Stock Markets

In the week just ended, the new year’s stock rally continued, driven in part by a deceleration in the rate of Federal Reserve rate hikes. Stocks rallied after the Fed announced a 25-basis point (0.25%) rate increase, marking a downshift in the pace of rate hikes, as the previous six rate increases were 0.5% or higher. The S&P 500 is now almost 8% up this year, while interest rates fell through the week due to expectations that the Fed policy will become less restrictive. A strong jobs report released on Friday, however, rekindled expectations that rate hikes will again be increased to stave off a strengthening economy.

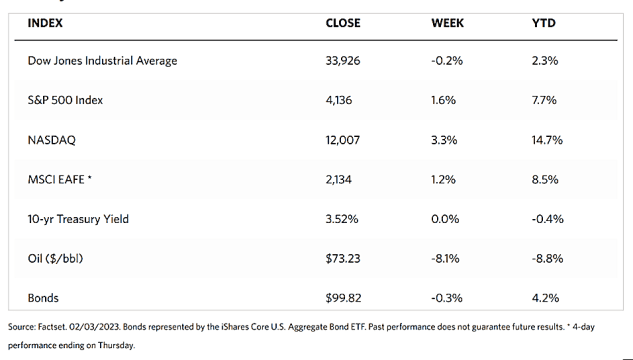

During the past week, the Dow Jones Industrial Average dipped by 0.15% while the total stock market index went in the opposite direction and rose by 1.89%. The S&P 500 Index also gained by 1.62%, while the technology-heavy Nasdaq Stock Market Composite surged ahead by 3.31%. Meanwhile, the NYSE Composite rose by 0.23%. The CBOE Volatility, which tracks risk investor risk perception in the stock market, ticked down by 0.97%. Most of the major indexes appear to extend their winning streaks, particularly after the release of encouraging economic data that defied expectation towards the week’s end. The rally was also helped by stellar earnings reports, with Facebook’s parent company, Meta Platforms, beating revenue expectations for the fourth quarter. Meta’s positive news was behind the Nasdaq’s outperformance, even after disappointing results and outlooks from Apple, Google’s parent company Alphabet, and Amazon.com.

U.S. Economy

On Friday, the January employment report was released, showing that an impressive 517,000 jobs were added to the economy. This is more than double the consensus forecast. Other parts of the economy are showing signs of slowing, but the healthy labor market is likely to provide support for economic spending and thus soften a potential downturn. The slowdown in rate hikes is an implicit admission on the part of the Fed that disinflationary forces are taking effect and the Fed’s efforts are bearing fruit, even if it is still “at an early stage,” according to Fed Chair Jerome Powell.

Despite positive news in some aspects of the economy, inflation is still a major force, impacting the pocketbooks of consumers. A broader look at the economy may point to the fact that the inflation rate has fallen noticeably from its peak, and is expected to continue in its decline toward a more manageable point. Key factors that drove the inflation rate up last year have now changed course and appear to justify continued consumer price moderation. As inflation gradually falls further, real wages (adjusted for inflation) are expected to rise and offer support to consumer spending as well as help ease prospects of an economic slowdown.

As for the labor market’s strength, it may be tested in the future as large layoffs by big companies are just getting started. Spiking unemployment will likely bring a recession, albeit a mild one light of this week’s unemployment and jobs reports. Unemployment fell to 3.4%, a level last touched in the late 1960s. Payroll gains for January were significant with a strong performance in the leisure and hospitality, retail, manufacturing, health care, and construction sectors.

Metals and Mining

For the past weeks, analysts believed that the gold market was likely to undergo a pullback, and this week it occurred. In January, Gold saw the best start in a year going back ten years, but the momentum reversed as February began. Gold prices ended the week’s trading at a loss after a six-week winning streak. The selloff began on Thursday, but prices plunged sharply on Friday after pronouncements by the Bureau of Labor Statistics that the U.S. economy added on 517,000 jobs in January, beating expectations by a significant margin, as economists were predicting a job gain of only 193.000 for the month. Gold price’s reaction suggests that it is still tied to the Federal Reserve and the U.S. dollar. If the labor market remains strong, economists expect that the U.S. central bank will be compelled to maintain its aggressive monetary policy stance longer than expected. In the meantime, the World Gold Council underscored the growing depth of the gold market as physical demand for gold grew 18% in 2022, led by solid bullion purchases from retail investors. Central banks also hiked the demand for gold in the second semester of last year.

The spot prices for precious metals were soft for the week. Gold came from $1,928.04 the previous week and ended at $1,864.97 per troy ounce this week, closing lower by 3.27%. Silver’s week-ago price was $23.60 and this week it was at $22.35 per troy ounce, losing 5.30%. Platinum ended last week at $1,015.74 and this week at $976.78 per troy ounce for a loss of 3.84%. Palladium did better, ending this week at $1,631.77 per troy ounce, 0.50% higher than the previous week’s close at $1,623.59. The three-month London Metal Exchange (LME) futures prices for base metals also experiences a price correction. Copper, which ended trading last week at $9,263.50, closed this week at $8,980.50 per metric tonne, down by 3.06%. Zinc came from $3,413.50 last week to close at $3,241.50 per metric tonne this week, for a price drop of 5.04%. Aluminum price, which was at $2,627.00 one week ago, is now $2,569.50 per metric tonne, a decline of 2.19%. Tin was at $30,838.00 last week, but traded this week at $28,379.00 per metric tonne, for a weekly loss of 7.97%.

