Stock Markets

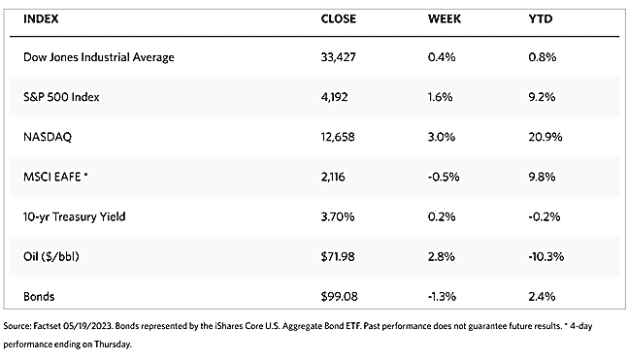

Major stock indexes chalked solid gains for the week, with the S&P 500 Index rising above the 4,200 level in intraday trading for the first time since late August before retracing back to close at 4,191.98. It gained by 1.65% for the week, while the Dow Jones Industrial Average (DJIA) rose by 0.38% and the Total Stock Market Index mirrored the S&P 500 with a rise of 1.68%. The Nasdaq Stock Market Composite climbed by 3.04%, while the NYSE Composite inched up by 0.51%. The risk perception tracker CBOE Volatility Index slid down by 1.29%, based on the weekend tally by Wall Street Journal Markets.

The stock indexes have remained range-bound for the past few months, trading within a relatively narrow margin, with the S&P 500 Index ending the week up by only 0.93% for the year to date. The strong performance was attributed to some mega-cap technology-related stocks. Google parent Alphabet registered particularly strong gains as well as Facebook parent Meta Platforms. Other outperformers were Advanced Micro Devices (AMD), NVIDIA, and other chipmakers. Some regional bank shares rallied to recover some of their recent losses, resulting in a regional bank exchange-traded fund (ETF) registering its best daily gain since early 2021 on Wednesday.

The boost in performance within the week may be attributed to the increasingly optimistic tone regarding debt ceiling negotiations. After a meeting on Wednesday to discuss the stymied negotiations, President Biden commented that he was confident there would be no default, while Republican House Speaker Kevin McCarthy said that the deal was “doable.” The stock market seemed to lose steam on Friday, however, after Republican negotiators mentioned that they would pause the negotiations.

U.S. Economy

In recent economic news, consumption growth was recorded at 3.7% in the first quarter, the best pace in two years. The particularly strong consumer spending growth may, however, signal the start of waning consumer vigor and the onset of fatigue. Gasoline sales slowed while sporting goods and home furnishing weakened. Major retailers still reported stronger-than-expected performance, raising April retail sales overall following two straight months of declines. Nevertheless, some softness has more recently emerged in smaller tickets and less demand for discretionary items such as clothing, electronics, and home goods.

While wage growth remains healthy, unemployment is at a half-century low. Signs of softening employment conditions are beginning to surface, although the labor market will continue to remain a source of energy for consumers. A sign of the post-pandemic economy has been the tight labor market, which supports elevated consumer demand while preventing inflation from coming down more quickly. Continuing jobless claims are significantly up from the same time last year, indicating that jobs are increasingly becoming harder to find, possibly signaling a broader return to the workforce. The year-over-year increase in pay for job switchers has declined considerably from its peak, another sign that wage growth will further moderate.

There is a possibility that the economy is headed toward a recession, although this has already been earlier discounted by the markets, and may, therefore, cause a milder drop than previous recessions. Due to the strength in the labor market and relative resilience in consumption, the coming recession may be softer than that in 2001.

Metals and Mining

The dramatic run-up in gold prices since November may just have scratched the surface of the potential for the precious metal. The combination of real interest rates, quantitative easing, debt, and deficits is poised to propel the investment market share of gold to what should be the four-decade mean at a minimum. Experts say that people’s concern about maintaining their purchasing power is the driving force behind the price of gold. Gold’s upward trajectory may be sustained in the medium term, although its pace will be slower if the government continues to raise nominal interest rates.

In the week just ended, the spot price of gold ended at $1,977.81 per troy ounce, a drop of 1.64% from its week-ago close at $2,010.77. Silver came from $23.97 to land this week at $23.85 per troy ounce, a slight downward correction of 0.50%. Platinum, which closed the previous week at $1,053.04, closed this week at $1,066.59 per troy ounce for a gain of 1.29%. Palladium ended the prior week at $1,512.77 and this week at $1,514.72 per troy ounce, a gain of 0.13%. The three-month LME prices of base metals were mixed for the week. Copper closed the week at $8,251.50, down by 0.02% from the previous week’s close at $8,253.00. Zinc ended this week at $2,479.00 per metric tonne, down by 2.75% from the previous week’s close at $2,549.00. Aluminum closed at $2,283.50 this week, locking in a gain of 3.28% from the previous week’s close at $2,211.00. Tin came from a close the prior week at $25,308.00 and ended this week at $25,451.00 for a gain of 0.57%.

Energy and Oil

Oil prices appear to have finally broken out of the downside pressures and increasingly bearish sentiment that characterized the past month, and may be set for their first weekly gain in a month. A great amount of that optimism was provided by the U.S. as debt ceiling negotiations may be likely to head towards a resolution after last Wednesday’s meeting between President Biden and Speaker McCarthy. Gasoline demand is also showing some strength after another week-on-week drop in the inventory. In the international scene, a group of Western countries led by the U.S. and the U.K. has called for increased surveillance over the growing practice of ship-to-ship crude transfers, carrying either Russian or Iranian oil, as these transfers increase the risk of maritime oil spills. Also, India is intent on replenishing one-quarter of its strategic petroleum reserves, which are substantially lower than the U.S. or Chinese SPRs at a mere 39 million barrels. Nevertheless, reports suggest that they may buy about 9.2 million barrels in the coming months.

