Stock Markets

The past week was the busiest week of the third-quarter earnings reporting season, which gave impetus for stocks to rapidly ascend. Most of the major indexes broke out into new highs as most sectors recorded gains. Technology and internet-related companies announced strong results, causing an increase in trading volumes. Within the S&P 500, consumer discretionary shares outperformed due to the surge in Tesla’s prices. As a result, the company’s capitalization topped $1 trillion after news broke out that car rental company Hertz Global will purchase 100,000 of Tesla’s electric vehicles (EVs). As oil prices descended from their recent long-term peaks, prices of energy shares corrected, causing the sector to underperform the market. Also lagging were Amazon.com and Apple, with a capitalization of $1.7 trillion and $2.5 trillion respectively. Supply chain woes continue to plague this sector, with labor and input shortages prompting lower growth forecasts. The resulting decline pulled stock indexes lower from their highs on Friday morning.

Volatility fell this month compared to past years, with the VIX (“fear index”) falling to 17.0, similar to readings before the pandemic. The 5.2% September correction shed most of the overhang, enabling a lighter market to recover and register a 6.6% on the S&P 500 for October. Both growth and value sectors responded with optimism. The further improvement in the COVID-19 situation, both in the U.S. and in other countries, appears to provide a further boost to investor sentiments.

U.S. Economy

The U.S. and the global economy continue on their path to recovery as the pandemic trend and the delta variant situation continue to decline. Looking forward to 2022, however, some risks continue to demand attention and vigilant monitoring. One persistent signal is the elevation in the inflation rate at above the 2.0% targeted by the Federal Reserve. This has remained consistent over the past six months, which is accounted for in part by the supply chain disruptions and supply shortages in areas such as semiconductors. There are signs of gradual improvement, such as the shortening of semiconductor lead times from their peak in October, causing a few automakers to positively note better supply conditions for the third quarter. Generally, corporations estimate that by mid-2022, they may expect supply chain pressures to be fully resolved.

Another area of concern is the monetary policy and future policies to be implemented by the Fed. Speculation is rife that Fed rate hikes might commence as soon as the summer of 2022, triggering volatility in markets. Recently, higher yields on two-year Treasury notes cued the possibility of some market disturbance. However, the Fed has provided continued assurance that it plans to begin with tapering its asset purchases and pause before it would contemplate hiking interest rates. Tapering is likely to begin in November 2021 and continue until midyear 2022. It is the opinion of market analysts that the Fed will continue to exercise patience and continue to observe accommodative measures until the data confirms the need for tightening monetary policy. This outlook will continue to support economic recovery and bring down unemployment below its current 4.8%, which by then will enable the Fed to more confidently raise rates. It has been historically proven that markets perform better during periods of tapering towards the start of rate hiking. There is every reason to believe that the same is likely to occur in this post-pandemic recovery.

Metals and Mining

As with the preceding three weeks, gold tested but retracted from the $1,800 per ounce significant resistance level. The threat of inflation continues to create speculation about the future direction of gold prices due to the precious metal’s attraction as a flight-to-safety investment vehicle. The Federal Reserve tends to take a more hawkish position when inflationary pressures become more pronounced. In the coming week, the Fed will meet to possibly discuss commending the reduction of their monthly bond purchases. Causes for concern include the higher cost of energy and pandemic-related supply constrictions which, if stronger than anticipated, may speed up plans towards adopting more restrictive monetary policies.

The spot price of gold declined slightly last week, falling 0.52% from $1,792.65 to $1,783.38 per troy ounce. Silver likewise dipped from $24.32 to $23.90 per troy ounce, down 1.73%. Platinum descended 2.09% to $1,022.22 per troy ounce from $1,043.99 the week before. Palladium also went south but only slightly, losing 0.86% from the earlier week’s close of $2,021.50 to this week’s $2,004.06. While precious metals generally fell, prices of base metals were mixed. Copper lost 1.68%, closing the past week at $9,666.50 from the previous week’s $9,831.50 per metric tonne. Zinc lost 19.92% to close this past week at $2,746.50 per metric tonne from the earlier week’s $3,429.50. Tin declined by 3.74% from $37,250.00 to $35,858.00 per metric tonne. Bucking the trend was aluminum, which gained 15.86% from $2,910.50 to $3,372.00 per metric tonne.

Energy and Oil

The impressive rally in oil over the past several weeks has settled somewhat over the recent trading week as oil, gas, and coal prices all posted weekly losses. Crude experienced its first week-on-week decline in two months despite the very optimistic third-quarter results announced this week, the most notable of which was Chevron which announced its highest quarterly profit in 8 years. For the week, crude oil settled at below the $85 per barrel benchmark around which it had been moving. Oil supply will continue at their present levels with the OPEC+ Joint Technical Committee agreeing to maintain its commitment to the 400,000 barrel per day supply increase per month, notwithstanding calls from importers to increase supply further.

