Stock Markets

The past week’s trading again assumed a heightened level of volatility as different news stories provided investors causes for concern, despite six months of listless trading. An early 5% sell-off based on intraday prices dominated the major benchmarks. Still, in the end, the market proved resilient as the indexes recovered lost ground to move sideways to slightly higher. The week began with the S&P 500 plunging to its greatest intraday loss since May 12 and slipped momentarily below the index’s 100-moving day average, a closely monitored indicator of technical movement. Over the week, the longer-term bond yields sharply increased, promising an improvement in banks’ lending margins and thus propping up financial shares. Utility shares lagged, although energy stocks outperformed, together with financials, within the S&P 500. The week’s opening sell-off appears to have been influenced by several factors. The most prevalent was speculation that Evergrande, China’s second-largest real-estate developer, could default. Evergrande is also the most heavily leveraged company in the world, such that a likely default could trigger a global financial contagion can take place, reprising the September 2008 collapse of Lehman Brothers. By Wednesday, however, equities recovered much of their losses. News of a restructuring plan for the beleaguered Evergrande perked up investor sentiment, together with the report of a substantial capital infusion into the Chinese banking system.

U.S. Economy

The possibility of softening in the housing market constituted another dampener in China’s economic growth prospects, adding to the lethargy created by restrictions to halt further COVID-19 case outbreaks. Credit growth slowdown and regulatory crackdowns affecting several sectors further weighed in on the economic recovery. However, despite the bad news, the market still showed some resilience, a signal that much of the anticipated adverse developments have already been discounted, and a policy stimulus is likely to be adopted.

- Industries that correlate more closely with the economy rallied despite this week’s precipitous trading. The financial and energy sectors as well as small-caps and value-style investments overperformed in the market, consistent with their cyclicality. These sectoral strengths associated with the broad economy are signs of a resilient market that has already considered possible adverse developments.

- The yield on the benchmark 10-year Treasury bonds rose to its highest level since the start of July. This is due to signals from the Fed of the impending tapering of the bank’s bond purchases. The policy change will likely be announced at the November meeting, to be concluded by the middle of 2022. The optimism in equities and steepening of the yield curve are signs of investor confidence that economic growth will be strong next year, enough to sustain the gradual elimination of the Fed stimulus.

- For S&P listed companies, profit margins rose much faster than costs during the second quarter, attributed to the strong underlying economy. Soon the third-quarter earnings report season may show a slowdown in companies’ profits due to the slower pace in revenues increases and input-cost increases catching up as a result of labor and materials supply shortages. The recent peak in the ISM manufacturing Purchasing Managers’ Index suggests that companies may incur difficulties passing production costs to consumers, further slowing earnings growth. These problems may prove transitory with the easing of supply-chain disruptions in the succeeding quarters, but some market volatility is reasonable to expect.

Metals and Mining

The precious metals sector is returning to some normalcy as investors met in person at the prestigious Denver Gold Forum for the first time in almost two years. Until now, there had been lackluster interest and bearish price movements in the precious metals sector. Analysts attribute the market’s bearishness to the plans of the Federal Reserve to gradually taper its monthly bond purchases and adopt further tightening in monetary policy. The prevailing pessimism sets up the current environment for investors to adopt a profitable contrarian position. Despite gold prices coming down from last year’s record highs, the mining sector continues to hold plenty of value. Gold still holds promise as an excellent long-term investment.

The precious metals sector ended mixed the past week. Gold slid 0.22% from $1,754.34 to $1,750.42 per ounce. Silver gained a slim 0.13% to close at $22.42 from $22.39 per ounce. Platinum also gained, closing at $985.36 from $942.79 per ounce, up 4.52%. Palladium lost 2.18% to close at $1.972.96 per ounce from the previous week’s close at $2.017.00.

According to some analysts, the base metals sector shows promise of taking off on a good, long run. Copper gained marginally, rising 0.22% from $9,312.00 to $9,332.50 per metric tonne week-on-week. Zinc spot price rose 1.31% to $3,128.00 on Friday’s close from $3,088.00 per metric tonne a week earlier. Aluminum closed at $2.915.50 from the week-ago $2,885.50 to $2.915.50 for an increase of 1.04%. Tin gained a substantial 7.03%, from $34.140.00 to $36,539.00 per metric tonne for the week.

Energy and Oil

Last week was the third straight week of oil price gains despite a slight correction on Friday. The price increases of late are due to the current supply disruptions in the United States and failure among some OPEC+ members to increase production consistent with their stated production targets, including Nigeria and Angola. Last week’s optimism surrounding the speculated Chinese SPR sale lost steam this week as discussions now focus on the capabilities and willingness of oil-producing countries to meet the robust worldwide demand for oil. The global benchmark Brent price hovered around $77 per barrel last Friday, as WTI was assessed more recently at $73 per barrel. Discounting the period when Hurricane Ida took place, the difference between the Brent and the WTI Crude Oil Spot Prices is now at its broadest since March of this year.

