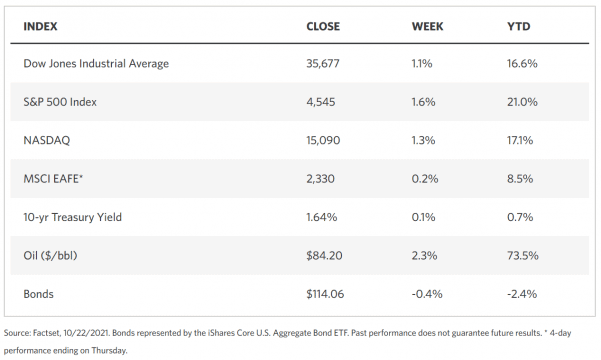

Stock Markets

Making significant moves to record highs in the past trading week are the Dow Jones Industrial Index (DJIA), the broad S&P 500 Index (which hit a seven-day winning streak), and the S&P MidCap 400 Index. The surges were partly due to the series of positive company earnings reports for the third quarter. The Cboe Volatility Index (VIX) fell to its lowest since the pandemic began in apparent confirmation of the currently prevailing strong investor sentiment. Leading the gains within the S&P 500 are the real estate and utilities sectors, as well as health care shares boosted by insurance providers. For most of the week, communications services remained strong, although social media stocks took a deep dive on Friday due to negative news from Snapchat parent Snap. The latter issued downward guidance on possible future earnings, blaming its dilemma on the new Apple iPhone privacy settings. Another sector that underperformed during the week was Energy shares, after their recent substantial gains. Due to the past week’s performance, equities gained nearly 6% this month, fully offsetting the previous month’s losses. In contrast, bonds came under pressure, with the 10-year yield reaching its highest level since May. The rising inflation continued to be a major concern, although bonds may continue to be a worthwhile investment.

U.S. Economy

Despite the fact that the 10-year Treasury yield advancing to 1.70% in the past week from 1.20% in August, over the last 50 years, yields have never been this low relative to economic growth and inflation. This phenomenon hints at the existence of further upside for yields, yet it is worth keeping in mind that longer-term yields peaked at a lower rate in each of four market cycles over the past four decades. This downward trend has persisted and may continue to persist in the future. Interest rates may continue to experience downward pressure due to a number of factors. One is the changing demographics; the rising life expectancy and aging population indicate greater savings for prolonged retirements. This will drive an increase in savings and demand for bonds. \

On the other hand, investors with a longer-term investment horizon may benefit from higher yields in the long run, however, rising interest rates may be unattractive for fixed-income returns in the short run. It is typical for interest rates to rise as the economy improves and corporate earnings rise. High-yield bonds will tend to outperform in a lower corporate-bond default risk scenario. Consequently, with the growth, higher inflation, and rising interest rates, the value-style investments and cyclical sectors in equities are also likely to perform well, in the same manner as financials and energy shares did this year. As the economy expands, investors will do well to maintain a balanced approach in their portfolio allocations between equity and fixed income. It will be best to overweigh investment-grade bonds in the fixed-income portion, as bonds will likely prove resilient during brief downturns.

Metals and Mining

The optimism that pushed precious metals higher spilled over into the greater part of the past trading week, with gold and silver prices rising to near-peak levels. Gold even exceeded $1,800 an ounce to realize a new six-week high. However, the buoyancy in precious metals was disturbed by the announcement by Federal Reserve Chair Jerome Powell that steps are being taken to contain the risk of rising inflation. On an online conference hosted by South African Reserve Bank, Powell affirmed that the central bank would pursue the reduction of its monthly bond purchase as scheduled. He commented that supply chain issues are expected to be resolved despite rising inflation risks, and inflation will return to 2%. Since gold is regarded as the flight-to-safety alternative during rising inflation, the announcement caused a roughly $30 correction in gold prices off their session highs. Nearing Friday’s close, however, investors went bargain hunting and pushed the precious metal to within a few dollars short of $1,800 per ounce.

Gold spot price ended the week at $1,792.65 per troy ounce, up 1.42% from last week’s close at $1,767,62. Silver gained 4.33% to close at $24.32 per troy ounce from the previous $23.31. Platinum lost 1.38% to close at $1,043.99 from the earlier week’s $1,058.64 per troy ounce. Palladium also lost for the week, ending at $2.021.50 per troy ounce from $2.078.21, down by 2.73%. Base metals did not fare better. Copper spot slid from the previous week’s $10,281 to this Friday’s close of $9,831.50 per metric tonne. Zinc ended the week at $3,429.50 per metric tonne, down 9.62% from last week’s close of $3.794.50. Aluminum ended at $2.910.50, per metric tonne, lower by 8.23% from the earlier week’s close of $3,171.50. Tin moved sideways, gaining only 0.13% week-on-week, from $37,200 to $37,250 per metric tonne.

