The big takeaway from the past week in business news is that A) secretly released documents show that billionaires aren’t paying their fair share in taxes. (Gee, you think?) And meanwhile, B) hotels and restaurants and other businesses can’t find enough people to work as maids and dishwashers, etc.

If that doesn’t get your “hmmm” juices flowing, I don’t know what will.

Let me explain by first going through the A and B elements and then speak to how they’re connected.

The billionaire tax news I’m referring to comes from a blockbuster ProPublica story which dropped on Tuesday, (highly recommended reading, btw.)

Here’s a money sentence: “Taken together, [all the documents] demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most.”

The main takeaways are 1) that the super wealthy, the .001%, make most of their money through the appreciation of property and especially stock, which isn’t taxed of course. And that there are myriad means at their disposal to derive monies from these troves, like bank loans, so they can live high on the hog tax free. And 2) to the extent that they do have income, none of these billionaires are paying anywhere near the top marginal rate of 37%—thanks to loopholes and deductions—and in fact some have paid no taxes at all.

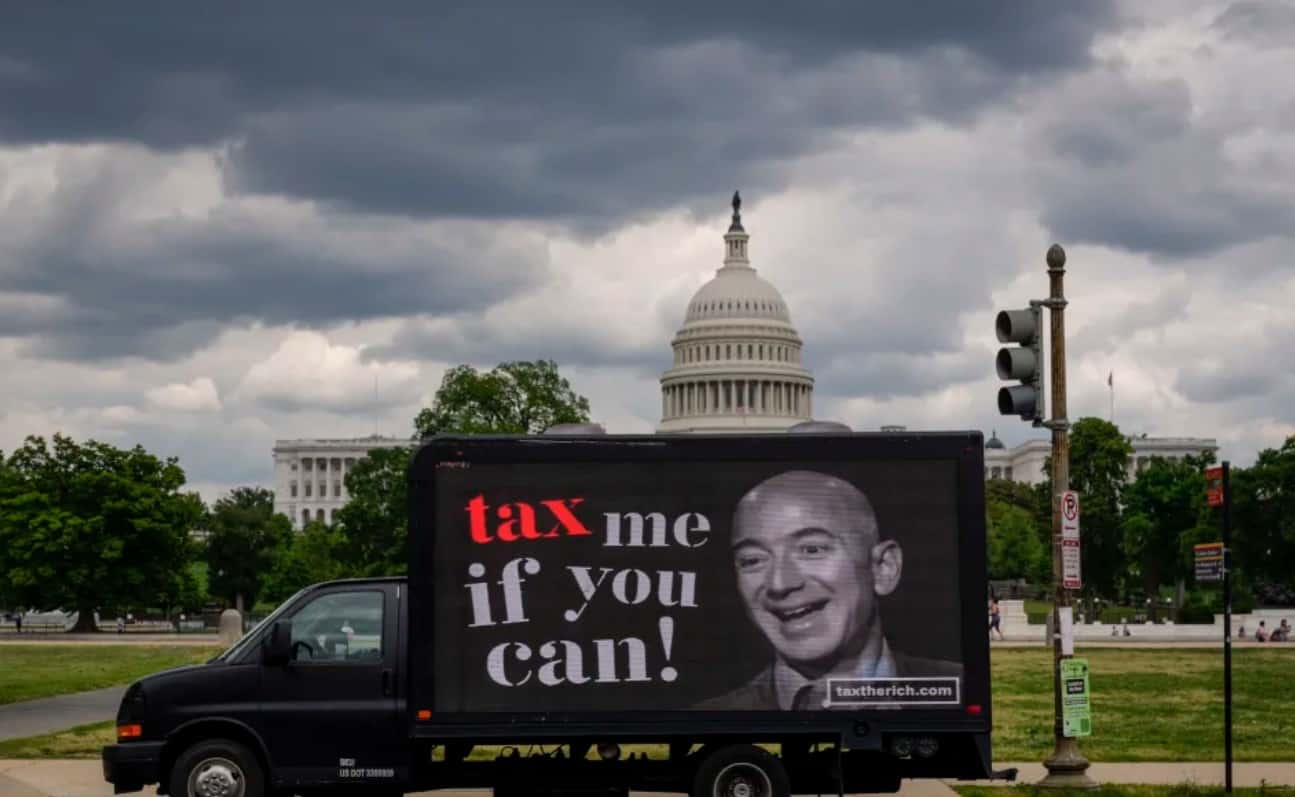

If you think these tax avoiders are all a bunch of rock-ribbed, Trump-loving Republicans, you are wrong. Subjects include Warren Buffett, George Soros and Jeff Bezos, who are Democrats or lean that way.

