Stock Markets

World stock markets saw strong gains as major indices broke records during the first week of trading for the year. Following the two runoff elections in Georgia, Democrats gained the majority in the Senate that may signal further fiscal stimulus later in the year to push economic recovery. An increase in corporate tax rates is a possibility as a result of Democrat control of the government, although this may not be a priority for 2021 due to the tenuous economic recovery and the party’s slim majority. For the first time in nine months, ten-year yields rose above 1%, and anticipation of strong performance in the post-vaccine phase caused small-cap and international stocks to outperform. The positive sentiment was bolstered by the return of WTI oil prices to February levels, rising above $50 in response to announcements of an expected production cut by Saudi Arabia.

U.S. Economy

Over the past week, economic data showed a combination of resiliency and lockdown stress. Political uncertainties dominated the news, and expectations of a policy stimulus and post-vaccine recovery pushed stock market activity. The optimism surrounding the economy’s strong underlying fundamentals, expectation of corporate profits, and stable interest rates fueled the stock gains and signaled investors’ bright outlook in the long-term.

- The market performed well over the past year, posting a 10% average return. Considering that this is a presidential election year, the market gains are encouraging.

- A Democratic White House and Congress are expected to push for fiscal stimulus through increased aid for households and increased government spending that may include an infrastructure bill. These measures are expected to boost the economy despite an increase in public debt.

- The 34% market plunge that occurred in 2020 as a result of the pandemic lockdowns is an aberration that quickly recovered with a 60% rally in the past five months. A new bull market has most likely begun, sustained by increasing corporate earnings and low interest rates that will continue to give rise to a strong domestic and global economy.

The bottom line is that we are likely seeing the early stage of a new economic expansion. Pressures from pandemic protocols and the resulting constraints on business activity may cause temporary stalls such as the loss of 140,000 jobs in December, the first monthly loss since April. However, these are expected to give way to a sustained new normal for the rest of the year and beyond.

Metals and Mining

The gold price corrected as of Friday, the 8th of January, closing below $1,900 per ounce after gaining for three consecutive weeks. The fall was caused by the strengthening of the US dollar and the 10-year Treasury yield. Ahead of the break-in at the Capitol building last Wednesday, gold reached a five-day peak of US$1,956; it was valued at $1,863.88 as of 11.01 a.m. EST on Friday. Downward pressure was also felt from the rising bitcoin value that set a record all-time high of US$41,000. Demand for bitcoin rose 39% from the 1st of January, causing a 2% decline in the price of gold. The corresponding movements in prices of these two investment vehicles appear to suggest that the market perceives them as competitors.

Silver likewise ended the week down after mid-week volatility. Values climbed to a five-day high of US$27.79 per ounce before the open of trading on Wednesday, the January 6th; a sharp decline followed thereafter. The downward momentum continued on Thursday, dipping below US$26 to settle at US$25.81 on Friday. Platinum rose to a 10-month high at $2,394 per ounce on Tuesday then corrected to a low of $2,226 then rebounded to end the week at US$2,247.

While the broad precious metals sector may experience further volatility, base metals were buoyed by a positive outlook over potential infrastructure development. Copper, zinc, nickel, and lead prices all made strong showings for the week due to strong forecasted demand.

Energy and Oil

The commitment by Saudi Arabia to further reduce production has fueled a solid rally that saw Brent topping $55 per barrel before the week’s close. Other developments were at play, such as the monetary stimulus package, potential for a deeper stimulus moving forward, and optimism on the effectiveness of the covid vaccine. The steady rise over the last two and a half months, with one slight interim correction, suggests an underlying market resiliency that is expected to remain bullish in the medium term. In the US., the near-term future of shale is bleak as the likelihood of an increase in supply will remain lackluster for the coming years. Aggressive drilling has been dismissed by shale producers as they project annual growth to remain capped at 5%.

In related developments, coal prices are rising as China’s demand for heat increases due to the prevailing cold winter in the northern hemisphere. Producers of lithium, which makes renewable energy possible, saw a severe drop in prices in anticipation of rising production costs, but there remain strong incentives to be bullish about this energy-linked sector. One reason is the full swing of automotive manufacturing from fossil fuels to renewable energy. The share price of Tesla, the leading electric vehicle (EV) manufacturer, rose more than 700% over the past year. Other stocks in the EV sector have shown similar gains.

