Stock Markets

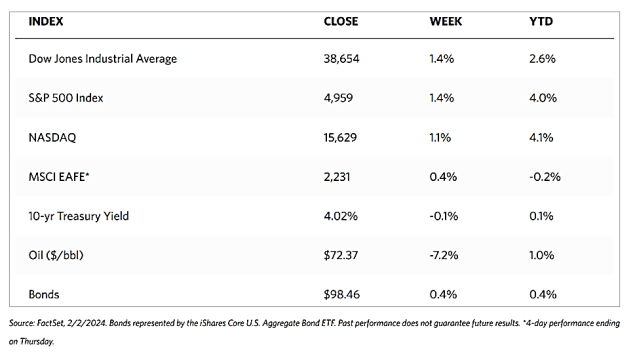

Amid a profusion of significant earnings reports and economic data, the stocks responded with mixed reactions. All major indexes were modestly up for the week but small-cap indexes recorded losses. According to the Wall Street Journal Markets monitor, the Dow Jones Industrial Average gained by 1.43% while the Total Stock Market Index advanced by 1.22%. The broad-based S&P 500 Index climbed by 1.38% but its equally weighted version closed with a moderate loss. The technology-heavy Nasdaq Stock Market Composite moved up by 1.12%, and the NYSE Composite marginally gained by 0.90%. The CBOE Volatility Index, a measure of investors’ risk perception, moved up by 4.45%. Over the past month, the small-cap Russell 2000 Index declined by nearly 4.0%.

Several releases from tech heavyweights drove movements in the major indexes during this, the busiest week of the fourth-quarter earnings reporting season. In response to lower-than-expected earnings guidance from Google parent Alphabet, Microsoft, and chipmaker Advanced Micro Devices, the Nasdaq Composite Index and the S&P 500 Index plunged precipitously on Wednesday. On Thursday, however, the benchmarks recovered much of their losses, buoyed by the stronger-than-anticipated earnings reports from Facebook parent Meta Platforms, Apple, and Amazon.com. Also seeming to sway sentiment was the Federal Reserve policy meeting that concluded on Wednesday. Short-term interest rates were left unchanged by the policy-making body, which broadly aligned with expectations. However, Fed Chair Jerome Powell stated that the Fed was unlikely to cut rates in March, which resulted in futures markets pricing in only 20.5% (from 47.7% one week earlier) of a rate cut at the Fed’s next policy meeting.

U.S. Economy

On Friday, the Labor Department reported that employers added 353.000 new nonfarm jobs in January, double the consensus estimates, at the same time adjusting even higher the gains made in November and December due in part to an annual benchmark revision. The strong employment report weakened the chances that the Fed will cut interest rates soon, Also surprising on the upside were average hourly earnings which rose by 0.6% and brought the year-over-year increase to 4.6%. Unemployment remained unchanged at 3.7%. However, the average workweek unexpectedly contracted from 34.3 to 34.1 hours. The data was consistent with an upside surprise in job openings reported earlier in the week. December’s job openings rose to their highest level in three months, at 9.03 million.

Some reassuring news on the struggling manufacturing sector also emerged this week. Revisions to the January gauges of factor activity for both S&P Global and the Institute for Supply Management were released on Wednesday, beating expectations with the former indicating the best (but still moderate) pace of growth in the sector since September 2022. The yield on the benchmark 10-year U.S. Treasury note rose in reaction to Friday’s jobs report but still ended lower for the week. Aside from the modest upside surprise in weekly jobless claims, also possibly exerting some limiting pressure on yields is the lower-than-expected borrowing needs figures reported by the Treasury Department on Tuesday. Furthermore, a relatively light primary calendar and positive flows over the week benefitted the tax-free municipal market.

Metals and Mining

This week, gold and silver continued to defy the odds as they followed the price action pattern established in 2023 that has propelled their prices to record highs. Gold has managed to hold critical support levels, consolidating within a broad-based uptrend despite the Federal Reserve maintaining a restrictive monetary policy that holds the Fed Funds rate at its highest level in nearly two decades. This week, investors received the Fed’s message that the anticipated rate cuts are not going to take place just yet. Despite significant headwinds for metals – the reduced expectations of a rate cut and the S&P 500 and DJIA treading new highs – the April gold futures and rending the week with a close to 1% gain and prices testing resistance around $2,050 per ounce. This shows that there is strength in the physical demand for gold in the marketplace.

The spot prices for precious metals were mixed for the week. Gold gained 1.05% from its close the previous week at $2,018.52 to its close this week at $2,039.76 per troy ounce. Silver ended lower by 0.48% from its closing price last week of $22.80 to its closing price this week of $22.69 per troy ounce. Platinum ended this week lower by 2.05%, from its price last week of $915.68 to its closing price this week of $896.95 per troy ounce. Palladium ended down by 1.19% from last week’s close at $960.31 to this week’s close at $948.92 per troy ounce. The three-month LME prices of industrial metals were mostly down for the week. Copper came from $8,568.50 last week to $8,482.00 per metric ton this week for a loss of 1.01%. Zinc began from its closing price last week of $2,580.00 to its closing price this week of $2,451.00 per metric ton for a decline of 5.00%. Aluminum came from its close last week at $2,238.50 to end this week at $2,233.50 per metric ton for a reduction of 0.22%. Tin, which closed last week at $26,648.00, ended this week at $25,550.00 per metric ton for a loss of 4.12%.

Energy and Oil

Market fundamentals took a back seat to speculation this week as oil prices were weighed down by unsubstantiated reports of an impending ceasefire between Israel and Palestine. Brent futures were dragged below $80 per barrel in response to the rumors. Regarding fundamentals, OPEC+ held its ministerial meeting and announced that it was retaining its policy of making no changes to its production policy. Participating top officials indicated that they will meet once more in early March to decide on an extension of the 2.2 million barrels-per-day cuts into the second quarter. With this as background, unforeseen refinery outages in the United States may weaken the U.S. demand further and thus have an even more lasting impact on prices.

