Stock Markets

The stock market indexes ended the week all in positive territory. The Dow Jones Industrial Average (DJIA) managed to close the week up by 2.02% while the broader S&P 500 gained by 1.83% after touching its highest intraday level since mid-August 2022. The technology stock-heavy Nasdaq Stock Market Composite rose by 2.04% for the week, its sixth straight weekly gain, after hitting its best level since mid-April 2022. The NYSE Composite ended up by 1.77%. The CBOE Volatility Index, the investors’ risk perception indicator, descended by 18.66%. Although markets were closed on Monday in observance of Memorial Day, the rally was broad-based with strong gains in both value and growth stocks, as well as small caps. This was a positive ending for the month, in contrast with the several weeks that preceded it.

The solid gains made during the week may have led observers to speculate that the markets were lifted by the news that the White House and Republican congressional leaders had reached an agreement to raise the federal debt limit to stave off a default on government’s obligations. This turned out not to be the case as the agreement to raise the debt ceiling has a limited impact on market sentiment. Enough signals had previously been sent that a deal was imminent, thus it had not come as a surprise. Investors, however, appear to have diverted their attention back to the economic data, which pointed to positive developments during the week.

U.S. Economy

On Wednesday, the news was released that job openings rebounded considerably more than expected in April to hit 10.1 million, their highest level since January. The jobs data for March was also revised higher. As a result, the probability of a mid-June Federal Reserve interest rate hike priced into futures markets surged to 71%, compared with only 23% one month earlier. The closely watched nonfarm payrolls report released on Friday also surprised on the upside. Details on Friday’s report, however, appeared to indicate that the labor market might be cooling. Some 339,000 jobs were added by employers in May, significantly above the consensus estimate of approximately 190,000. However, the unemployment rate, estimated by surveys of households, rose surprisingly to 3.7% from 3.4%. This increase suggested that workers are faced with a more difficult job market ahead. The Labor Department reported that the number of people losing jobs or completing temporary jobs rose significantly in May, reaching its highest level since February 2022. Nevertheless, the number of long-term unemployed remained relatively constant.

An encouraging development for investors was the release last Thursday of the Institute for Supply Management’s (ISM’s) Manufacturers Purchasing Managers’ index for May. This is the seventh straight month that factory activity contracted, as anticipated. Defying expectations for a modest increase in prices paid for supplies and other inputs by manufacturers, prices instead contracted at the fastest rate since December. These developments are taken as encouraging inflation signals which seemed to drive a decrease in longer-term U.S. Treasury yields. Furthermore, the finalization of a debt ceiling agreement resulted in a plunge in the yield on one-month Treasury bills, from 6.02% intraday on the previous Friday to 5.28% at the end of this week. While it is true that limited reaction greeted news of the debt ceiling agreement, it nevertheless provided a tailwind to the municipal market.

Metals and Mining

The past week saw the end of a challenging and volatile month for the gold market. It was during this month that gold soared to near-record highs above $2,080 per ounce. Since then, the short-term correction was only to be expected since the pattern has repeated over the last 12 months. New recession fears ignited by weak economic data, causing markets to front-run the Federal Reserve pricing in rate cuts. At the start of May, markets saw a nearly 17% chance of a rate cut in June. At the same time, markets saw interest rates approximately 100 basis points lower by the end of the year. Inflation pressures seem to have descended but remain too elevated for the central bank to definitively signal a change in monetary policy. A challenging environment for gold is being created by the current shift in interest rate expectations, since it is supporting the dollar which is presently at a three-month high. Nevertheless, there remains significant support for gold despite the challenging environment that could keep gold from hitting record highs in the near term.

This past week, the spot prices for precious metals were mixed. Gold, which came from its week-ago price of $1,946.46, ended Friday at $1,947.97 per troy ounce which is a minimal 0.08% up. Silver was at $23.30 the previous week and ended at $23.61 per troy ounce this week, up by 33%. Platinum ended this week at $1,007.95, lower by 1.79% from last week’s close at $1,026.37. Palladium closed the previous week at $1,426.25 and this week at $1,424.29 per troy ounce, down slightly by 0.14%. The three-month LME prices of base metals were also mixed for the week. Copper closed at $8,237.00 per metric tonne this week, up by 1.25% from the previous week’s close at $8,135.00. Zinc closed this week at $2,306.50 per metric tonne, lower by 1.58% from its price the week before at $2,343.50. Aluminum, which was priced at $2,237.50 the previous week, ended this week at $2,263.50 per metric tonne, up by 1.16%. Tin closed this week at $25,651.00 per metric tonne, up by 3.24% from the previous week’s price of $24,846.00.

Energy and Oil

Bullish sentiment returned to the oil market with the lifting of the U.S. debt ceiling that averted a government shutdown. Brent rose back to above $75 per barrel while WTI climbed above $71 per barrel as a result of the positive investor reaction. While some downward pressure on oil prices is being exerted by rising U.S. crude inventories and the weak Chinese manufacturing outlook, the anticipated OPEC+ meeting this weekend may provide another upward push for oil prices if the group eventually decides to cut oil production. Meanwhile, the European Commission is expected to present its 11th package of Russian sanctions in the coming week, thereby targeting Chinese firms that shipped banned goods to Russia. The new sanctions will continue to pursue banning flows through the northern Druzhba pipeline and forbidding the transit of EU-bound goods through Russian territory.