In some instances, it appears they are paying huge amounts of taxes, but look again. Check out this on Bezos from the ProPublica piece:

“His tax avoidance is even more striking if you examine 2006 to 2018, a period for which ProPublica has complete data. Bezos’ wealth increased by $127 billion, according to Forbes, but he reported a total of $6.5 billion in income. The $1.4 billion he paid in personal federal taxes is a massive number — yet it amounts to a 1.1% true tax rate on the rise in his fortune.”

ProPublica doesn’t even bother to calculate the rate he paid on his $6.5 billion in income. I did. It’s 21.5%, thanks no doubt to tax avoidance schemes. If he was paying at today’s top marginal rate of 37%, he would have paid $2.4 billion, instead of $1.4 billion. (The top marginal rate ranged from 35% to 39.6% in that time period.) The difference—the avoidance if you will—a cool $1 billion is enough to…well, maybe we should ask Bezos what he did with it.

Same logic applies to Warren Buffett who despite his protestations that the tax code is messed up, paid $24 million in taxes on $125 million in income between 2014 and 2018, according to the article. His defense is that he will give 99.5% of his money to philanthropy upon his death. Fair enough Warren, but again, how about having it both ways? Avoid the tax avoidance and pay your 37% across the board. You’ll still be giving away more than $100 billion.

Now consider the practice of billionaires paying themselves a pittance in salary. Bezos famously pays himself $81,840, as a nod to the working man, apparently. Mark Zuckerberg, Larry Ellison and Larry Page reportedly take home $1 a year. We used to think of this as a show of good faith, a display that the billionaires believed their company’s stock would go up and that they were aligned with and would share in that risk with shareholders.

Now it almost looks like flaunting. As in, NAH-nah-nah-NAH-nah, I make so much money in capital gains I don’t need income and by the way, it allows me to avoid paying any taxes. Wouldn’t it be nice if Elon Musk took a salary of $500 million and paid $185 million in taxes. That’s a whole lot more than the $65,000 he paid in taxes in 2017, according to ProPublica. (And he paid zero in 2018, according to the article.) Know that Musk’s net worth increased by nearly $14 billion from 2014 to 2018 and that he is worth some $166 billion today.

What that means is working people essentially subsidize billionaires. Drive down Highway 101 in Silicon Valley, and know you chipped in more than Elon Musk did for that road, not only on a relative basis, but in some years on an absolute basis. That Musk and his cohort have created thousands of jobs and billions of market value does not offset this in any way. How about create the jobs and the market value, AND pay your fair share of taxes? Is that too much to ask?

And to those of you who are crying, ‘lay off these people, they are engines of our economy and it’s the American way,” I will tell you I agree with you (except the lay off part.) They are (mostly) helping move our country forward. But again, it’s not a binary thing is it? You can get insanely rich and pay billions in taxes. Yes, both. Do you really think Musk and Bezos knew they’d be worth over $150 billion-plus each and their plans would have been foiled if they paid $5 billion or $10 billion more in taxes along the way?

By the way, does the government waste money? Sure. Is that any reason not to pay taxes? No, it’s a problem to fix, and it’s not all broken anyway. I was just at Grand Teton and Yellowstone National Parks and it was a joy to see my tax dollars at work there.

But I would admit that our system of tax collection is so broken that it would almost make more sense to tell billionaires that from now on paying taxes is 100% voluntary, the only catch is that it’s transparent. I bet this would result in squeezing more money out of them than they currently pay. Or how about a billionaires’ minimum tax? I know that’s essentially a wealth tax, like the one Bernie Sanders and Elizabeth Warren have proposed, which would be 3% for billionaires.

Sorry for the rant. I just couldn’t help myself when I discovered that in any given year I’m paying more, much more, taxes than George Soros or Mike Bloomberg. I don’t care what the tax code says. That. Is. Just. Not. Right.

People won’t work for peanuts anymore

Which brings us to Element B that I mentioned at the top, which is that hotels, restaurants and other businesses are having a devil of a time hiring right now. The U.S. Bureau of Labor Statistics reported on Tuesday that job openings increased by almost 1 million at the end of April to nearly 9.3 million, a record high. Separations, or “quits” also hit a record of 2.7%.

