On-chain indicators show that short-term bitcoin holders are turning slight profits, but long-term holders are continuing to sell at a loss.

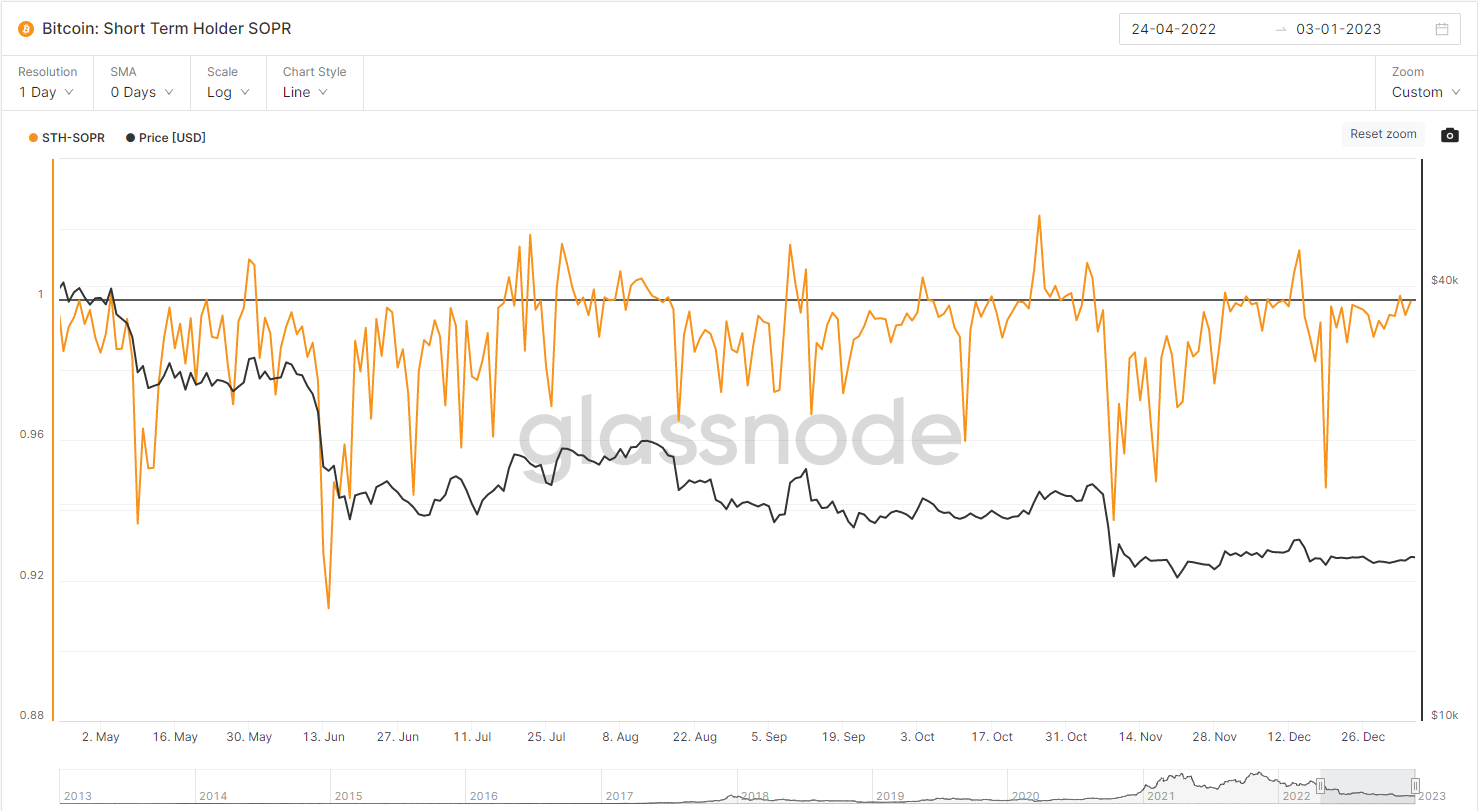

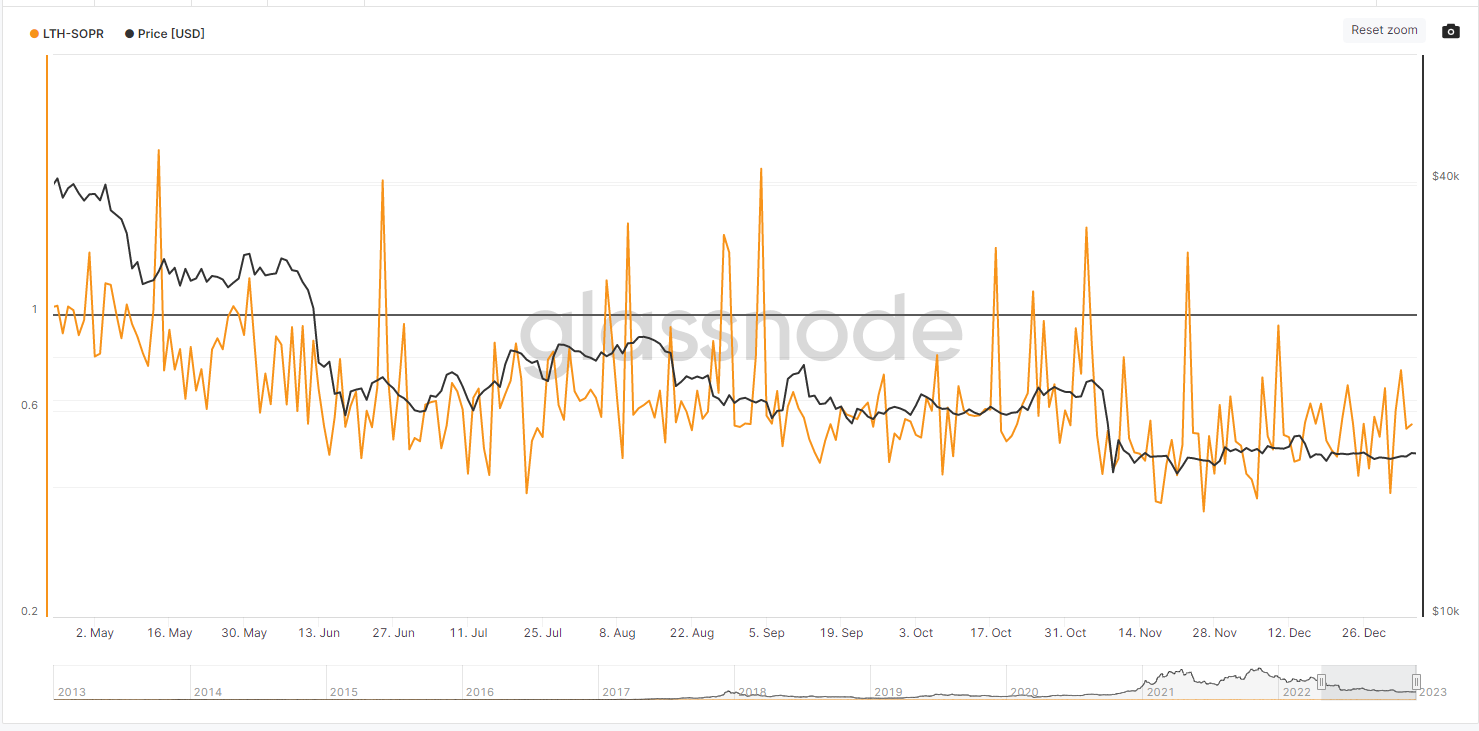

The Short Term Holder Spent Output Profit Ratio (STH-SOPR) and Long Term Holder Output Profit Ratio (LTH-SOPR) have recently suggested that short-term investors have found small opportunities even as the bear market lengthens and volatility remains low, but that long-term investors who bought at higher prices will have to wait for their windfalls.

The STH-SOPR is an on-chain indicator measuring the price sold versus the price paid for BTC less than 155 days (roughly five months) old.

When the figure is above one, it indicates that the asset is being sold on average at a profit. When the figure is below one, the asset is being sold at a loss.

The Long Term Holder Spent Output Profit Ratio (LTH-SOPR) is calculated in the same manner, but applies to bitcoin held in excess of 155 days.

Current STH-SOPR: 0.99

Current LTH-SOPR: 0.56

Most short-term BTC holders holding profitable positions likely entered their long positions in late November when bitcoin was trading at its five-month low of $15,599. The largest cryptocurrency by market capitalization has risen about 8% since then.

The STH-SOPR metric has been climbing since a Dec. 19 reading of .95. A previous reading above 1.0 occurred on Dec. 14, before declining the subsequent week.

The likely entry point may hint where markets perceive a potential BTC bottom.

From a timing vantage point, Nov. 21 trading activity coincides with a sharp expansion, and subsequent contraction of bitcoin volatility.

BTC’s average true range increased 43% between Nov. 1 and Nov. 21, and has fallen 64% since then. The $15,599 low falls just below a high volume node, when using the Volume Profile Visible Range (VPVR) tool to measure trading activity.

The combination of compressed volatility and high price agreement implies that short-term traders were comfortable with their entry points, and follow-on trading activity.

Long-term holders have not had the same fortune, as the LTH-SOPR fell below the profitability benchmark on Nov. 24, and has remained there since. But many long-term BTC holders are likely to maintain their holdings, rather than sell at a loss.

However, are many short-term BTC holders short-term in name only?

Investors truly holding a short-term outlook may wish to quickly capitalize on recent price appreciation should those prices push higher.

But those who have been holding bitcoin for only a short time but have longer-range goals may be unwilling to unload bitcoin. For this group, the accumulation of BTC between $15,999 and $16,500 months ago may reflect a level of price support.