It’s a question many a personal finance educator has asked: What’s the best way to engage my students’ parents in the financial knowledge I’m teaching?

Tamara Gordon, an 8th grade social studies teacher at Centennial Academy in Atlanta, is one of them.

“Some parents think teaching personal finance education is nonsense. How do I overcome that?” she asked a panel of experts during the May 5 Invest in Teachers: Ready. Set. Grow. event, a partnership with CNBC, the Council for Economic Education and Next Gen Personal Finance.

“Sometimes you’re getting that resistance because, honestly, parents feel ashamed about where they are, they feel ashamed of not knowing,” said Tiffany Aliche, founder of The Budgetnista and a former schoolteacher in Newark, New Jersey.

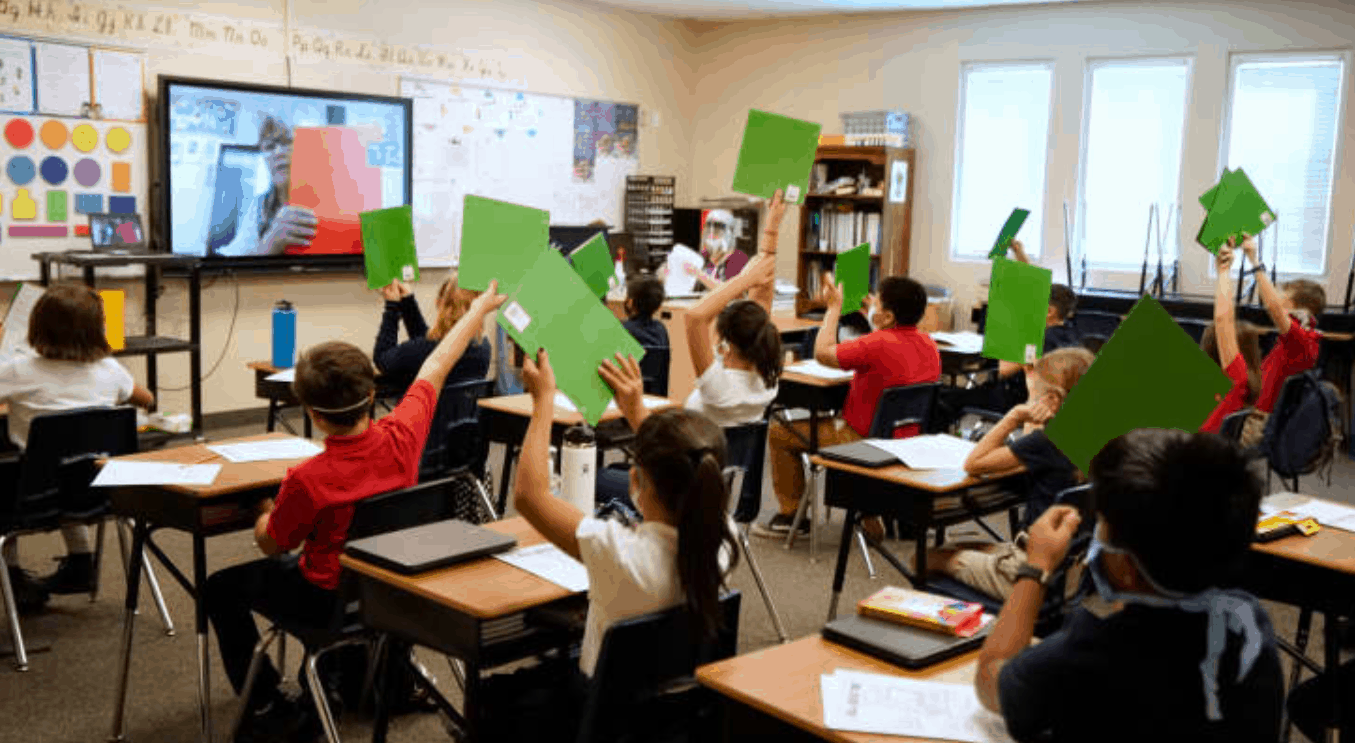

To bridge the gap, what Aliche would do when she was teaching was gamify financial education for her students — in one game, they’d assume adult personas and practice paying bills with Monopoly money. On those days, she’d invite her students’ parents to come in and play, as well.

“What your child is learning, also you, too, can learn in a way that maintains your dignity,” she said. “Invite those parents into the classroom.”

There are also ways to take the conversation home.

“I think you can give assignments that involve asking parents financial questions,” said Dan Otter, executive director of 403(b)wise, an education advocacy service, adding that those could be about parents’ first jobs, or how their families handled money.

“You don’t want to make it threatening,” said Otter. “I think you have to start with those basic questions.”

Personal finance education across the U.S. varies by state, city and even school. Only 21 states require high-school students to take a course on personal finance, and few require it to be a standalone class, as opposed to being incorporated into another course.

In 24 states, high schools must offer personal finance education, but it is not mandatory. Less than 12% of students are required to take a stand-alone personal finance course to graduate high school, outside of the six states that mandate it, according to research by Next Gen Personal Finance, a nonprofit focused on providing financial education to middle and high school students.

But this share is lower for students of color, exacerbating existing wealth gaps. Only 7.4% of Black and Brown students and 7.8% of low-income students are required to take a personal finance course to graduate.

Using personal stories

Beyond the school and state requirements, many students might not have examples of adults in their lives who have solid financial knowledge and have modeled good personal finances.

“Studies show that parents would rather talk to their kids about sex than money,” said Brad Klontz, a certified financial planner and financial psychologist, during the Wednesday panel.

Some teachers also make a point of bringing their personal finance experience into the classroom to engage their students and set an example.

Yamiesha Bell, a 10th grade special education teacher at Gotham Collaborative High School in the Bronx in New York City, has made a point of sharing her personal finance story with her students.

She kept them in the loop as she paid off about $27,000 in credit card debt over seven months, and as she built her total net worth to $100,000.

“I felt it was important for someone who looked like them to show them that there are options to building wealth,” said Bell, who also chronicles her personal finance journey on an Instagram account called The Bold Budgeter.

The panel of experts also encouraged teachers to do their own personal financial research and planning, as well as talk about finances with their students and peers.

“I think it’s incredibly helpful because, chances are, other people are going to breathe a sigh of relief,” said Klontz. “All you have to do is start talking about it and others will relate.”