Energy and Oil

Emerging once more into the spotlight are energy stocks. The energy sector significantly outperformed the broad S&P 500 index in the past week, The crude oil spot price itself was stagnant for most of the week, with Brent trading at $85 per barrel and WTI moving closer to Brent at $83 per barrel. Although both gas and coal prices have corrected this week off their previous peaks, the reduction was not sufficient enough to balance the tight supply. Oil was able to maintain its price support as a result of a surprise U.S. crude stock draw, even as the EIA data controverted the API’s forecast of solid gains for the week. Although crude futures experienced a steep reversal, it is unlikely that oil prices will significantly change until the current energy crunch experiences a fundamental shift. On the global front, Saudi Arabia turned down the clamor for a strategic change in the OPEC+ production strategy. Amidst increasing pressure to reduce outright prices, Saudi Energy Minister Prince Abdulaziz bin Salman stated that the current crude shortage is not the cause of the present energy crunch.

Natural Gas

For the report week, Wednesday, October 13 to Wednesday, October 20, natural gas spot prices descended at most locations. The Henry Hub spot prices dropped $0.66 from $5.45 per million British thermal units (MMBtu) to $4.79/MMBtu week-on-week. Demand declined more than supply for the week, causing the Gulf Coast prices to come down. The HIS Markit estimates a drop by about 220 million cubic feet per day (MMcf/d) in average weekly supply into Southern Louisiana where the Henry Hub is located, due mainly to lower receipts from the north and lower offshore production. Midwest prices also declined during the past week as a result of mild temperatures. A warming trend across the central lower 48 states brought a $0.35 price decrease from $5.18/MMBtu to $4.83/MMBtu at the Chicago Citygate. In California, prices are mixed for the week, rising in the south while falling in the north. The PG&E Citygate in Northern California dropped by $0.10, from $6.86/MMBtu to $6.76/MMBtu. The price at SoCal Citygate in Southern California increased by $0.02 from $6.00/MMBtu to $6.02/MMBtu for the week.

World Markets

In Europe, shares rose due to investor optimism in positive corporate earnings reports. Investor sentiments discounted for the meantime the potential risks of tightening monetary policy by central banks and the likelihood of a slowdown in economic momentum. The pan-European STOXX Europe 600 Index closed 0.53% higher week-on-week, while the major indexes were mixed. Italy’s FTSE MIB gained marginally by 0.31%, while Germany’s Xetra DAX Index lost slightly by 0.28%. France’s CAC 60 Index was unchanged. The UK’s FTSE 100 Index slid by 0.41%. These performances were quite acceptable, given that the market might have been spooked by the rising inflation and the possibility of more restrictive central bank policies. Core eurozone bond yields were elevated on concerns that monetary authorities might raise interest rates sooner than expected. Peripheral eurozone bond yields mirrored the movements in core markets. UK gilt yields rose steeply after the Bank of England hinted that it would “have to act” should inflationary pressures persist, maybe as soon as November. A Reuters poll of economists suggested that the BoE might be the first major central bank to begin rate increases, sending yields further upwards.

In Japan, campaigning for the October 31 general election commenced even as the ruling Liberal Democratic Party led in the polls. Japan’s stock markets absorbed a weekly loss, with the Nikkei 225 Index down by 0.91% and the broader TOPIX Index declining by 1.07%. The yen moved close to a four-year low against the U.S. dollar, ending the week at JPY 113.9 versus USD 1. The currency underperformance was primarily attributed to the widening spread between U.S. and Japanese sovereign yields, speculation that the Japanese government would adopt more stimulus measures, and the steep increase in oil prices. The yield on the Japanese 10-year government bond ascended to 0.09%.

China’s stock markets gained steam as the large-cap CSI 300 benchmark rose by 0.6% and the Shanghai Composite Index gained 0.3%. Officials exerted efforts to calm the markets, particularly with regard to the property sector. Cash-strapped China Evergrande Group made a delayed coupon payment, triggering a rally in the property developer’s bonds and shares. At the start of the week, China’s stocks were sluggish after the data released on Monday showed that the country’s third-quarter GDP increased by a lower-than-expected 4.9% from last year. The underperformance was due to economic expansion being reined in by power shortages and property sector woes. The most recent quarterly growth report was the weakest since the third quarter in 2020 and much slower than the second quarter’s 7.9% growth rate.

The Week Ahead

Consumer credit and consumption, core inflation, and GDP growth are included among the important economic data to be released in the coming week.

Key Topics to Watch

- S&P Case-Shiller home price index (year-over-year)

- Consumer confidence index

- New home sales (SAAR)

- Durable goods orders

- Core capital goods orders

- Advance report on trade in goods

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- Gross domestic product (real, SAAR)

- Pending home sales index

- Nominal personal income

- Real disposable income

- Nominal consumer spending

- Real consumer spending

- Core inflation

- Employment cost index

- Chicago PMI

- UMich consumer sentiment index (final)

Markets Index Wrap Up