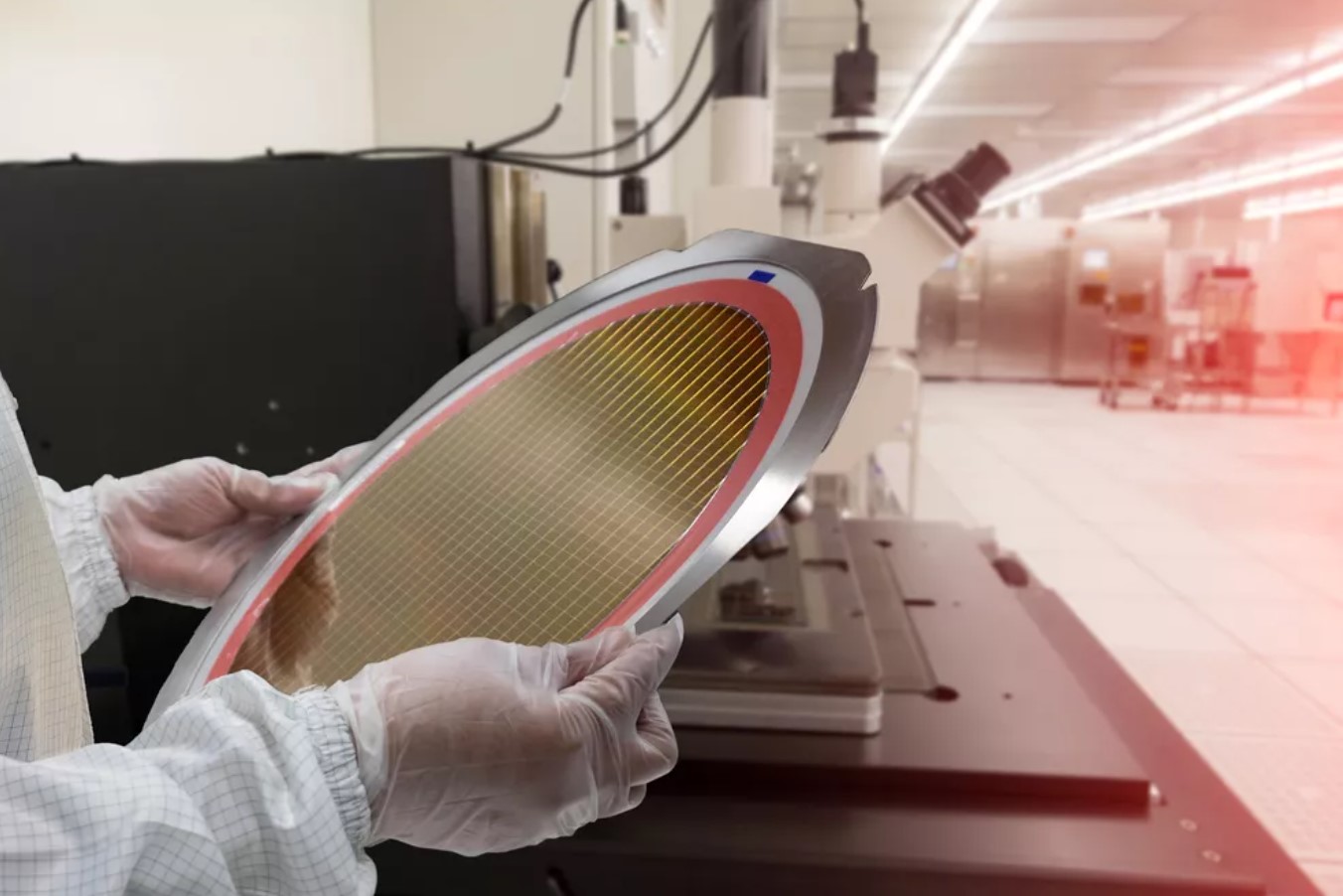

The tech shortage is wreaking havoc on the market, and the world’s largest chipmakers are going into overdrive to procure as many raw materials as possible to alleviate the issue. As reported by Nikkei Asia, the world’s nine leading chipmakers hit a record high of $64.7 million worth of raw materials inventory in June as they continue to ramp up production.

The total inventory for these chipmakers, including TSMC, Intel, Samsung, Micron, SK Hynix, Western Digital, and more, is now at historic highs. The amount of raw materials in total inventory has been steadily increasing since March of 2019 to the point where all these companies have at least 24% more inventory than ever before.

Despite the large stockpiling of raw materials, demand for semiconductor chips has remained incredibly high, negating the increased output. This is largely thanks to the automotive industry, which is believed to be purchasing far more chips than it needs for building cars.

Traditionally, automakers use the ‘just in time’ strategy for processors, meaning they order chips as they are needed. But now, many automotive companies plan to switch gears by holding years worth of stock to ensure there’s enough of a buffer to hold out in case of another shortage.

While this is a good idea for carmakers, this could turn out to be a big problem for chipmakers down the road. Having ‘artificial’ chip demand means there could be a huge drop in demand down the road, which could cost chip makers a lot of money.

However, there are ways to ensure that does not happen. For example, Toyota wants to create a new centralized inventory that monitors both chip manufacturing output and how many chips are headed to its storage sites. This solution could potentially be great for chipmakers, allowing automakers to not overbuy chips and preventing a massive demand drought.

But the automotive industry is not the largest consumer of semiconductor chips, so the tech shortage is still largely driven by appliance, smartphone, and computer sales.

Thankfully, chip makers now have a significant amount of raw materials to use when needed. The problem is the current fab capacity which currently cannot sustain market demand.

Both Intel and TSMC are in the middle of building new fabs in the United States, which should be the killing blow to the tech shortage. All we have to do is wait a year or two until those facilities come online.