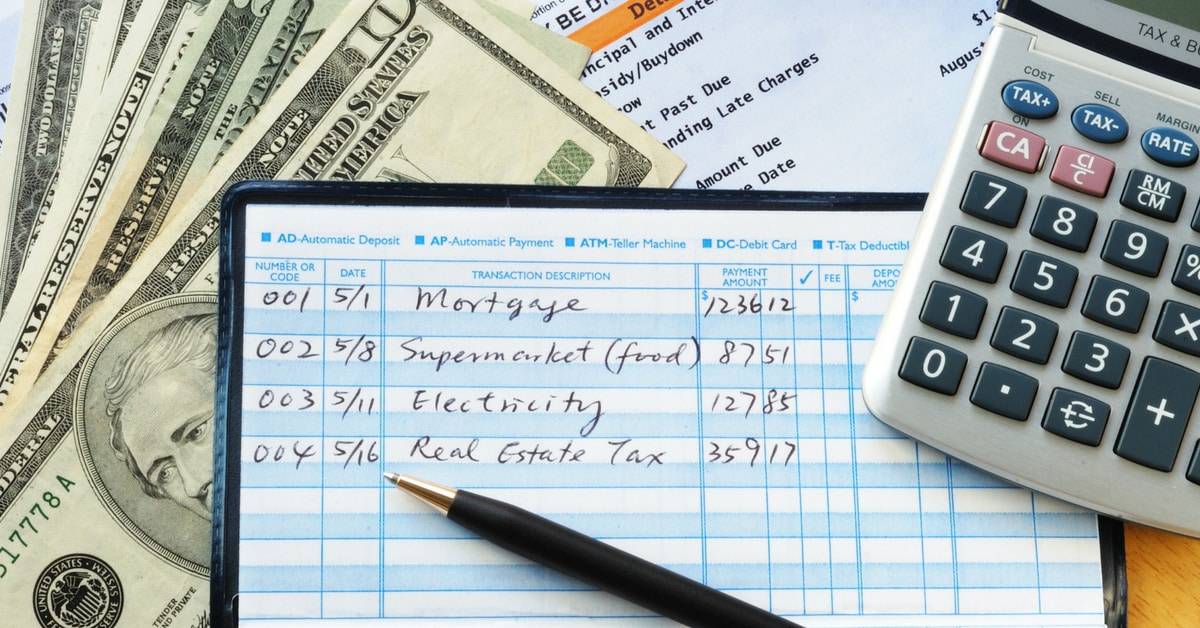

When we think about personal finance, we often consider budgeting or investing, but we don’t necessarily think about balancing a checkbook. Perhaps that is because paper checks are less common than they used to be. But there are other ways to keep track of what you spend.

In other words, there are more options other than writing your check balances in the back of a checkbook. These days, you can do things digitally instead. Thus, you may not actually be keeping track of paper checks you have written; instead, you might keep track of all your transactions. In doing so, you know exactly how much you spend each month, helping you stay on budget.

In this article, we’ll go through how to balance a checkbook digitally and why it is important to do so.

Tips for Managing Your Budget Digitally

Unless you are still writing paper checks, you won’t actually have a checkbook to balance digitally. You can, however, balance your budget to ensure you aren’t spending too much in any given area. And even if you are just managing your digital transactions, many of the same skills apply from balancing a checkbook.

Of course, there is still work involved, and things won’t always be perfect. Here are some tips for managing your budget digitally, with advice from Dani Pascarella, CFP, founder and CEO at OneEleven Financial Wellness.

Make It a Habit

We have more tools than ever to make the process easier, and Pascarella suggests taking advantage of them. “Setting an alert on your phone for a time that’s convenient makes this process easy. Once you’ve mastered daily budgeting and have a solid handle on your spending, you can make the habit less frequent, like on a weekly basis.”

Change Your Budgeting Narrative

Managing your money can seem like a chore. Maybe you’d rather just worry about it later, but Pascarella says changing your narrative can go a long way. “If budgeting feels boring and restrictive, you’re doing it wrong. It should feel empowering. You are the CEO of your own life. You worked hard, earned money and now it’s time to figure out how to spend those dollars in the way that makes you as happy as possible. Changing your budgeting narrative from a negative one to an empowering one will motivate you to stick with it.”

Don’t Expect Perfection

We’re all human. There might be times where you go over budget, said Pascarella. “Unfortunately, the majority of budgeting tools leave little room for error. We start the process with the best of intentions, and then we feel disappointed in ourselves when our actual spending doesn’t exactly line up with our initial budget.”

But even if you go over budget, that shouldn’t discourage you. “So ditch the perfectionist mindset, leave some wiggle room in your budget and understand that it’s OK when your spending doesn’t go according to plan.”

Best Digital Resources and Apps To Balance a Checkbook

There are more digital resources and apps available than ever to balance a checkbook and maintain a budget. Some of the best ones include:

- Mint

- Personal Capital

- YNAB

- PocketGuard

- Goodbudget

Remember that budgeting and digital checkbook apps are just a tool. And, as they say, a tool is only as good as the hands that wield it. That old wisdom applies to budgeting tools, too, says Dani Pascarella. “All of these budgeting tools can help you create a budget and stick to it. The important thing is finding the tool that you will actually use on a regular basis.”

Why Balancing a Checkbook Is Important

Whether you are balancing a checkbook digitally or simply keeping track of your transactions, it’s important to stay on top of things. For one thing, we don’t always know where our money is going until we keep track. When you start to track every transaction, you might be surprised to find how much you are spending on something that isn’t adding much value to your life. Thus, you can start to prioritize your spending and work on achieving your financial goals instead.

“Balancing a checkbook is the first step in taking control of your financial situation,” said Pascarella. “It helps you understand where your money is going and what changes you can make to improve your overall quality of life.”