Natural Gas

The liquid natural gas imports into Brazil are rising to a record high for September, at one million tons LNG). Petrobras and others continue to purchase US cargoes. In other news, Mark Gyetvay, who holds the position as deputy head of Russia’s lead LNG producer NOVATEK, was arrested in the U.S. on tax charges involving $93 million in offshore Swiss accounts. Gyetvay holds both Russian and U.S. passports. Also in the LNG sector, Gulfport Energy, a U.S. natural gas upstream-focused company, is considering a possible sale. Control of the firm has been transferred to creditors months earlier as part of its completion of a Chapter 11 bankruptcy process. The current market value of Gulfport is approximately $1.6 billion. U.S. natural gas spot prices fell at most locations over the past report week (September 15 to 22).

The Henry Hub spot price descended from $5.60 per million British thermal units (MMBtu) to $4.83/MMBtu. The price of the October 2021 NYMEX contract fell $0.66 from $5.460/MMBtu to $4.805/MMBtu for the same report week. The price of the 12-month strip averaging October 2021 through September 2022 futures contracts dipped by $0.41/MMBtu to $4.258/MMBtu. Natural gas futures prices have descended from last week’s multi-year highs. Only the January futures contract settled above $5.00/MMBtu, at $5.04/MMBtu on the week’s end.

World Markets

European equities began to surge on heightened optimism that the economic expansion would continue with enough strength to balance off the impending elimination of the central bank’s accommodative monetary policies. However, there remain ongoing concerns about the giant Chinese property developer, Evergrande, that somewhat offset the gains in the market. The pan-European STOXX Europe 600 Index closed 0.31% up this past week over the previous week. The major indexes followed suit, with Germany’s Xetra DAX Index gaining 0.27%, Italy’s FTSE MIB Index rising 1.01%, and France’s CAC 40 Index climbing 1.04%. The UK’s FTSE 100 Index gained 1.26% for the week. The major European markets appeared poised to absorb the central bank’s monetary tightening after Norway became the first Group of Ten (G10) country to raise its key short-term lending rate by 25 basis points to 0.25%, with the possibility of a further rate increase in December. The Bank of England maintained its rate at 0.10% even as two policymakers opted to end the quantitative easing program earlier.

In a holiday-shortened trading week, Japanese stocks closed lower on volatile trading. The stock markets were closed on Monday and Thursday in commemoration of Respect for the Aged Day and Autumnal Equinox Day, respectively. The Nikkei 225 Stock Average ended the week at 30.248.81, a slight margin down for the week and a minor correction off the index’s 31-year high attained earlier this month. The yen traded close to JPY 110 against the U.S. dollar. The yield of the 10-year Japanese government bond settled at 0.55% at the week’s end. The OECD adjusted Japan’s GDP forecast to 2.5% in 2021, but revised it further to 2.1% in 2022. This represents the slowest growth rate among all the major developed economies. The global GDP growth rate was revised downward to 5.7% in 2021, reflecting the rise in inflation and supply chain disruptions.

Chinese stocks closed a holiday-shortened trading week sideways from the previous week’s close. The stock markets were closed for trading on Monday and Tuesday in celebration of the Mid Autumn Festival. Comparatively, Hong Kong’s Hang Seng Index plunged more than 3% on Monday due to the rising debt crisis revolving around the Evergrande Group of China. Helping to ease worries over a disorderly debt resolution for Evergrande was the series of large cash injections by China’s central bank during the week. However, some of Evergrande’s offshore bondholders did not receive their share of the USD 83.5 million in interest payments in compliance with the Thursday deadline. Evergrande is now on a 30-day grace period. If the period passes without payment, the company will be considered in default. In the bond market, amid concerns over the cost to Beijing should it need to rescue Evergrande, the yield on the 10-year Chinese government bond rose two basis points to 2.92%. The renminbi remained unchanged against the U.S. dollar, trading at 6.463 per dollar in Shanghai by late Friday afternoon.

The Week Ahead

Among the reports to be released this week on important economic data are consumer confidence, personal income, and personal consumption.

Key Topics to Watch

- Durable goods orders

- Core capital goods orders

- Trade in goods, advance report

- S&P Case-Shilller home price index (year-over-year)

- Consumer confidence index

- Pending home sales index

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Real gross domestic product (revision)

- Chicago PMI

- Real disposable income

- Real consumer spending

- Core inflation

- Market manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Consumer sentiment index (final)

- 5-year expected inflation rate (final)

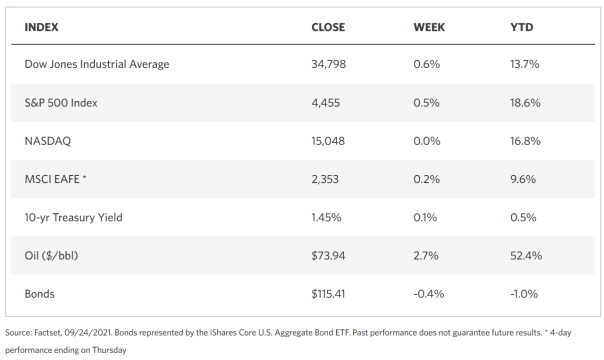

Markets Index Wrap Up