Natural Gas

For the report week beginning Wednesday, May 10, and ending Wednesday, May 17, 2023, the Henry Hub spot price rose $0.13 from $2.12 per million British thermal units (MMBtu) at the start of the week to $2.25/MMBtu at the end of the week. The price of the June 2023 NYMEX contract increased by $0.174, from $2.191/MMBtu on May 10 to $2.365/MMBtu on May 17. The price of the 12-month strip averaging June 2023 through May 2024 futures contracts climbed $0.143 to $3.060/MMBtu. At most locations this report week, prices rose with few exceptions. At major pricing hubs, price changes ranged from an increase of $1.12/MMBtu at the Waha hub in West Texas to a decrease of $0.03/MMBtu at PG&E Citygate in Northern California.

International natural gas futures prices decreased this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia dropped by $0.65 to a weekly average of $10.62/MMBtu. Natural gas futures for delivery at the Title Transfer Facility in the Netherlands, the most liquid natural gas market in Europe, declined by $1.17 to a weekly average of $10.44/MMBtu. In the corresponding week last year (the week ending May 18, 2022), the prices were $21.65/MMBtu and $29.72/MMBtu in East Asia and at the TTF, respectively.

World Markets

European shares advanced this week, driven by optimism that interest rates may be close to peaking and that the U.S. is likely to avoid a debt default. The pan-European STOXX Europe 600 Index closed the week ahead by 0.72% from last week. The major markets reflected this trend, with Germany’s DAX surging by 2.27% and France’s CAC 40 Index rising by 1.04%. European government bond yields rose higher on the back of growing confidence in the European economy coupled with the imminent breakthrough in debt ceiling negotiations in the U.S. The yield on the 10-year German bond climbed to 2.5%, its highest level in more than three weeks. In the U.K., the benchmark 100-year gilt yield rose above 4% due to hints by policymakers that if inflationary pressures do not moderate, more monetary tightening could be forthcoming. Official economic data suggests that Europe might be headed toward an industrial recession. Eurozone industrial production plummeted by 4.1% sequentially in March, after rising by 1.5% in February. Industrial output sank by 1.4% on a year-over-year basis, after increasing 2.0% in the preceding month. Irish production led the drop, although German, French, and Italian output also weakened.

Japanese stocks recorded their sixth consecutive weekly gain. The Nikkei 225 Index advanced by 4.8% while the broader TOPIX Index jumped by 3.1%. Both indexes approached their 33-year highs during the week driven by solid domestic earnings, yen weakness, and strong overseas purchases of Japanese stocks. The sentiment was also boosted by data indicating that Japan’s economy grew at a higher-than-expected pace for the first quarter of this year, partly due to a post-Covid increase in consumption. Further adding to investors’ optimism was the perception that the U.S. government would soon reach a deal on raising the debt ceiling. The yield on the 10-year Japanese government bond rose to 0.39% from 0.37% at the end of the previous week. During the week, it dipped to its lowest since March as the Bank of Japan (BoJ) continued to maintain its commitment to ultra-loose monetary policy. The yen weakened significantly to around JPY 138.17 against the U.S. dollar, from its level the previous week at JPY 135.75. Some of the yen’s depreciation was stemmed by strong inflation data toward the end of the week.

Amid concerns that China’s post-Covid recovery may be losing steam, Chinese stock markets moved sideways as equities ended the week mixed. The Shanghai Stock Exchange Index marginally rose by 0.34% while the blue-chip CSI 300 inched up 0.17% in local currency terms. In Hong Kong, the benchmark Hang Seng Index lost by 0.90%. According to official data, industrial output, retail sales, and fixed asset investment grew at a weaker-than-expected pace in April year-on-year. Unemployment dipped to 5.2% in April compared to 5.3% in March, although youth unemployment jumped to a record 20.4%. This raised concerns that the post-pandemic recovery is not robust enough to attract new talent. Investors were disappointed at the latest figures, although the data appeared to be an improvement over that of the previous year when China was still under lockdown. On Friday, China’s yuan currency depreciated at the fastest pace in nearly three months after the PBOC cut its central parity rate below RMB 7 per dollar for the first time since December. The local currency was weighed down by signs of slowing growth in China and a surge in the U.S. dollar prompted by the likelihood that the U.S. government would raise its debt ceiling in time to avoid a default.

The Week Ahead

The PMI data, FOMC Minutes, and Preliminary Q1 GDP data are scheduled for release in the coming week.

Key Topics to Watch

- St. Louis Fed President James Bullard speaks

- San Francisco Fed President Mary Daly speaks

- Atlanta Fed President Raphael Bostic, Richmond Fed President Tom Barkin speak

- Dallas Fed President Lorie Logan speaks

- S&P flash U.S. services PMI

- S&P flash U.S. manufacturing PMI

- New home sales

- Fed Gov. Christopher Waller speaks

- Minutes of Fed May FOMC meeting

- GDP (second reading)

- Initial jobless claims

- Richmond Fed President Tom Barkin speaks

- Pending home sales

- Durable-goods orders

- Durable-goods minus transportation

- Personal income (nominal)

- Personal spending (nominal)

- PCE Index

- Core PCE Index

- PCE (year-over-year)

- Core PCE (year-over-year)

- Advanced U.S. trade balance in goods

- Advanced retail inventories

- Advanced wholesale inventories

- Consumer sentiment (final)

Markets Index Wrap Up