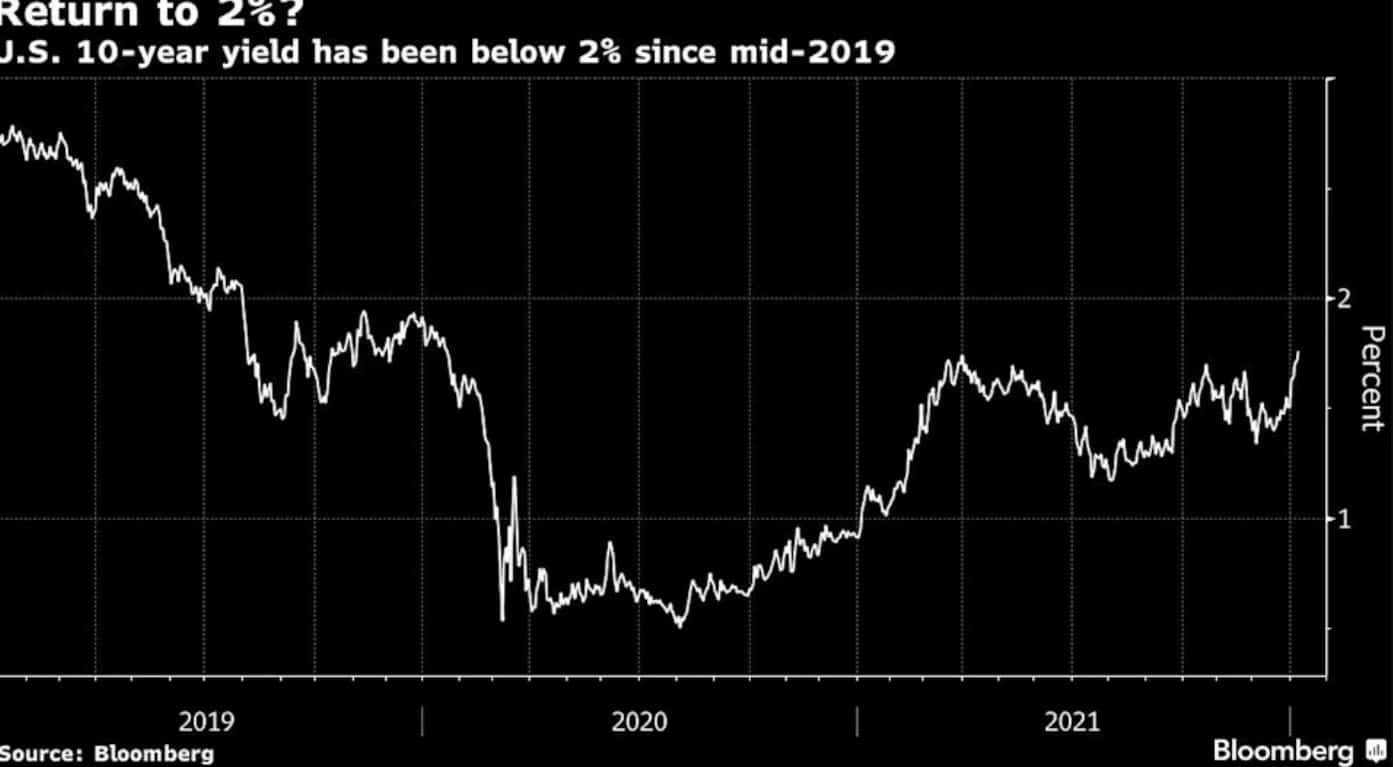

The torrid selloff that raced through the Treasury market this past week has investors bracing for further losses that would push the benchmark 10-year yield toward 2%, with growing expectations the Federal Reserve is poised to act quickly to tamp down the steepest inflation in four decades.

The relentless surge in yields has drawn comparisons with the sharp rise a year ago that extended across the opening three months of 2021. So far, the 10-year note yield has jumped from 1.51% on Dec. 31 to as much as 1.8% on Friday, the highest since January 2020. That sets up the market to soon challenge the year-end target of 2.04% from strategists surveyed by Bloomberg.