Energy and Oil

Oil prices took a sudden direction change this week, even though trading might not have been as volatile as it was for most of 2022. Several events during the week exerted further downward pressure on oil markets. Amidst crude stock refinery woes, the repeated crude stock continues to build, while industrial activity slows down, and the U.S. dollar appreciates, all combining to impact WTI and bringing it back below $76 per barrel. The G7 product price cap may exert some upward correction, but presently no clear indication exists as to whether the Price Cap coalition had effectively managed to settle their differences on Friday, the last working day before the February 5 deadline. On Wednesday, the Joint Ministerial Monitoring Committee of OPEC+ met for less than 30 minutes. During that time, they endorsed the current production policy of the oil group and left output targets unchanged, overshadowed by the specter of demand increases from the recovering Chinese economy.

Natural Gas

In the United States, natural gas prices decline in warm weather. The Henry Hub futures prices have plunged to their lowest level since April 2021, impacted by a much smaller than usual inventory draw (151 billion cubic feet) and forecasts of warm weather throughout the U.S. until mid-February. It is now at its lowest level since April 2021, selling at $2.45 per million British thermal units (MMBtu) on Thursday. In 2024-25, fewer global LNG export capacity additions are expected than in previous years. U.S. LNG export capacity is expected to grow as three projects are currently under construction and will soon be completed.

In the market highlights during the report week from Wednesday, January 24, to Wednesday, February 1, 2023, Henry Hub spot prices fell by $0.42 from $3.09/MMBtu at the start of the week to $2.66/MMBtu by the week’s end. The February 2023 NYMEX contract expired on Friday at $3.109/MMBtu[, up by $0.04 from Wednesday. The March 2023 NYMEX contract price decreased to $2.458/MMBtu, down by $0.45 from the start to the end of the week. The price of the 12-month strip averaging March 2023 through February 2024 futures contracts declined by $0.25 to $3.268/MMBtu.

International natural gas futures prices declined for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $2.99 to a weekly average of $19.43/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $1.64/MMBtu to a weekly average of $18.04/MMBtu. In the corresponding week last year, (i.e., for the week ending on February 2, 2022), the price in East Asia was $24,94/MMBtu, while that at the TTF was $27.80/MMBtu.

World Markets

European shares were elevated this week on expectations that central banks may be approaching the end of the most restrictive stage of the monetary tightening cycle. The pan-European STOXX Europe 600 Index closed the week higher by 1.23%. The major stock markets of the region also ended on the plus side. Germany’s DAX Index climbed by 2.15%, Italy’s FTSE MIB Index gained 1.95% and France’s CAC 40 Index added 1.93%. The UK’s FTSE 100 Index gained by 1.76%, driven partly by the depreciation of the pound against the U.S. dollar after the Bank of England (BoE) suggested that interest rates might peak at a lower level than expected by the market. European government bond yields declined broadly, which can be attributed to investors perceiving that the major central banks could shift their monetary policy later this year. Despite the European Central Bank (ECB) raising interest rates by 0.05% and signaling that it will do the same in March, Germany’s 10-year sovereign bond yield fell toward 2%. Similarly, and for the same reason, French and Swiss government bond yields declined. In the UK, despite the BoE hiking rates, the yields on the benchmark 10-year debt tracked their global counterparts and approached 3%.

Japanese stock markets’ performance this week ended mixed. The Nikkei 225 Index rose 0.46% while the broader TOPIX Index declined 0.63%. Expectations that the U.S. Federal Reserve’s monetary policy tightening cycle may be nearing its peak have boosted investor sentiment. The Bank of Japan (BoJ), in the meantime, has reiterated its ultra-loose monetary policy. The yield on the 10-year Japanese government bond (JGB) climbed to 0.49%, from 0.47% at the end of the week before. According to figures released by the BoJ, the central bank’s JGB purchases reached a record high in January as it sought to defend its wider 0.50% yield cap The yen strengthened to around JPY 128.58 against the U.S. dollar, from the prior week’s JPY 129.89, supported by the Fed’s moderation of its rate hikes and some anticipation of potential change in the BoJ’s easing stance.

After the week-long Lunar New Year holiday, China’s stock markets fell in the first full week of trading due to some profit-taking from the recent rally by investors, who turned cautious about the strength of the country’s recovery. The broader capitalization-weighted Shanghai Composite Index eased by 0.04%, while the blue-chip CSI 300 Index dipped by 0.95%. In Hong Kong, the benchmark Hang Seng Index retreated 4.5%, its biggest decline since the end of October. In economic developments. China’s official manufacturing Purchasing Managers’ Index (PMI) advanced to 50.1 in January from December’s 47.0. This signaled a return to growth for the first time since September, indicating that domestic activity improved after Beijing exited its coronavirus restrictions at the end of the year. The nonmanufacturing PMI climbed to a better-than-expected 54.4 from 41.6, its highest level since June. Meanwhile, the IMF raised its annual growth forecast for China as the economy rebounds after the removal of the pandemic protocols. The IMF projected that the economy of China would grow 5.2% this year, up from its October forecast of 4.4%, and maintained its 2024 estimate at 4.5%.

The Week Ahead.

Among the important economic data scheduled for release this week are the wholesale inventories report, consumer credit, and the Federal budget balance.

Key Topics to Watch

- International trade deficit

- NY Fed 1-year inflation expectations

- NY Fed 5-year inflation expectations

- Consumer credit

- Wholesale inventories (revision)

- Initial jobless claims

- Continuing jobless claims

- UMich consumer sentiment index (early)

- UMich 1-year inflation expectations (early)

- UMich 5-year inflation expectations (early)

- Federal budget balance

Markets Index Wrap Up