Stock Markets

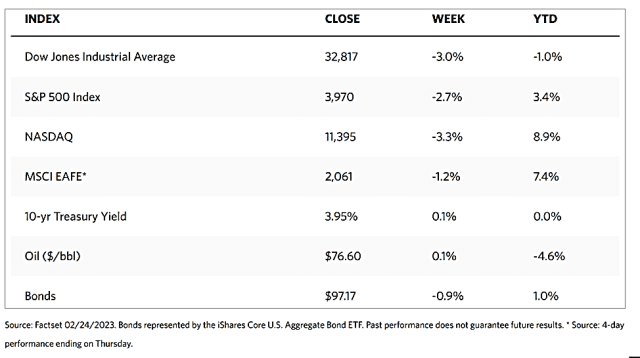

The week’s major stock indexes were rocked to a major correction as a slew of upside inflation and growth reports that broke expectations were released. The broad S&P 500 Index plunged 2.67%, its worst weekly loss since early December. At its close on Friday, this index gave up approximately 35% of the rally that began in October, but at its present level, it is still 3.40% up for the year to date. The narrowly-focused Dow Jones Industrial Average fell by 2.99% and has moved into negative territory for 2023, while the total stock market index corrected by 2.72%. The Nasdaq Stock Market Composite lost even more, giving up 3.33% for the week. This is consistent with communication services and consumer discretionary stocks underperforming other sectors, although the declines were widespread, and growth stocks were only slightly behind value shares. The NYSE Composite is down by 2.37%, while the risk perception monitor (the so-called “fear index”), the CBOE Volatility indicator, is up substantially by 8.24%, although it remains slightly below its mid-December levels.

The data released over the week impacted expectations on the timing and extent of future Fed rate hikes. The futures markets had begun pricing in an approximate 27% probability of a 0.50% hike in the federal fund’s target rate at the policy meeting coming up in March. There is also an approximately 38% likelihood that the terminal rate would reach a target rate of 5.50% to 5.75% or higher. Commensurately, the expectations that the Fed would start cutting rates in the fall considerably dwindled. In the meantime, the growth and inflation data triggered a sell-off in U.S. Treasuries, causing the yield on the benchmark 10-year U.S. Treasury note to approach 4.00% for the first time since mid-November. Risk sentiment was weakened by the release of the minutes of the Fed’s last policy meeting.

U.S. Economy

The Commerce Department reported on Friday that core personal consumption expenditures (PCE) price index, which excludes food and energy, rose by 0.6% in January which exceeded expectations of an increase of 0.4%. This is also its biggest rise since August. Furthermore, December’s figure was also revised upward and pushed the year-over-year increase (which many consider to be the Federal Reserve’s preferred inflation indicator) from 4.6% to 4.7%, the first time inflation pace picked up since September. The consensus expectation was for another decline to about 4.3%. Personal spending gained by a solid 1.8% in January, the biggest increase in almost two years and similarly well above consensus estimates.

The sharp equities correction is taken by some as a red flag that inflation might have reversed course and begun to accelerate again as 2023 started. However, additional data suggested that consumers and employers were not yet deterred by the rising interest rates. The University of Michigan’s consumer expectations indicator in February was revised upwards to its best level in more than a year. Both initial and continuing jobless claims descended below consensus estimates. The sales of new single-family homes reached their highest level since March 2022, when 30-year mortgage rates were roughly 2.5 percentage points lower, indicative of solid household balance sheets. However, some major retailers reported disappointing earnings and offered cautious guidance during the week, which suggests that household budgets may undergo some tightening.

Metals and Mining

Expectations of lower gold prices were proven right as the yellow metal tested its support just above $1,800 per ounce this week. The two key factors that continue to weigh on gold prices are inflation and rising bond yields. The likelihood that the Federal Reserve may continue to aggressively raise interest rates depends on its perception of the need to control rising inflation. Rising rates may push yield higher, however, and this may draw investors away from non-yielding assets like precious metals and bring their money instead to the bond market. Currently, bond yields are rising as long-shot expectations start to build that the U.S. central bank could push rates above 6% in an aggressive tightening cycle. A shift in interest rate expectations is also creating new momentum for a strengthening U.S. dollar against a basket of global currencies. These trends point to a rather dismal gold market ahead.

In the week just ended, gold prices ended at $1,811.04 per troy ounce, lower by 1.70% from its close one week ago at $1,842.36. Silver closed this past week at $20.76 per troy ounce, down 4.46% from the previous week’s close at $21.73. Platinum closed on Friday at $913.03 per troy ounce, lower by 0.89% from its close one week earlier at $921.21. Palladium ended at $1,415.62 per troy ounce this week, descending by 5.79% from its previous week’s close at $1,502.59. The three-month LME prices of base metals were also mostly down for the week. Copper ended this week at $8,716.50 per metric tonne, down by 3.02% from its close one week ago at $8,987.50. Zinc closed this week at $2,964.00 per metric tonne, losing by 3.07% from its week-ago close at $3,058.00. Aluminum ended this week at $2,335.50 per metric tonne, lower by 2.18% from its closing price last week at $2,387.50. Tin ended 0.79% lower this week, closing at $25,651.00 per metric tonne compared to its close one week ago at $25,856.00.

