Dozens of shipping containers lie hidden behind a hillside south of Thimphu, the Himalayan capital of Bhutan, one of the world’s most isolated nations. Inside, millions of dollars of bitcoin mining machines work unceasingly to amass the valuable currency that now fascinates the country’s monarch — and his kingdom. Under the reign of Jigme Khesar Namgyel Wangchuck, the “Dragon King,” Bhutan has been quietly transformed into a crypto Shangri-La with its government dedicating land, funding and energy to operations like these, which it hopes will avert a looming economic crisis.

But Bhutanese officials have never disclosed the location or scope of these facilities. And when it became the first country to have founded a sovereign bitcoin mine approximately four years ago, few outside of Bhutan knew. Its government only began commenting on its digital asset investments after Forbes first reported details of its multi-million-dollar portfolio earlier this year, which were exposed by the bankruptcies of fallen crypto lenders BlockFi and Celsius, with whom it had banked significant holdings.

Now, Forbes has identified the sites of what appear to be four mines run by the Thunder Dragon kingdom, based on sources with knowledge of Bhutan’s crypto investments and confirmed through satellite imagery from Planet Labs, Satellite Vu and Google Earth. They show long rectangular mining units, data center cooling systems and high capacity power lines and transformers that run from Bhutan’s hydroelectric plants to the sites. They have never been publicly disclosed.

One facility — the pilot location for Bhutan’s bitcoin mining efforts, a source said — was built near Dochula Pass, an area that holds cultural and political significance for its 108 memorial shrines dedicated to fallen Bhutanese soldiers. Planet Labs and Google Earth satellite imagery indicate that earthmoving began on the site in 2020 with construction appearing to have finished in late 2022. Aerial views show a cluster of green and white-roofed mining units enclosed by miles of forest. Though just steps from a busy highway, Google Street View suggests it is completely hidden from unknowing passersby. A second source told Forbes that the ground has been leveled along this stretch of road to provide additional cover for the site.

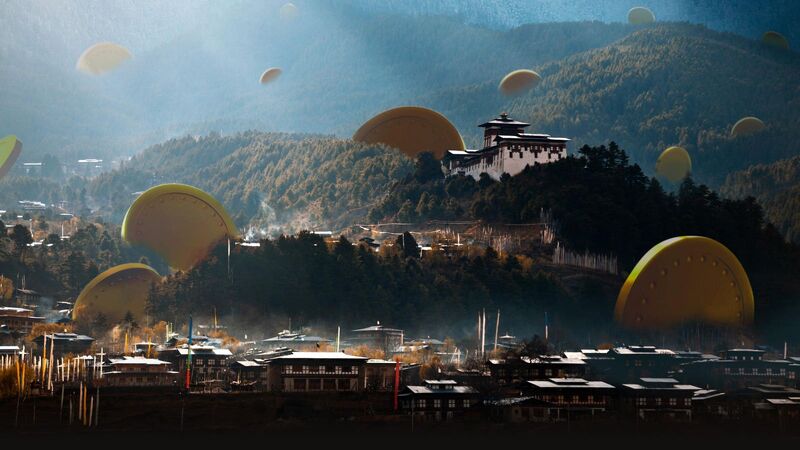

A second mine is located near Trongsa, a town east of Thimphu and ancestral seat of the current Wangchuck dynasty. A third is situated in the heavily forested district of Dagana, near a middle school that caters to children in the rural community.

What appears to be the kingdom’s fourth and largest mine sits on the bones of a contentious — and failed — $1 billion government megaproject called “Education City,” an effort to establish an international center “for education and knowledge” in Bhutan. The mine runs alongside the country’s first paved road, Phuentsholing-Thimphu national highway, but is concealed behind mountainous terrain. Only transformers and power lines betray the fact that a bitcoin mine now occupies the site. Historical satellite imagery shows that its construction began around December 2021, coinciding with the import of $193 million in “processing units,” according to customs data from the Ministry of Finance. The imports were appended with the same tariff code used by bitcoin mining hardware companies.

Bhutan had pitched the Education City project to its citizens as a means to secure their future amid rising youth unemployment, surging emigration numbers and brain drain. Roughly 1.5% of Bhutan’s population emigrated last year to Australia alone, many seeking job opportunities and better pay. In Bhutan, the minimum wage is set at just $45 per month and approximately 12% of its population lives below the poverty line, according to local newspaper Kuensel.

Education City was supposed to change that. In 2009, Bhutan’s government paid consulting firm McKinsey & Co. some $9 million to help design a $1 billion “world-class regional hub for health, education, finance, ICT services.” Nestled between the confluence of two rivers, the 1,000-acre campus would be a beacon of the country’s experimental Gross National Happiness economic model, and a higher ed hub for Asia. It was to host satellites of some of the most prestigious universities in the world, as well as R&D facilities, laboratories, hotels and event centers. And according to the Bhutanese government, it would promote “Brand Bhutan,” creating a “green and sustainable economy,” “culturally and spiritually sensitive industries” and a “knowledgeable society.”

It did none of those things. Plagued by political scandals, mismanagement and innumerable delays, Education City was scrapped in 2014. But left behind were roads, bridges, a water supply and, crucially, power lines — building blocks for a bitcoin mine.