For November, nuclear talks with Iran returned to the geopolitical agenda. Coming to the table are European Union negotiators with their Iranian counterparts. The restart follows a three-month pause due to the election of President Ebrahim Raisi. Meanwhile, Chinese thermal coal futures traded on the Zhengzhou exchange have dropped to their biggest weekly fail in years. The decline, amounting to 970 CNY or $150 per metric tonne, resulted from Beijing’s restriction on coal prices. In Saudi Arabia, prospects surged on the launching of a 400 MW Dumat al Jandal wind plant by Vestas, the world’s largest wind turbine maker in the months to come.

Natural Gas

The supply of natural gas in the U.S. for the report week, October 20 to October 27, is slightly higher than the week earlier due to increased dry natural gas production. Data from the IHS Markit indicates that the average total supply of natural gas increased by 1.4% over the previous week’s total of 98.1 billion cubic feet per day (Bcf/d). Almost all of this increase is accounted for by the dry natural gas production week-on-week growth of 1.5%, or 1.4 Bcf/d. There was a 1.1% increase in average net imports from Canada from last week to 5.8 Bcf/d. This is significant as it is the highest weekly average going back to the third week of February.

Natural gas consumption in the U.S. rose week-on-week led by the strong increase in the residential/commercial sector demand. The total demand for natural gas in the country increased by 4.8%, or 4.1 Bcf/d for the week, according to the IHS Markit data. This exceeds the increase over the previous week by twofold. The average weekly consumption of natural gas surged in all end-use sectors, the largest demand being in the residential and commercial sectors. This sectoral increase registered 24.3%, or 3.4 Bcf/d, due to the transition to the winter heating season.

During this report week, natural gas spot prices rose at almost all locations. The Henry Hub spot price ascended from $4.79 per million British thermal units (MMBtu) at the start of the week, to $5.86/MMBtu by the week’s end. The November 2021 NYMEX contract expired by the end of the week at $6.202/MMBtu, up by $1.03/MMBtu from the week earlier. The December 2021 NYMEX contract price rose to $6.198/MMBtu, up by $0.75/MMBtu for the week.

World Markets

Over the past week, the pan-European STOXX Europe 600 Index rose by 0.77% on the back of strong corporate earnings. The optimism this generated appears to have compensated for concerns about inflation and the likelihood that central banks may begin to adopt restrictive monetary policies. Germany’s Xetra DAX Index gained 0.94%, France’s CAC 40 Index advanced 1.44%, and Italy’s FTSE MIB Index rose 1.14%. The UK’s FTSE 100 Index climbed 0.46%. Core eurozone yields rebounded while peripheral eurozone bond yields mirrored the core markets. the Debt Management Office reduced the amount of gilt issuance for the rest of the fiscal year by a larger-than-expected amount, resulting in the fall in UK gilt yields.

Japan’s stock exchanges moved sideways for the week with mixed outcomes in anticipation of the October 31 general election. The Nikkei 225 gained 0.30% as the broader TOPIX Index dropped by 0.05%. The ruling Liberal Democrat Party, led by Fumio Kishida, is generally expected to remain in power post-election, but it may lose seats in the powerful lower house of parliament. Nevertheless, earnings announcements among domestic companies helped to buoy market sentiment for the week. The yield on the 10-year Japanese government bond slid earlier in the week but recovered to end the week unchanged at 0.1%. The yen also moved sideways to close at JPY 113.5 against the U.S. dollar.

China’s bourses retreated in light of sustained worries surrounding the property sector. The large-cap CSI Index benchmark and the Shanghai Composite Index each fell by 1% for the week. Weakness in the property sector raised investors’ anxiety since the sector comprises a full third of the country’s overall economy. A series of defaults, credit rating downgrades, and lately a proposed tax plan shook investor confidence in the market. The tax plan is conceived by authorities to reduce leverage among the leading developers. Concerning new tech regulation, Beijing continued its restrictive policies and proposed to impose a security review on internet companies with more than one million users, before they can send user-related data abroad. The yields on China’s 10-year government bond dipped by two basis points to 2.986%, and the yuan lost ground by 0.2% against the U.S. dollar due to dollar purchases by state-run banks at the week’s end.

The Week Ahead

This week, the important economic data expected to be released include the Employment Rate, Unit Labor Costs, and Productivity data.

Key Topics to Watch

- Markit manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Homeownership rate

- ADP employment report

- Markit services PMI (final)

- ISM services index

- Durable goods orders (revision)

- Core capital goods orders (revision)

- Factory orders (revision)

- Federal Reserve statement\

- Fed Chair Jerome Powell press conference

- Initial jobless claims (regular state program)

- Continuing jobless claims (regular state program)

- International trade deficit

- Productivity (SAAR)

- Unit labor costs (SAAR)

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Consumer credit

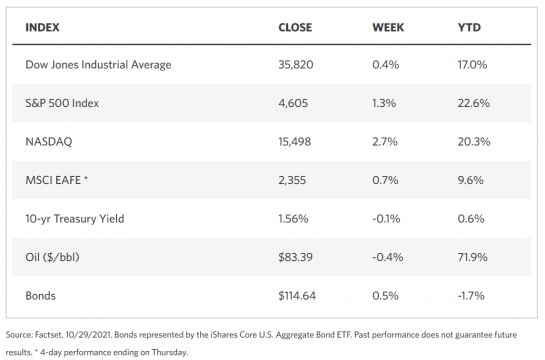

Markets Index Wrap Up