The rout has already driven a broad index of Treasuries to a loss of 1.6% this month, blowing past the 1% decline for all of January 2021. The rapid pace of that repricing has raised questions about when the current selloff will abate and whether the early-year rate shock will fade, giving way to a lengthy period of range-bound trading, albeit at higher yields.

“You do get the sense we’ve seen this movie before, but the big difference from 12 months ago is that this time the Fed is driving the market by signaling they want to tighten policy,” said Kevin Flanagan, head of fixed-income strategy at WisdomTree.

“A lot depends on how restrictive policy looks and how deliberate the Fed is in their approach,” said Flanagan, who does not rule out 10-year yields nearing 2.25% before the end of March.

The December Federal Open Market Committee meeting minutes released Wednesday showed the central bank is willing to start raising rates as soon as March and also allow its massive asset holdings to run down at a faster pace than during the previous tightening cycle. The case for such moves was seen as strengthened by Friday’s employment report, which showed unemployment dropped and wages rose at a faster-than-expected pace.

Both Jerome Powell and Lael Brainard will shed more light on the bank’s views in the coming week, when they appear before the Senate Banking Committee for their nominations as Fed chair and vice chair, respectively. The release of the monthly consumer price index on Jan. 12 is expected to show that inflation accelerated from what was already the fastest pace since the early 1980s.

“The minutes are a reiteration of a Fed at a juncture that rate normalization needs to take place,” said Gargi Chaudhuri, head of BlackRock Inc.’s iShares investment strategy, Americas. “Rates will not rise in a straight line and we think buyers will turn up and make for more of a two-way market as the 10-year nears 2%.”

Positioning in the market has become increasingly bearish since the start of the new year, with rates traders favoring positions betting on higher yields in the options market. Some of the notable trades included $16 million spent on a downside hedge targeting a 1.95% 10-year yield by the middle of February.

There are signs emerging that real-money accounts have also begun the year in a bearish frame of mind. This week’s JPMorgan Chase & Co. Treasury client survey showing short positions rising some 7 percent up to Jan. 3. The bearish sentiment stretched through right up to the payroll-data release, when a flurry of weekly options were bought targeting rising yields to cover the reaction to the data.

“Some investors are really getting bearish, but we expect inflation starts falling during the first quarter and don’t see more than three rate hikes this year,” said Colin Robertson, head of fixed income at Northern Trust Asset Management, which oversees some $526 billion of assets. “The 10-year looks attractive at these levels and if we get to 2%-2.25%, investors will be rewarded over the next year.”

This week a key focus of the bond market will be on whether overall consumer price inflation exceeds a forecast pace of 7% over the preceding 12 months. The core measure, which excludes food and energy prices, is expected to accelerate to a pace of 5.4% from 4.9% for the year ending November.

After seeing wage growth running at a hefty annual pace of 4.7% in Friday’s jobs report, the swaps market is now pricing in an approximately 88% chance of a 25-basis-point hike in March. Economists at JPMorgan shifted their forecast of the first rate hike to that month, “followed by a quarterly pace of hikes thereafter” due to the tighter jobs market.

“The real difference between pre-Covid and today is wage growth, and this is what the Fed is keying on,” said Steven Blitz, chief U.S. economist at TS Lombard. “A higher base inflation rate fueled by better wage growth seems baked-in,” and “this is what the Fed is reacting to.”

A robust headline inflation figure from December will extend the current trend of higher Treasury yields, said WisdomTree’s Flanagan because “the Fed would be under pressure to move in March and set out their thinking at their next meeting” in late January.

To be sure, the speed of the rise in Treasury yields may invite buying. Financial conditions are tightening as the real 10-year, or inflation adjusted yield, has surged from minus 1.12% to around minus 0.74%. But calmer waters may not ensue until after the inflation data, with a test of investor sentiment also looming from the sale of $36 billion 10-, and $22 billion of 30-year Treasuries.