The kingdom’s sovereign investing arm, Druk Holdings & Investment (DHI), confirmed the mines’ existence. “Sites for bitcoin-mining related facilities in Bhutan have been selected based on the logistical needs of the operations such as power supply and a variety of other factors,” it told Forbes through an outside communications firm. It declined to comment on their locations, however, stating that “DHI does not disclose commercially sensitive details of its operations.”

Bitcoin was a Hail Mary addition to Bhutan’s economic masterplan. The kingdom’s finances have long been underpinned by tourism revenues and the export of a massive surplus of hydropower to its neighbor India. But the Covid pandemic tanked the $88.6 million annual revenue the country collected from $65-a day visa fees, requiring an urgent course correction. According to multiple sources, Bhutanese government officials began holding talks with bitcoin miners and suppliers sometime in 2020.

DHI, which oversees Bhutan’s bitcoin operations, told local newspaper The Bhutanese that it “entered the mining space” when the cryptocurrency’s price was $5,000 (it was last valued at this level in April 2019 but is now worth $36,000). Bhutan’s own import data and satellite imagery suggest that its operations truly ramped up in 2020. In May, when Forbes asked DHI to confirm that timing, a spokesperson for the fund would say only that a series of bitcoin investments were made “in a period in 2019.” They added that DHI was “currently net positive in our digital asset position.” Bitcoin’s price collapsed from $69,000 in November 2021 to under $17,000 last December.

The Bhutanese reported in June that DHI was planning to sell down its bitcoin stockpile to fund a 50% salary hike for government officials worth $72 million, as Bhutan faces an economic and political crisis with a trade deficit running down its hard currency reserve to just $689 million. (This will cover just 14 months of imports while the country’s constitution requires 12 months of reserves.)

Several sources inside Bhutan told Forbes that the mines are now an open secret, though neither the Bhutanese government nor DHI have formally disclosed their existence. In emails to Forbes, DHI has consistently declined to comment on the scope or financing of its cryptocurrency regime.

DHI, which also operates the nation’s flagship airline, hydroelectric power plants and a cheese factory, does not provide any breakdown of revenues or investment in bitcoin mining in its annual accounts beyond noting it had raised foreign currency bonds to fund the project. Bhutan’s Ministry of Finance has been equally quiet. Outside academics and insiders who specialize in monitoring global bitcoin activity told Forbes that the country’s mining activities remain a conundrum. DHI claimed that it was “not involved in decisions as to the use of funds that DHI pays out to the Government.”

But the kingdom left a breadcrumb trail. Trade data accessed through the Observatory of Economic Complexity, an open source platform that visualizes global trade patterns, indicates that more than $220 million in chips used for bitcoin mining were shipped from China to Bhutan between 2021 and 2022. DHI declined to answer questions about them, citing “NDAs with contractual parties.” And Bhutan’s Ministry of Energy data reveals a massive 63% spike in power usage by industry in 2022.

Meanwhile, Bhutan, which has for years sold off surplus energy to India, has massively ramped up imports, purchasing $20.7 million worth of electricity in 2023, according to Kuensel. Government officials recently warned that this bill would balloon to $72 million over the coming winter with imports needed for five months to cover demand.

The Asian monsoon season means that Bhutan has always experienced droughts when its hydropower plants stand largely idle for three months, requiring it to import electricity from India’s largely coal-powered grid. Bhutan’s investment in bitcoin mining has, however, hinged on reliable access to cheap and clean energy.

“Bhutan prioritises power supply for domestic consumption. Industry and business — including projects related to bitcoin mining — are accorded lower priority,” DHI’s spokesperson said. In the winter months when hydropower generation typically decreases, “mining activity may be shut down subject to electricity availability.”

However, the four state-owned mines Forbes believes it has identified might not even be Bhutan’s largest. In 2022, the country entered a partnership with Singaporean bitcoin mining giant, Bitdeer, which made Bhutan the seat of its Asian expansion. In March, Bitdeer broke ground on a mine in the southern town of Gedu, according to satellite imagery from Planet Labs, bringing 100 megawatts (MW) online in August, the company said. DHI, which owns Bhutan’s national power company, will be supplying electricity to the site. Bitdeer disclosed in a July update that it was already running 11,000 miners and had ordered an additional 15,000 machines. When completed, the 600 MW facility will consume more energy than the rest of the nation, Nikkei reported.

Recently, Bitdeer staff have been approaching investors at industry conferences such as Mining Disrupt for a $500 million “green crypto mining” fund. DHI estimates it will support 300 to 400 jobs and a new computing sector in Bhutan — echoing the country’s moonshot pitch for the defunct Education City. Bitdeer CEO Matt Linghui Kong told Forbes in a statement that the company is “getting a lot of interest” in the fund and is currently in negotiations with multiple investors who it declined to name.

The new fund and jobs could be desperately needed, with the Asian Development Bank forecasting that Bhutan’s economy would slow to 4.6% this year. The government’s own economists called for economic reforms and budget cuts to stave off a financial crisis.

For now, Bhutan’s appetite for blockchain-based solutions seems undimmed by these challenges. Earlier this month, on the king and queen’s 12th wedding anniversary, it unveiled an experimental decentralized digital identity app. Its first test subject and digital citizen? The crown prince.