Stock Markets

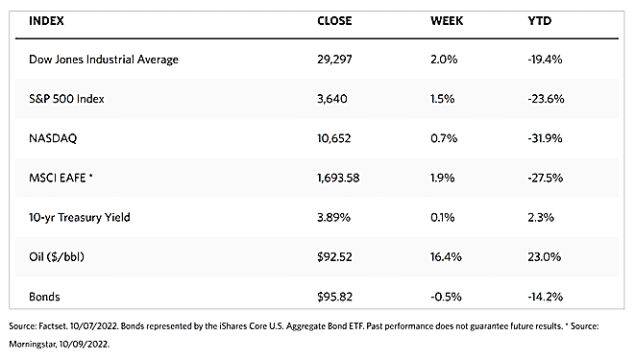

In September, the markets reached new lows for the year, but for the first two weeks of the last quarter of 2022, they appeared to have rebounded from what might be the ultimate bottom. However, nothing is certain at this point. For instance, this week the S&P 500 saw its biggest two-day rise since April 2020, although it returned some of those gains later in the week despite a strong jobs report. Therefore, the question remains whether the recent rebound from last month’s lows is a true reversal or just relief rallies on the way to a continued bear market. Over the past week, the Dow Jones Industrial Average (DJIA) gained 1.15% although the total stock market lost 1.75%. The Nasdaq Stock Market Composite lost 3.11%, suggesting relative weakness in the technology sector and growth stocks in general. The NYSE Composite likewise slid 1.38%. CBOE Volatility increased by 2.10%.

Factors that led to major indexes underperforming were the third-quarter earnings report which began in earnest this week and the inflation data and their implications for Federal Reserve policy. The resulting investor pessimism led to the S&P 500 losing almost half of its gains since its March 2020 bottom. The typically defensive healthcare and consumer staples sectors remain resilient, however, while consumer discretionary and communication services shares lagged. Tech stocks Amazon.com, Tesla, and Facebook parent Meta Platforms dragged the sectors lower. Growth stocks were steadily outperformed by their slower-growing value counterparts.

U.S. Economy

Thursday’s CPI inflation report suggested that lower wholesale prices were not yet trickling down to consumers in a more significant manner. On the contrary, inflation data trended in the opposite direction. Core consumer prices ascended by 6.6% year-over-year in September. This was hotter than expected, even higher than the previous peak in March, and showed the fastest growth pace in four decades. The price increases were mostly concentrated in medical services, transportation, and housing. In September, shelter prices increased by 0.7%, making up 40% of the rise in the core index. Many observers, however, expected the rapidly-cooling housing market to impact the calculation of owner-equivalent rents by the Labor Department, as well as the rental market itself.

Treasury yields climbed over the week. The 10-year U.S. Treasury note yield rose above 4.0% while the two-year yield reached 4.5%, the highest level it has hit since 2007. (Bond prices and yields travel in opposite directions.) Following the consumer inflation data release, yields surged broadly on Thursday morning. The municipal bond market continued to be impeded by industrywide outflows, but strong demand for primary deals was observed. Meanwhile, the tight labor market maintains its pressure on Federal Reserve policies, but there appear to be signs of loosening. The U.S. economy was in line with expectations when it added 263,000 jobs last month. The unemployment rate dipped to 3.5% which coincided with a five-decade low. Hourly earnings were up by 5% from a year ago, still well above the pre-pandemic level.

Metals and Mining

On Thursday, gold prices dropped precipitously into negative territory in reaction to reports that the consumer price index (CPI) climbed higher than expected in September. This raised the possibility that the Federal Reserve will continue to implement its aggressive monetary policy strategy through the remainder of the year. On Friday, gold prices continued to tread close to session lows following the release of mixed U.S. retail sales. Sales were unchanged for September, defying expectations of a 0.2% increase based on the latest data from the U.S. Commerce Department. Sales growth is up at 8.2% for the year. Despite reports, the gold market continues to see solid selling pressure.

Gold ended the week lower by 2.97%, starting at $1,694.82 and ending at $1,644.47 per troy ounce. Silver, which closed a week ago at $20.13, ended Friday at $18.28 per troy ounce for a 9.19% drop. Platinum lost 1.50% for the week, from $916.82 to $903.06 per troy ounce. Palladium, which previously ended at $2,194.75, closed this week at $1,995.88 for a 9.06% price drop. The 3-mo LME prices for basic metals were mixed for the week. Copper, which was priced one week ago at $7,457.50, ended this week at $7,573.00 per metric tonne, gaining 1.55%. Zinc began at $2,991.50 and ended at $2,901.00 per metric tonne for a week-on-week loss of 3.03%. Aluminum realized a weekly gain of 2.63%, rising from $2,299.00 to $2,359.50 per metric tonne. Tin also gained by 3.47% for the week, from its previous close at $19,425.00 to this week’s $20,100.00 per metric tonne.