Why is that?

Much of it is because of COVID-19, of course. The recovery and opening up of the economy is creating unprecedented demand for workers, ASAP. And there are worries about the workplace. “Part of the story is there are still workers who are concerned about COVID from a physical perspective (contracting the virus) and a mental perspective,” says Joseph Song, a senior U.S. economist at Bank of America. “A lot of these workers were in the service sector and dealing with customers during COVID is not easy, such as imposing COVID rules when a customer doesn’t want to abide can be tough. There are also some concerns about childcare and family issues especially for children who are still doing virtual or hybrid. Someone has to be at home.”

But there’s another matter, which is pay. Some companies just aren’t ponying up enough to attract workers. Plenty of people, including Democrats, point to the $300 a week stimulus checks (on top of state insurance of course) as being a deterrent to workers coming back on payroll. “I do think unemployment insurance benefits could be having some effect,” says Heidi Shierholz, a senior economist and director of policy at the left-leaning Economic Policy Institute. “We know low wage employers have a lot of capacity to suppress wages, and when workers have another option and aren’t totally desperate to take a job no matter how sh***y, unemployment insurance may be playing a role to some extent.”

Do the math. Take the federal minimum wage of $7.25 (which hasn’t been raised since 2009), and multiply it by eight hours (a day), times five days (a week), times 52 weeks. It comes to an annual salary of $15,080. (And that’s with zero time off, which is unrealistic of course.) The $15,080 is less than the $300 a week federal COVID payment (annualized $15,600), plus you can on average double that from state unemployment insurance, which comes to some $30,000.

No wonder people won’t work for peanuts anymore. And furthermore, you can argue the government has taught them not to, beginning with the CARES Act which was signed into law by President Trump in March 2020. To get workers back, companies are going to have to pay more.

“Right now it looks like we might see a one-time step up in wages as a result of these labor shortages,” says Daniel Zhao, a senior economist with the job site Glassdoor. “Even though no $15 minimum wage was enacted by law, we’ve now seen companies set it as a minimum wage or average wage. Folks have said that because minimum wages are so far away from market wages right now, employers don’t have useful reference for where to set wages. Employers are having to experiment much more aggressively to find what the right market wage is, which could mean a more dynamic market and more competition in terms of setting wages.”

So basically $15 is becoming the new minimum wage, which is $31,200 annualized. Kind of makes sense, right? If more than doubling up the minimum wage seems like a huge leap to you, consider that it amounts to a raise of about .64 percentage points per annum over those past 12 years.

Uh oh. Here come the whiners: “Ohhhh, I will have to lay people off. Ohhhh, I will have to raise prices. Ohhhh, that will kill job growth.” And there’s even this from supply side economist Arthur Laffer in an interview on Fox:

“…the poor, the minorities, the disenfranchised, those with less education, young people who haven’t had the job experience,” Laffer said. “These people aren’t worth $15 an hour in most cases….And after becoming unemployable, they become hostile…”

It’s all bunk of course, and if you don’t believe me ask the CEOs of McDonald’s (MCD), Target (TGT) and Chipotle (more on them below), which now have or are moving to $15 an hour. Even Walmart is heading in that direction. Amazon, btw, raised its minimum wage to $15 three years ago. (That makes sense given negative press about the work environment in some of Amazon’s warehouses and given that Bezos doubtless didn’t want to give his nemesis President Trump any more ammunition.)

For a company of any size though, if you can’t raise your pay over $7.25 an hour, it means that over the past decade the federal minimum wage has helped you hold down wages and subsidize your business. I suspect the partly free lunch will soon be over for you.

I’m not saying it will be easy for all businesses. But for some excellent case studies, read this spot-on article in the Washington Post about 12 companies that raised pay for workers. Here’s the lead:

“The owners of Klavon’s Ice Cream Parlor had hit a wall.

For months, the 98-year-old confectionary in Pittsburgh couldn’t find applicants for the open positions it needed to fill ahead of warmer weather and, hopefully, sunnier times for the business after a rough year.

The job posting for scoopers — $7.25 an hour plus tips — did not produce a single application between January and March.

So owner Jacob Hanchar decided to more than double the starting wage to $15 an hour, plus tips, ‘just to see what would happen.’

The shop was suddenly flooded with applications. More than 1,000 piled in over the course of a week.”

