In fact, he has directed his trustee to put 90% of his wife’s inheritance into them (and the other 10% in short-term government bonds).

An index fund is like a mutual fund — it is a portfolio of securities designed to match the performance of the market or a sector. But since they’re not actively managed, index funds have very low fees. They typically hold groups of stocks, bonds, commodities, or real estate investment trusts (REITs) that track a particular market index, like the S&P 500 or the Russell 2000.

But the best thing is that you don’t have to worry about them because your returns will parallel those of the overall index they follow. In other words, it’s a no-brainer way to invest.

2. Stay out of debt

Buffett is a huge believer in staying debt-free. At the 2004 Berkshire Hathaway annual meeting, a 14-year-old asked him for a piece of advice, to which he responded:

It would be just to don’t get in debt. It’s very tempting to spend more than you earn; it’s very understandable. But it’s not a good idea.

Before you begin investing, it’s important to develop a plan to pay down whatever debt you’re carrying. Then, once you’re free from that burden, you’re ready to take that money and put it into the stock market. But it takes discipline and commitment to make sure you don’t get into debt again.

3. Have money on the sidelines

In the 2014 annual report, Buffett said: “We always maintain at least $20 billion — and usually far more — in cash equivalents.” For Berkshire, that’s its emergency fund — but what about yours?

Financial planners generally suggest that people should have money set aside to cover three to six months of expenses, just in case something unforeseen occurs, like car or home repairs, a medical emergency, or job loss. Then set additional cash aside to take advantage of buying opportunities in the stock market. You’re not expected to set aside billions, of course, but a few thousand dollars in rainy day funds could present you with investing opportunities and invaluable peace of mind.

4. Get educated and stay that way

If you’re just beginning, there’s a lot to learn to become a good investor, so reading everything you can is a great start. Even veteran investors must continue following the companies they buy, so reading annual reports and SEC filings is a must.

As Buffett said at his company’s 2007 annual meeting:

I think you should read everything you can. In my case, by the age of 10, I’d read every book in the Omaha public library about investing, some twice. You need to fill your mind with various competing thoughts and decide which make sense. Then you have to jump in the water — take a small amount of money and do it yourself. Investing on paper is like reading a romance novel vs. doing something else. You’ll soon find out whether you like it.

Becoming a good investor is challenging, but if anyone can help guide you, it’s Warren Buffett. The four basic tips above can help you become a great investor. You won’t likely get a 2,744,062% return on your investments, but you’re bound to end up with more than you started with by following the master’s advice.