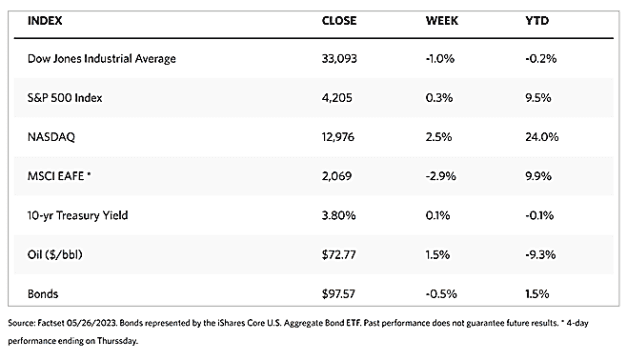

Stock Markets

Stock markets were broadly flat in trading over the past week. The Dow Jones Industrial Average (DJIA) was slightly down by 1.00% although the Total Stock Market Index was up by 0.31%. The NYSE Composite was also down by 1.60%. However, the S&P 500 Index inched up by 0.32% while the Nasdaq Stock Market Composite, the technology tracking index, surged by 2.51%, and it ended the week up by 23.97% year-to-date. (By comparison, the narrowly-focused DJIA declined by 0.16% over the same period.) CBOE Volatility Index rose by 6.78% reflecting an increase in investors’ perceived market risk.

While other sectors moved sideways on listless trading, one sector – information technology – overperformed the rest with a stellar 4.0% rise for the week. The technology sector is just one of three sectors in the S&P 500 Index that remains in positive territory year-to-date, together with consumer discretionary and communication services. Technology and communications services are well into bull-market territory as they are now up over 30% for the year. However, each of the other S&P 500 sectors remains negative so far for this year, possibly in reaction to the uncertainty regarding the stymied U.S. debt-ceiling negotiations, the future Fed action on interest rate hikes, and the potential softness in the economy.

The stellar performer during the week was chipmaker NVIDIA. On Thursday, the company’s shares jumped by 24% after it beat consensus first-quarter earnings expectations by a wide margin and raised its profit outlook. The large move in this heavily weighted stock took the company’s market capitalization to about $963 billion by the end of the week, landing it sixth among the most highly valued public company in the world. This sent shock waves among the major benchmarks, making Thursday among the most remarkable trading sessions in the last 25 years.

U.S. Economy

In a runup to the June 14 Federal Reserve meeting, Fed officials in recent weeks have indicated that their focus remains squarely on fighting inflation as it remains too elevated for comfort. Although trends have improved in headline inflation, the personal consumption expenditure price index, or PCE, inflation data released during the week oved higher, and services inflation remains steadily persistent, driven by a robust labor market and wage growth that remains stubbornly elevated. The U.S. GDP growth for the first quarter announced last week was also revised upwards, though modestly, to 1.3% annualized, compared to what was previously 1.1%. Consumption remains resilient at 3.8%. The Fed’s own GDO-Now tracker is presently indicating a solid 2.9% annualized growth rate for the second-quarter U.S. GDP.

Fed officials have been wondering if further rate hikes may be prudent to continue to dampen inflation, given the strong labor market and broadly healthy economic situation. Markets appear to be pricing in one additional rate hike by the Fed, probably during the June or July meeting. This would bring the Fed funds rate to 5.25% to 5.5%. Some of this is reflected in Treasury yields moving higher in recent days. The Fed may likely lean towards a temporary halt in rate hikes for the moment, particularly in light of the recent uncertainty in the regional banking sector and some tightening of credit conditions. Should the upcoming U.S. nonfarm jobs report and CPI inflation data for May show some cooling as expected, this could help determine the future direction of interest rates.

Metals and Mining

The release last week of upbeat economic data and persistently high inflation hammered the gold market. This is the third consecutive weekly loss of the precious metal’s price as the markets recalibrated for another 25-basis-point rate hike in June. Despite the selloff this week, the year-to-date price of gold is still up by more than 6%. The macro-data was the main factor that weighed down the precious metal by the end of the recent trading week. All broadly above expectations were personal spending, the durable goods statistics, and the PCE inflation measures, particularly since the PCE price index, the Fed’s preferred inflation indicator, ended at 4.7% in April. Inflation close to 5% did not justify a pause by the Fed in hiking interest rates in June, for which there is now a 60% probability of a rate increase. Gold prices may therefore be subdued for the second quarter and possibly the early part of the third quarter.

In the past week’s trading, spot prices for precious metals came down. Gold descended by 1.59% from the week-ago price of $1,977.81 to this week’s close at $1,946.46 per troy ounce. Silver closed 2.31% lower, from the previous week’s close at $23.85 to this week’s close at $23.30 per troy ounce. Platinum is down by 3.77% from last week’s close at $1,066.59 to this week’s close at $1,026.37 per troy ounce. Palladium, which was at $1,514.72 one week ago, ended at $1,426.25 per troy ounce this week, losing by 5.84%. The three-month LME prices for base metals were also generally down for the week. Copper lost by 1.41% from its week-ago price of $8,251.50 to this week’s price of $8,135.00 per metric tonne. Zinc closed this week at $2,343.50 per metric tonne, lower by 5.47% from last week’s price of $2,479.00. Aluminum ended this week at $2,237.50 per metric tonne, down by 2.01% from last week’s price of $2,283.50. Tin closed this week at $24,846.00 per metric tonne, lower by 2.38% from last week’s close at $25,451.00.

