Digital wallets — such as Apple Pay and Google Pay, which use near-field communication tags, and Amazon Pay and PayPal, which use QR codes — offer shoppers a contactless method to complete their purchases.

Because digital wallets store encrypted debit and/or credit card information, they also provide consumers with a more secure way to shop and spend. Convenience, too, is another important feature when shopping online, because digital wallets permit users to bypass the need to enter card details when checking out.

This helps explain why 79% of Generation Z consumers have embraced this sophisticated payment method. The use of digital wallets declines with each older generation, reaching a low of 26% among baby boomers and seniors.

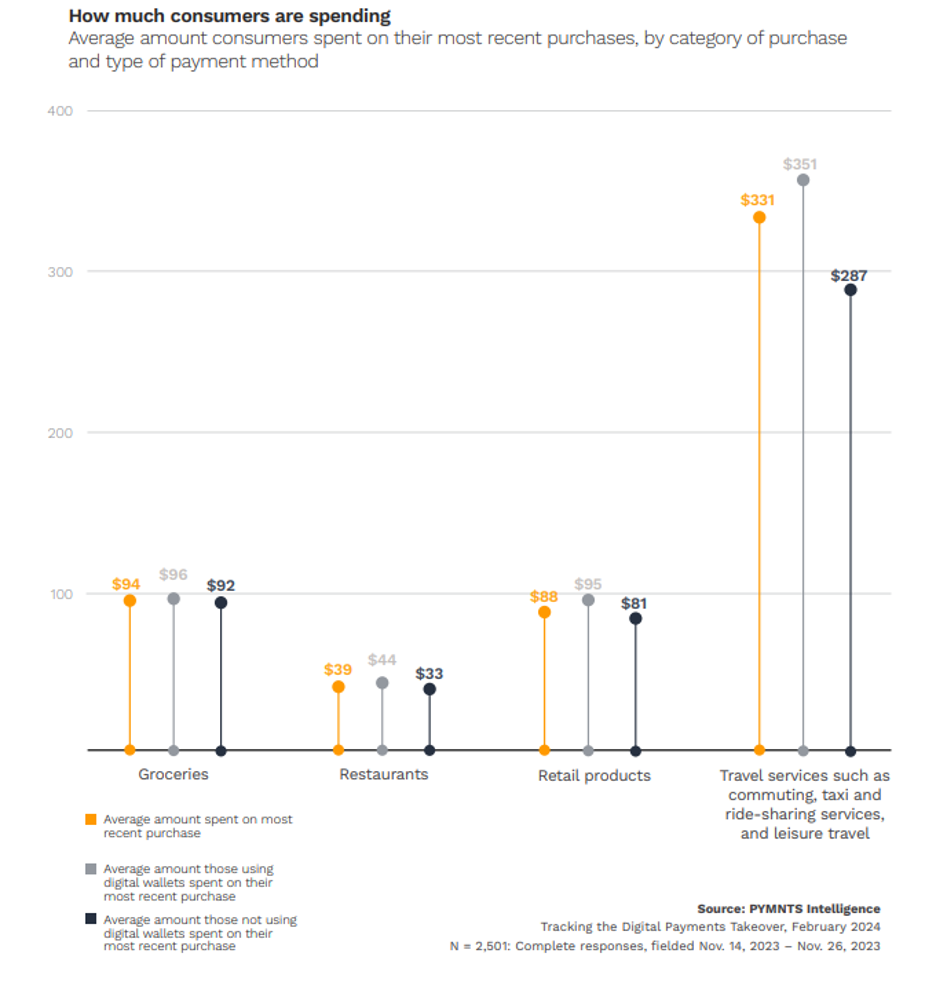

But what may be a surprise — and of particular interest to merchants — is that digital wallet users spend, on average, up to one-third more than consumers who use more traditional payment options across all purchases.

These are just some of the findings uncovered in “Tracking the Digital Payments Takeover: Can New Use Cases Drive Consumer Use of Digital Wallets?,” a PYMNTS Intelligence report created in collaboration with Amazon Web Services that surveyed more than 2,500 consumers to learn how and why they use (or don’t use) digital wallets.

The report found that the average retail purchase among digital wallet users is $95, while non-digital wallet users will spend about $81 per purchase. Data also showed that this higher spending is especially consistent in three categories: the average digital wallet user spends about 4% more on groceries, 17% more on retail and 33% more on restaurant purchases.

Travel trends are less distinct. For instance, last October, consumers who don’t use digital wallets spent more on travel than their counterparts. But in the following month, digital wallet users outspent nonusers on travel by 22%. This suggests that consumers divide big-ticket purchases more or less evenly across payment options — for now.

Regardless, the inclination for digital wallet users to spend more suggests that merchants, in particular restaurant owners, may want to consider catering to these consumers, especially Gen Z.