Not only did these 12 businesses get more and better applicants, but attrition dropped. And at least one company noted increased sales from having more employees which offset the increases in costs. Yes, a few had to raise prices. But higher wages doesn’t necessarily mean hurting your business.

For instance, as Yahoo Finance’s Brian Sozzi pointed out, Chipotle just raised prices, and presto, its stock went up. Why? Because people are now willing to pay more for their food.

“…despite the newest menu price increase, Chipotle (CMG) isn’t showing any signs of losing customers upset with having to pay more for a burrito or salad bowl. Actually it’s quite the contrary. With people becoming more mobile after getting their COVID-19 vaccine, they are packing out Chipotle (and other fast food restaurants) locations for lunch and dinner. What amounts to pricing power amidst strong demand is likely to be a tailwind to Chipotle’s earnings this year, even when factoring in higher labor costs.”

Good thing that Chipotle is raising pay for its workers, because its CEO felt no pay-pain during the time of COVID. Not at all. In fact Chipotle CEO Brian Niccol took home $38 million in 2020 or reportedly 2,898 times more than the median store-level employee. As if that ratio isn’t eye-catching enough, there’s this nugget too: “For 2020, Brian’s compensation includes the value of a one-time modification that is not reflective of his ongoing pay package.” Hmm, what modification might that be. Why, it’s right there on page 43 of the company’s proxy*.

Let me summarize for you. Chipotle got the go ahead from some big shareholders to throw out the performance of restaurants as well as cost increases during the worst of the pandemic which would have crimped the CEO’s comp. In other words, he got a mulligan. To be sure, Chipotle was supportive of its employees during COVID. But it does look like the company was even more supportive of its CEO and other top executives.

Same thing with Amazon—and this is how wealthy people not paying their share of taxes and worker pay is connected. Sure Bezos raised hourly comp to $15 an hour. But he’s now worth almost $200 billion and according to ProPublica paid 23% tax on his earnings of $4.22 billion between 2014 and 2018 (never mind no tax in 2011 ) and of course nothing per se on his net worth.

So while CEOs and billionaires employ armies of experts to pump millions and billions more into their pay packages and work furiously to avoid taxes, we get all bent out of shape over paying people, get this, a living wage.

It’s insane.

And it brings me back to the kicker of that Washington Post story:

“There’s a shaming that’s happening to working-class people,” said Schaefer, the owner of the D.C.-area hardware stores. “Nobody talks about the fact that the economy is going to fall apart when a tech guy gets a $195,000-a-year salary with a 5% raise every year, or when lawyers are making $300,000. This conversation only happens when you’re talking about the people who make the lowest wages. And I think as a society, that’s just really insulting.”

Hear hear.

I spoke to LA Dodgers co-owner and CEO of Eldridge Industries, Todd Boehly, on this subject recently:

“Labor costs are going to go up, period,” he said. “And I think they should. $30,000 a year is not enough to live on. I just think we need more people back working. So I think we’re going to be paying more for hotels and more for food and more for restaurants, which frankly, we should. I just think we’re lucky to be alive and we’re lucky to be American.”

Another round of hear hears.

How about this for a radical thought: Close the damn tax loopholes and make the billionaires pay their 37% rate. Or have them fork over a minimum annual tax of 1% of their net worth—a third of what Sanders and Warren want. (Or we could implement my purely voluntary but 100% transparent tax idea. Ha.)

And finally this: Raise the minimum wage in this country to $15 an hour.

Pay to the People!

*After engaging with five of our top shareholders with combined ownership of approximately 34.2% of our common stock to understand how to help ensure fair alignment for our leadership team, the Compensation Committee approved the following modifications to the 2020 annual incentive plan and 2018-20 long-term performance share units (“PSUs”):

(i) Excluded three months (March, April and May 2020) from the calculations of comparable restaurant sales (“CRS”) and restaurant cash flow (“RCF”) margin in which CRS growth was below -7.5%. For the PSUs, this is only three of 36 months in the performance period. These were months in which CRS growth was severely impacted by COVID-related government restrictions. These restrictions required us to completely close some of our restaurants, close many of our dining rooms, limit our offerings to takeout and delivery, and/or implement modified work hours.

(ii) Excluded certain COVID-related expenses (i.e., the net increase in delivery costs) in the calculation of RCF margin from the remaining months of 2020. We excluded these costs due to the unexpected, sudden and significant spike in delivery costs caused by the pandemic and our inability to rapidly offset these unexpectedly higher costs.