Natural Gas

For the report week from Wednesday, January 24, to Wednesday, January 31, 2024, the Henry Hub spot price fell by $0.21 from $2.44 per million British thermal units (MMBtu) to $2.23/MMBtu. Regarding Henry Hub futures prices, the February 2024 NYMEX contract expired on Monday at $2.490/MMBtu, down by $0.15 from the beginning of the report week. The March 2024 NYMEX contract price decreased to $2.100 /MMBtu, down by $0.16 from the start to the end of the report week. The front-month futures contract price fell after rising above $3.00/MMBtu in the middle of January. The price of the 12-month strip averaging March 2024 through February 2025 futures contracts declined by $0.14 to $2.767/MMBtu.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.07 to a weekly average of $9.42/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.22 to a weekly average of $9.13/MMBtu. In the week last year corresponding to this report week (the week from January 15 to February 1, 2023), the prices were $19.43/MMBtu in East Asia and $18.04/MMBtu at the TTF.

World Markets

European stocks were directionless this week resulting in the pan-European STOXX 600 Index ending the week roughly flat. Major stock indexes were mixed. While Italy’s FTSE MIB gained 1.11%, France’s CAC 40 Index declined by 0.55%, Germany’s DAX slipped downward by 0.25%, and the UK’s FTSE 100 Index dipped by 0.26%. The yield on the benchmark 10-year German government bond approached a three-week low but returned to end the week unchanged. The UK and Italian government bond yields also dived during the week before recovering lost ground on Friday to end the week slightly higher. On the economic front, the eurozone surprisingly avoided a recession in the last quarter of 2023. During the period, the gross domestic product (GDP) was unchanged relative to the previous three months and was 0.1% higher year-over-year. Annual consumer price inflation continued to proceed in the right direction as the headline rate slowed to 2.8% in January from 2.9% in December. The core inflation rate (excluding the volatile components – food, energy, alcohol, and tobacco prices) likewise inched lower to 3.3%.

Japanese stock markets ascended this past week. The Nikkei 225 Index gained by 1.1% while the broader TOPIX Index rose by 1.7%, mostly due to support lent by a robust corporate earnings season. Higher prices and strong tourism provided a boost to domestically focused firms. The 10-year Japanese government bond (JGB) yield dropped to 0.68% from 0.71% at the end of the previous week. Exerting downward pressure on yields was a surprisingly strong 10-year JGB auction. Regarding currency markets, the yen strengthened to around the high-146 range from the previous low-148 range against the U.S. dollar as the U.S. Federal Reserve dispelled expectations of an interest rate cut in March. Underpinning the yen’s gains are some signs of a hawkish stance by the Bank of Japan (BoJ). On the country’s economy, Purchasing Managers’ Index (PMI) data showed that Japanese manufacturing conditions deteriorated modestly in January, with continued falls in output and new orders. Over the month, managers also faced a steep rise in price pressures as cost burdens rose at a marked pace amid high raw materials, labor, and fuel prices.

In China, stocks retreated in the face of discouraging economic data and property sector headlines, fueling investors’ pessimism surrounding the growth outlook. The Shanghai Composite Index saw its worst week since 2018 as it plummeted by 6.19%. The blue-chip CSI 300 plunged by 4.63%, its biggest weekly loss since 2022. Both indexes are trading at their lowest levels in five years. The Hong Kong benchmark Hang Seng Index declined by 2.62%. A mixed picture of China’s economy was reflected in January’s economic data. The official Manufacturing Purchasing Managers’ Index (PMI) ascended to 49.2 in January from 49,0 in December amid improved production growth. However, this figure still lagged the 50-mark threshold that distinguished expansion from contraction. The non-manufacturing PMI is well into expansion territory as it registered an above-consensus 50.7 from 50.4 in December. By comparison, the private Caixin/S&P Global Survey of manufacturing activity held steady at 50.8 in January, exceeding expectations and marking its third straight month of expansion. Meanwhile, the value of new home sales by China’s top 100 developers fell by 34.2% year-on-year in January. This is roughly even with the 34.6% drop in December, according to the China Real Estate Corporation. The report shows no sign of improvement in China’s property crisis. Falling home prices and construction delays continue to sideline buyers, in turn increasing pressure on indebted property developers and leading Beijing to intervene to prop up the sector.

The Week Ahead

Included among the important economic data scheduled for release in the coming week are the ISM service PMI reading, consumer credit data, and the U.S. trade deficit.

Key Topics to Watch

- S&P Final U.S. services PMI for January

- Chicago Fed President Austan Goolsbee TV appearance

- ISM services for January

- Atlanta Fed President Raphael Bostic gives welcoming remarks

- Cleveland Fed President Loretta Mester speaks

- Minneapolis Fed President Neel Kashkari speaks

- Boston Fed President Susan Collins speaks (Tuesday, Feb, 6)

- Philadelphia Fed President Patrick Harker speaks

- U.S. Trade deficit for December

- Fed Gov. Adriana Kugler speaks

- Boston Fed President Susan Collins speaks (Wednesday, Feb. 7)

- Richmond Fed President Tom Barkin speaks (Wednesday, Feb. 7)

- Fed Gov. Michelle Bowman speaks

- Consumer credit for January

- CBO briefing on budget and economic outlook

- Initial jobless claims for February 3

- Wholesale inventories for December

- Richmond Fed President Tom Barkin speaks (Thursday, Feb. 8)

- CPI seasonal factor revisions

- Dallas Fed President Lorie Logan speaks

Markets Index Wrap-Up