Energy and Oil

Fears of a U.S. government shutdown have eased this week as the debt ceiling negotiations appear to be moving toward a resolution. The development has also eased some of the pressure on oil prices. Russia and Saudi Arabia continue to confuse the market with conflicting messages. One day after the Saudi energy minister warned market short-sellers of the possibility they would get burned should prices reverse, Russia’s deputy prime minister, Alexander Novak, doused expectations of a production cut at the June 4 meeting of OPEC+, stating that he does not anticipate new steps to be taken. Consequently, WTI and Brent have both trended sideways, at $72 and $76 per barrel, respectively. In the meantime, the U.S. government will hold a sale of oil and gas drilling rights on federal lands in New Mexico and Kansas, covering more than 10m000 acrease with two-thirds of acreage on offer in Cheyenne County, KS. This is the first block auction since the IRA was passed last year.

Natural Gas

For the report week beginning Wednesday, May 17, and ending Wednesday, May 24, 2023, the Henry Hub spot price fell by $0.01 from $2.25 per million British thermal units (MMBtu) on May 17 to $2.24/MMBtu on May 24. The price of the June 2023 NYMEX contract increased by $0.033, from $2.365/MMBtu at the beginning of the report week to $2.398 by the end of the week. The price of the 12-month strip averaging June 2023 through May 2024 futures contracts rose by $0.039 to $3.099/MMBtu. Natural gas spot prices fell at most locations for the report week. Price changes at major pricing hubs ranged from a decline of $0.95/MMBtu at PG&E Citygate to an advance of $0.42/MMBtu at the Waha Hub.

International natural gas futures prices decreased for this report week, The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.90 to a weekly average of $9.73/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid gas market in Europe, fell by $1.18 to a weekly average of $9.27/MMBtu. Last year, for the week corresponding to this report week (the week ending on May 25, 2022), the prices were $22.10/MMBtu and $27.16/MMBtu in East Asia and at the TTF, respectively.

World Markets

European equities plunged on investors’ sentiment that the economic outlook will likely worsen and uncertainty will continue over the U.S. debt ceiling talks. The pan-European STOXX Europe 600 Index lost by 1.59%, and so, too, did major indexes in the region weaken. Germany’s DAX fell by 1.79%, France’s CAC 40 Index declined by 2.31%, and Italy’s FTSE MIB dropped by 2.93%. The UK’s FTSE 100 Index slid by 1.67%. Due to concerns that central bank policymakers would extend their policy tightening to address inflationary pressures, European government bond yields broadly climbed. The yield on the benchmark 10-year German government bond came to rest above 2.5%, while Spain’s and Italy’s sovereign bond yields rose likewise. Robust core inflation data drove a broad sell-off in the UK bond markets, with the yield on the benchmark 10-year UK government bond approaching 4.3%. According to official figures, the German economy lapsed into recession in the first quarter. Meanwhile, UK inflation in April slowed less than forecasted to an annual rate of 8.7%, from 10.1% in March.

In Japan, the Nikkei 225 benchmark touched a 33-year high early in the week before ending just below the 31,000 level. This was the Nikkei 225’s highest close since July 1990, propelled by upbeat economic data and optimism regarding the U.S. debt ceiling negotiations. The broader TOPIX index closed the week slightly lower. Japanese manufacturing activity grew for the first time in seven months in May. Also reporting strong growth was the services sector. The return of domestic and international tourism spearheaded a record rise in business activity. Data also showed that Japan’s core machinery orders fell for a second straight month in March, although the optimistic market sentiment shrugged off any negative indicators for the week. Benchmark yields spiked noticeably on Friday, rising above 0.45% on positive news about the U.S. debt ceiling. The 10-year government bond yields settled around 0.41% by Friday’s close.

The Chinese stock market fell upon the release of several disappointing economic indicators in recent weeks pointing toward a slowing recovery. The benchmark CSI 300 Index dipped by 2.4%, its biggest weekly decline since the five days ended March 10, and erasing all its gains this year. Hong Kong’s benchmark Hang Seng Index plunged below the psychological key support at 19,000 to its lowest close since December in a holiday-shortened trading week. While there were no major indicators or policy measures announced during the week, mounting evidence that China’s post-pandemic recovery is losing momentum raised concerns about its economic outlook. In more recent announcements, retail sales, industrial output, and fixed asset investment all grew at rates that were weaker than expected in April. Credit growth indicators likewise pointed to sluggish domestic demand. The yield on China’s 10-year government bond descended to a six-month low of 2.70% last week.

The Week Ahead

In the coming week, the labor market, consumer confidence, and job openings data are among the important economic data scheduled to be released. All markets shall be closed on Monday in commemoration of Memorial Day.

Key Topics to Watch

- S&P Case-Shiller home price index (20 cities)

- Consumer confidence

- Richmond Fed President Barkin speaks

- ADP employment

- Chicago Business Barometer

- Job openings

- Philadelphia Fed President Patrick Harker speaks (Wed.)

- Federal Reserve Beige Book

- Initial jobless claims

- U.S. productivity

- IS&P U.S. manufacturing PMI

- ISM manufacturing

- Construction spending

- Philadelphia Fed President Patrick Harker speaks (Thur)

- U.S. employment report

- U.S. employment rate

- U.S. hourly wages

- Hourly wages year-over-year

Markets Index Wrap Up