Natural Gas

U.S. exports of liquefied natural gas (LNG) achieved a record high in the last month of 2020, continuing its November trend with an average of 9,8 billion cubic feet per day (Bcf/d). JKM benchmark prices for LNG continues to soar as spot prices for delivery in kay Asian LNG-consuming countries surged to a six-year high in large part due to the prevailing colder-than-normal winter. This compensates for the historically low prices encountered from April to July 2020 in Asia and Europe. The price slump began to reverse in August, and prices have now more than quadrupled. Since mid-October, prices for natural gas and LNG in the global spot and futures markets have exceeded the crude-oil indexed long-term LNG contracts despite the latter’s increase since September. The recent price increase in long-term contracts resulted from supply shortages caused by unplanned outages of several global export facilities. Fifty percent of U.S. exports since June went to Asian countries, 30% to Europe, and the remainder to the Middle East, Africa, and Latin America, according to reports by the U.S. Department of Energy and the U.S. Energy Information Administration (EIA) as of November 2020.

World Markets

Stricter lockdowns in Europe imposed in response to coronavirus resurgence have generally been shrugged off by the markets. Prices rose on hopes of renewed recovery resulting from a swift vaccine distribution and a potential massive U.S. stimulus package. The pan-European STOXX Europe 600 Index closed the week 3.04% higher. Gains were registered by Germany’s Xetra DAX Index (2.41%), Italy’s FTSE MIB (2.52%), and France’s CAC 40 (2.80%). UK’s banking and energy sectors led the 6.39% surge in the FTSE100 Index. Core eurozone government bond yields likewise ended higher, despite being tempered by weaker-than-expected eurozone inflation data and continued pandemic concerns. Peripheral eurozone bond yields fell for the week as it responded inversely to the core markets. Demand for high-quality government bonds fell while UK gilt yields rose. Germany’s economic data remained strong with better-than-expected trade and production figures together with robust factory orders data, suggesting a fourth-quarter expansion.

In Asia, Japan’s Nikkei 225 Stock Average advanced 2.5% to close the week at a multi-decade closing high of 28,139.03. The yen weakened against the U.S. dollar to close near JPY 104. A new spike in coronavirus cases has prompted Prime Minister Yoshihide Suga to declare a state of emergency in Tokyo and its surrounding prefectures effective Friday, January 9th. Measures to be implemented by the prime minister will be “limited and concentrated” to minimize the adverse economic impact. In China, the CSI 300 Index gained 5.5% and the Shanghai Composite Index rose 2.8% over their December 31 closing levels. Investor sentiment was shaken, however, over NYSE’s delisting of three Chinese telecommunication companies.

In other key markets, Saudi Arabia’s Tadawul All Share Index experienced a 5% correction from its strong close on December 31st. Earlier in the week, investors were greeted with the positive news of the resumption of normal trade and travel ties between Qatar and Saudi Arabia, the UAE, Bahrain, and Egypt. On January 5th, the five nations signed the reconciliation agreement that ended the three-and-a-half-year rift between them. On the same day, OPEC and non-OPEC oil-producing nations (aka Opec+) agreed to keep production flat. In Mexico, the IPC Index declined by 6% over the week. Inflation was reported at 3.15% year-over-year compared to 3.33% in November, which was generally in line with expectations.

The Week Ahead

The coming week signals the unofficial start to the earnings season during which time quarterly earnings reports are expected to be issued by national and regional banks. Important economic data to be released include industrial production, retail sales, and inflation figures.

Key Topics to Watch

- NFIB small-business index

- Job openings

- Consumer price index

- Core CPI

- Beige Book

- Federal budget

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Import price index

- Retail sales

- Retail sales ex-autos

- Producer price index

- Empire state index

- Industrial production

- Capacity utilization

- Consumer sentimental index (preliminary)

- Business inventories

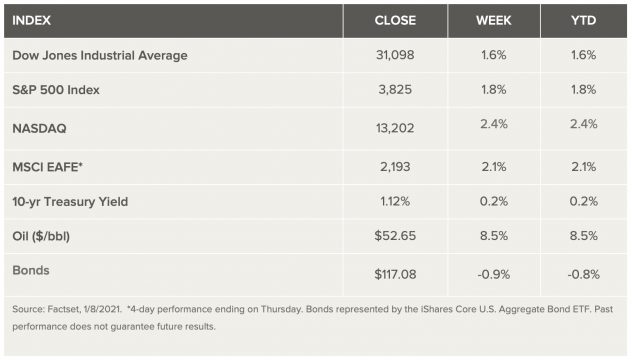

Markets Index Wrap Up