Energy and Oil

This week, building U.S. crude inventories have added to the downward pressure on oil prices as of Friday morning. The report released by the Energy Information Administration (EIA) weighed particularly heavily on West Texas Intermediate (WTI), a benchmark representing oil produced in the U.S., and opening an arbitrage window into both Europe and Asia. The market reaction to another 7.6-million-barrel build was originally mitigated by speculation of a further production cut from Russia and rumors of returning Chinese demand. The relative weakness of WTI has prompted the Chinese to renew its buying of U.S barrels by the state-owned Sinopec and PetroChina. In the end, inflation fears and continued inventory build brought oil prices lower, with ICE Brent hovering around the $81 per barrel price level.

Natural Gas

For the report week beginning Wednesday, February 15, and ending Wednesday, February 22, 2023, the Henry Hub spot price fell by $0.36 from $2.44 per million British thermal units (MMBtu) to $2.08/MMBtu throughout the week. The price of the March 2023 NYMEX contract decreased by $0.297, from $2.471/MMBtu at the start of the report week to $2.174/MMBtu at the week’s end. The price of the 12-month strip averaging March 2023 through February 2024 futures contracts declined by $0.225 to $3.003/MMBtu. International gas futures prices decreased for this report week to their lowest levels since the third quarter of 2021. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $2.57 to a weekly average of $15.34/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $1.04 to a weekly average of $15.64/MMBtu. In the corresponding week last year (the week ending February 23, 2022), the price in East Asia was $25.81/MMBtu, and that at the TTF was $26.36/MMBtu.

World Markets

In Europe, shares fell on fears of renewed rate hikes as better-than-expected economic data and corporate earnings raised prospects that central banks may anticipate renewed inflationary pressures. The pan-European STOXX Europe 600 Index descended by 1.42% in local currency terms. The region’s major stock indexes likewise fell. Italy’s FTSE MIB Index plunged by 2.76%, France’s CAC 40 Index lost 2.18%, and Germany’s DAX Index slid by 1.76%. The UK’s FTSE 100 declined by 1.57%. Headline inflation in the eurozone was confirmed to have eased in January to an annual rate of 8.6% from 9.2% the month earlier. This was only slightly higher than the initial estimate, even after data from Germany indicated that consumer price growth remained elevated in Europe’s largest economy. Underlying price pressures continued to increase, however, with the core inflation indicator, which excludes fuel and food prices, accelerating to 5.3% from the 5.2% measured in December. Meanwhile, business activity in the UK manufacturing and services sectors ticked up in February, contrary to expectations. According to the PMI survey, prices charged by companies eased only marginally during the month. Manu firms expressed the need to pass on higher wages, food costs, and energy bills.

In Japan, equities declined over the week, with the Nikkei Index slipping by 0.22% and the broader TOPIX Index inching down by 0.18%. Comments by incoming Bank of Japan (BoJ) Governor Kazuo Ueda that were perceived as dovish provided some support to markets on Friday. Incoming BoJ Governor Kazuo Ueda emphasized monetary policy continuity but also acknowledged that the current policy had side effects. These encouraging comments were outweighed, however, by general worries about the impact of possible further interest rate hikes by the U.S. Federal Reserve. Surging consumer prices further added pressure on the BoJ to start scaling back its massive stimulus program. These developments caused the yield on the 10-year Japanese government bond to linger around the BoJ’s 0.50% upper limit. The yen lost ground against the U.S. dollar, from JPY 134.1 at the end of the prior week to JPY 135.2 at the end of this week.

Chinese stocks bucked the global trend and advanced after three consecutive weeks of losses. Hopes for stepped-up regulatory support offset concerns surrounding elevated U.S. tensions with China. The Shanghai Stock Exchange Index gained by 1.34% and the blue-chip CSI 300 added 0.66% in local currency terms. In Hong Kong, the benchmark Hang Seng Index plummeted by 3.43% as a strengthening U.S. dollar added to concerns over the strength of China’s economic recovery. China’s yuan currency fell to a seven-week low against the greenback after the release of unexpectedly strong U.S. inflation data on Friday, raising expectations that the Federal Reserve may resume its aggressive rate increase policy. Signs of deteriorating U.S.-China relations, which is a key factor that has influenced currency trading in recent years, also exerted pressure on the yuan amid reports that the U.S. plans to increase the number of troops helping train Taiwanese forces. The U.S. is Taiwan’s largest weapons supplier and has recently increased its presence around the island to guard against a potential Chinese invasion. Analysts forecast that the People’s Bank of China (PBOC) will continue its accommodative policies to support the economy amid a sluggish property market, declining exports, and fragile consumer confidence. The PBOC instructed lenders, however, to control the pace of new loans after they reached a record level in January.

The Week Ahead

This week, the important economic data scheduled for release include unit labor costs, consumer confidence, and the trade balance.

Key Topics to Watch

- Factory orders

- Wholesale trade

- Consumer credit

- ADP employment

- U.S. trade balance

- Job openings (JOLTS)

- Beige Book

- Jobless claims

- Employment report

- Unemployment rate

Markets Index Wrap Up