Natural Gas

For the week from Wednesday, May 24 to Wednesday, May 31, 2023, the Henry Hub spot price fell by $0.14 from $2.24 per million British thermal units (MMBtu) at the start of the week to $2.10/MMBtu at the end of the week. Regarding Henry Hub futures prices, the June 2023 NYMEX contract expired on May 26, Friday, at $2.181/MMBtu, down $0.22 from Wednesday. The July 2023 NYMEX contract price fell to $2.266/MMBtu, down $0.30 from the start to the end of the report week. The price of the 12-month strip averaging July 2023 through June 2024 futures contracts decreased by $0.21 to $2.959/MMBtu.

International natural gas futures prices decreased this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.42 to a weekly average of $9.31/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, Europe’s most liquid natural gas market, fell by $1.29 to a weekly average of $7.98/MMBtu. In the week last year corresponding to this week, (week ending June 1, 2022), the prices were $23.30/MMBtu and $27.67/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stocks were relatively unchanged over the past week in the absence of any strong incentive to buy or sell. The STOXX Europe 600 Index moved sideways in local currency terms, and the pan-European index gained back losses after the data suggested that eurozone inflation had slowed and the U.S. Senate passed a bill suspending the statutory limit on government borrowing. The major stock indexes were mixed. Italy’s FTSE MIB ascended by 1.33%, Germany’s DAX climbed by 0.42%, and France’s CAC 40 Index lost by 0.66%. The UK’s FTSE 100 Index slid by 0.26%. Eurozone’s headline inflation slackened from an annualized 7.0% in April to 6.1% in May, notably below a FactSet consensus estimate of 6.3%. The core inflation rate, excluding food and fuel prices, its volatile components, was 5.3%, also an improvement from the previous month as well as below expectations.

Japanese stocks rose over the past week amid continued strong foreign investor interest. The Nikkei 225 Index rose by 1.97% while the broader TOPIX Index increased by 1.72%. The benchmark indexes reached new 33-year highs with the gains supported by the weakness in the yen as well as strong domestic earnings. Investor sentiment was propelled by the passage of the U.S. debt ceiling agreement and the fact that default was avoided. Also, there was optimism of indications that the U.S. Federal Reserve may likely pause its interest rate hikes by June. The yield on the 10-year Japanese government bond fell to 0.41% from 0.43% at the end of the previous week. Governor Kazuo Ueda of the Bank of Japan (BoJ) mentioned that it was too early for the central bank to discuss an exit from its ultra-easy monetary policy and that there was no definite time frame for reaching its 2% inflation target. Ueda urged the importance of the central bank being more careful in the way it communicates its policies. The yen strengthened to around JPY 139 against the U.S. dollar this week from the prior week’s JPY 140.66.

Chinese equities gained over the past week after the passage of legislation to suspend the debt ceiling by the U.S. Senate. This eliminated the risk of a destabilizing U.S. default, thus encouraging greater investor confidence and risk appetite. The Shanghai Stock Exchange Index rose by 0.55% while the blue-chip CSI 300 gained 0.28% in local currency terms. In Hong Kong, the benchmark Hang Seng Index added 1.1% after it descended to a six-month low earlier in the week. The country’s official manufacturing Purchasing Managers’ Index (PMI) fell to a lower-than-forecasted level of 48.8 in May from 49.2 in April, signaling the second consecutive month of contraction and the lowest reading since December 2022. A reading above 50 represents an expansion from the previous month. This was the first time since January that production activity fell into contraction, weighed down by declines in new orders and exports. The non-manufacturing PMI also weakened, falling to a lower-than-expected 54.5 in May from 56.4 in April. Although the sector continued to grow, this was the slowest pace it did so since December when China lifted pandemic restrictions.

The Week Ahead

The important economic data being released this week include consumer credit and PMI data.

Key Topics to Watch

- S&P U.S. services PMI

- Factory orders

- ISM services

- U.S. trade deficit

- Consumer credit

- Initial jobless claims

- Wholesale inventories

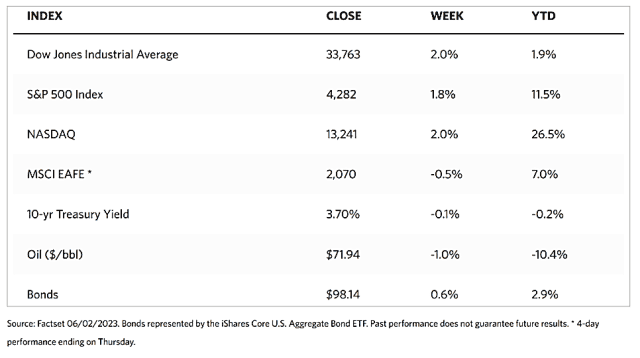

Markets Index Wrap Up