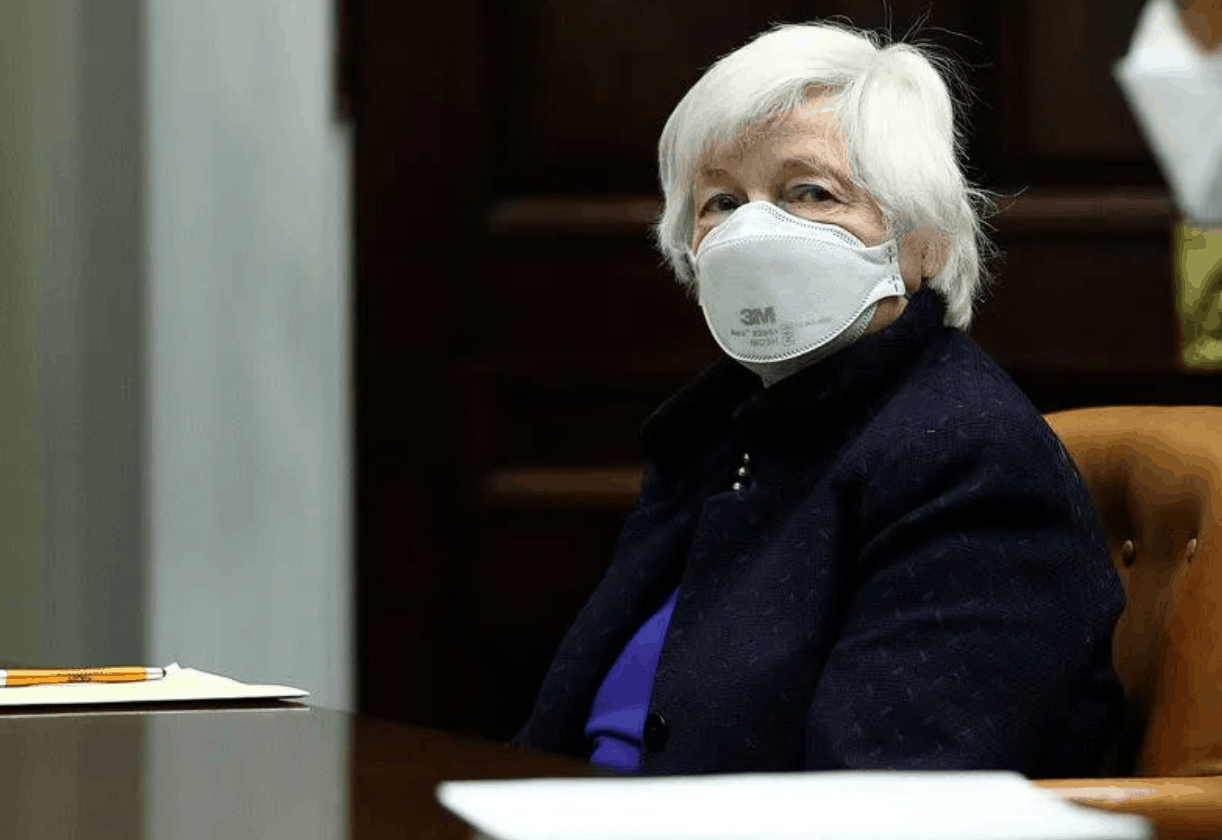

U.S. Treasury Secretary Janet Yellen on Wednesday pledged to aggressively tackle climate change using all the tools at her disposal, warning that a failure to do so effectively and promptly could undermine economic growth.

To bring the U.S. economy in line with international goals of eliminating carbon emissions will “require bold and urgent action – nothing less than transforming important sectors of the global economy, especially when it comes to how we generate power and move people and goods,” Yellen said in a wide-ranging speech to the Institute of International Finance.

“We are committed to directing public investment to areas that can facilitate our transition to net-zero and strengthen the functioning of our financial system so that workers, investors, and businesses can seize the opportunity that tackling climate change presents,” Yellen said.

U.S. President Joe Biden is scheduled on Thursday to convene a summit of 40 world leaders on climate change, where he is expected to unveil a target to cut emissions by roughly 50% by 2030 compared with 2005 levels.

Yellen’s remarks reflect a sharp reversal of the policies of the Trump administration, which had pulled the United States out of the 2015 Paris climate accord and blocked greater action by the Group of Seven advanced economies.

Yellen said international cooperation was urgently needed, and the Biden administration’s comprehensive approach to climate change would give financial institutions and international partners greater certainty about U.S. plans.

“This is an immense, immense task. We need to work together closely … in order to deal with what has become an essential risk to our planet,” Yellen said during a Q&A session after her speech, adding that the financial sector had a big role to play in funding the transition to a net-zero economy.

The costs would be “enormous,” Yellen said, noting that Biden’s $2.3 trillion infrastructure plan would make some needed investments in greening the economy while removing tax subsidies for fossil fuels, which cost taxpayers some $4 billion a year.

But she said private capital would be needed to fill a gap that one estimate put at over $2.5 trillion for the United States alone over the next decade.

To make that happen, she said, investors needed reliable, consistent and comparable data on climate-related risks amid the growing incidence of severe weather events.

Yellen said the Financial Stability Oversight Council would be the principal agency managing and assessing the financial risks associated with climate change, and if necessary, taking appropriate action to mitigate them.

She said the FSOC could also facilitate the sharing of data on risks among regulators, but that required greater disclosures by non-financial and financial companies of risks.

The global Financial Stability Board’s Task Force on Climate Related Disclosure had devised a framework that was proving useful, and she hoped the U.S. Securities and Exchange Commission would base its own efforts on that work.