Energy and Oil

The oil markets this week were inundated with plenty of conflicting signals. Weighing on bearish sentiments was news of an increase in crude stocks of almost 10 million barrels, a large change week-on-week. Also rattling oil investors was the U.S. inflation data suggesting that the core consumer price index hit a 40-year high in September. Propping up the bulls, on the other hand, were reports that diesel inventories in the U.S. fell by 4.9 million barrels, pointing possibly to a worrisome shortage ahead of winter. Strikes in France are adding to the fuel supply fears in Europe, particularly after one union walked out of talks on Friday after rejecting a pay hike offer. Less than a month after announcing its pledge to cut production by up to 2 million barrels per day, the OPEC also cut its demand growth figures for both 2022 and 2023 to 2.64 and 2.34 million barrels per day respectively, on a forecasted slowdown in economic growth, monetary tightening, and ongoing supply issues. The big picture for the week shows oil prices falling, with both WTI and Brent poised to report weekly losses after charting two weeks of gains.

Natural Gas

For the report week beginning October 5, Wednesday, and ending on October 12, 2022, Wednesday, the Henry Hub spot price rose $0.41, from $6.06 per million British thermal units (MMBtu) at the beginning of the week, to $6.47/MMBtu by the end of the week. Regarding futures, the price of the November 2022 NYMEX contract descended by $0.495, from $6.930/MMBtu to $6.435/MMBtu week-on-week. The price of the 12-month strip averaging November 2022 through October 2023 futures contracts decreased by $0.097 to $5.733/MMBtu.

In the international market, the natural gas futures prices came down for this report week. Weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia declined by $3.18 to a weekly average of $34.81/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $5.17 to a weekly average of $45.83/MMBtu.

World Markets

European shares changed little after they pulled back sharply in the prior week. The pan-European STOXX Europe 600 Index ended slightly lower in local currency terms. Major continental indexes climbed. Germany’s DAX Index forged upward by 1.34%, France’s CAC 40 Index advanced 1.11%, and Italy’s FTSE MIB Index gained slightly by 0.14%. The UK’s FTSE 100 Index, however, declined by 1.89%. European government bonds experienced high volatility for the week, with the yield on Germany’s 10-year government debt descending from more than 11-year highs that they hit earlier in the week. Keeping yields trading within a range, however, was the higher-than-expected U.S. CPI data, with Italian and French sovereign bonds oscillating widely. Yields on 10-year gilts in the UK retreated from close to 14-year highs after the government reversed some of the controversial policy changes that it announced late last month. European Central Bank (ECB) Governing Council member Pablo Hernandez de Cos, governor of the Bank of Spain, raised the possibility that the economy could soon contract as indicated by the occurrence of some shocks in the ECB downside scenario. There is a possibility that interest rates will have to keep rising into the next year.

Japanese stocks began the shortened week with a sharp pullback as traders returned from a long weekend on Tuesday. Hawkish signals from the U.S. Federal Reserve fueled fears. A weak domestic currency that has failed so far to respond to government intervention measures fed bearish sentiments for most of the week. Stocks snapped a four-day losing streak on Friday, however, responding to a strong turnaround in the U.S. on Thursday, where equity markets rebounded despite higher-than-expected inflation numbers. The Nikkei average jumped 3.3% on Friday to end the week essentially unchanged at 27,091. The broader TOPIX index climbed by 2.4% to also finish sideways for the week at 1,898. There was also positive local economic news. Although business confidence among big manufacturers for the second straight week to its lowest level in five months, this report was followed by data from the Bank of Japan showing that Japanese corporate goods prices grew the most in five months in September. The yield on Japan’s 10-year government bond briefly rose to 0.255% during the week before sliding to 0.254% in late Friday trading.

China’s stock market surged after the weeklong National Day Holiday, optimistic at supportive comments from the central bank and encouraged by policy signals during the Communist Party Congress, a twice-a-decade gathering of the country’s political elite that commenced on Sunday. The broad, capitalization-weighted Shanghai Composite Index gained 2.07% and the blue-chip CSI 300 Index, which follows the largest listed companies in Shanghai and Shenzhen, gained 1.32% from the pre-holiday closing levels. According to People’s Bank of China (PBOC) governor Yi Gang, the bank will concentrate its efforts on supporting infrastructure construction and encouraging quicker delivery of home projects. The governor further elaborated that the PBOC will also step up the implementation of prudent monetary policy and provide stronger support for the real economy.

The yuan, which descended to a near 28-month low in September, traded at 7.191 per U.S. dollar late on Friday after falling to a two-week low on Thursday, when U.S. inflation data sparked fears of larger rate hikes. The yuan has already lost more than 10% of its value against the dollar and is on track to register its largest annual loss since 1994 when China unified its official and market rates. The yield on the 10-year Chinese government bond fell to 2.719% from September’s close of 2.776% after September inflation data came in lower than expected.

The Week Ahead

Among the important economic data to be released this week are inflation, consumer confidence, and leading economic indicators.

Key Topics to Watch

- Empire State manufacturing index

- Industrial production index

- Capacity utilization rate

- NAHB home builders’ index

- Building permits (SAAR)

- Housing starts (SAAR)

- Beige Book

- Initial jobless claims

- Continuing jobless claims

- Philadelphia Fed manufacturing index

- Existing home sales (SAAR)

- Leading economic indicators

- Index of common inflation expectations, 5-10 years

- Index of common inflation expectations, 10 years

Markets Index Wrap Up