As global markets navigate a volatile landscape marked by geopolitical tensions and fluctuating economic indicators, the Asian market presents unique opportunities for investors seeking growth potential. With indices like China’s CSI 300 showing mixed results amid uneven economic growth, identifying stocks with solid fundamentals becomes crucial for navigating these uncertain times. In this context, Pizu Group Holdings and two other companies emerge as promising contenders with robust metrics that may appeal to those looking to explore lesser-known opportunities in Asia’s dynamic market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jetwell Computer | 34.75% | 16.24% | 27.51% | ★★★★★★ |

| Wuxi Double Elephant Micro Fibre MaterialLtd | 5.49% | 13.38% | 64.10% | ★★★★★★ |

| Komori | 17.34% | 9.58% | 57.34% | ★★★★★☆ |

| Xinjiang Torch Gas | 0.14% | 17.07% | 14.43% | ★★★★★☆ |

| House of Investments | 18.23% | 14.46% | 47.47% | ★★★★★☆ |

| JB Foods | 113.93% | 31.03% | 41.46% | ★★★★☆☆ |

| Banyan Tree Holdings | 42.74% | 15.33% | 72.59% | ★★★★☆☆ |

| Pizu Group Holdings | 45.21% | -1.54% | -3.14% | ★★★★☆☆ |

| Spectrum Electrics | 87.60% | 46.02% | 71.22% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 51.85% | 20.80% | -5.94% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Pizu Group Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pizu Group Holdings Limited is an investment holding company that manufactures, trades, and sells civil explosives in the People’s Republic of China and Tajikistan, with a market capitalization of HK$4.88 billion.

Operations: The company’s revenue streams are primarily derived from its mining operations, contributing CN¥965.07 million, and explosives trading and blasting services, which bring in CN¥619.40 million.

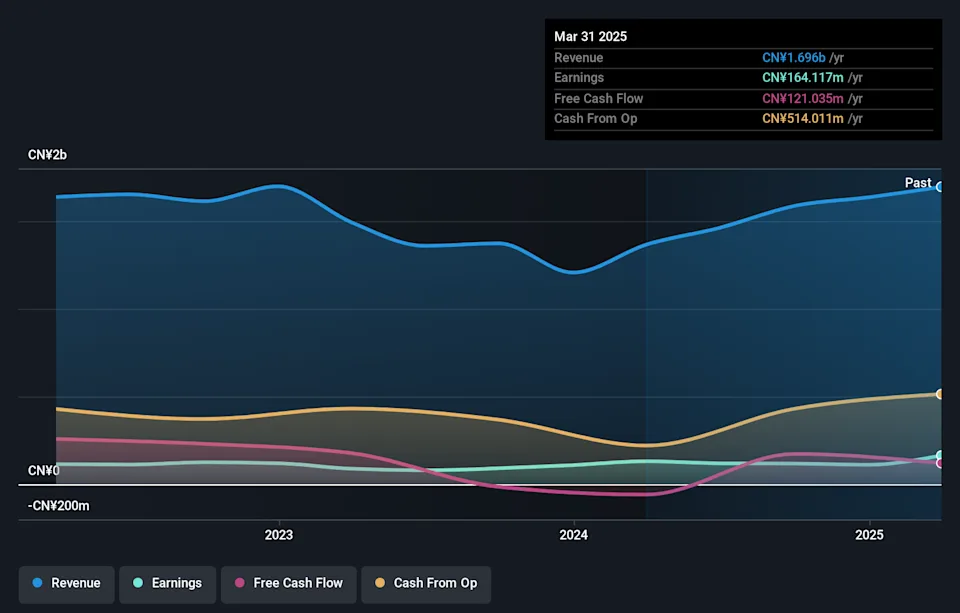

Pizu Group Holdings, a small cap player in Asia, has shown notable earnings growth of 57.5% over the past year, significantly outpacing the construction industry’s -2.3%. Despite this, its debt to equity ratio has risen from 26.9% to 45.2% over five years, indicating increased leverage risk. Trading at 52.4% below estimated fair value suggests potential undervaluation opportunities for investors seeking bargains in the market. Recent financials reveal sales of CNY 748 million for the half-year ending September 2025 compared to CNY 859 million previously; however, net income rose to CNY 107 million from CNY 85 million a year earlier, highlighting improved profitability despite lower sales figures.

Yong Jie New MaterialLtd

Simply Wall St Value Rating: ★★★★★★

Overview: Yong Jie New Material Co., Ltd. specializes in the research, development, manufacture, and sale of aluminum alloy products globally with a market capitalization of approximately CN¥9.43 billion.

Operations: The primary revenue stream for Yong Jie New Material Co., Ltd. comes from its aluminum alloy products. The company’s financial performance is influenced by its net profit margin, which stands at 4.5%.

Yong Jie New Material Ltd. showcases a compelling profile with its recent financial performance. The company reported sales of CNY 7.02 billion for the first nine months of 2025, up from CNY 5.85 billion in the previous year, while net income rose to CNY 308.62 million from CNY 235.61 million, indicating robust growth in earnings per share to CNY 1.71 from last year’s CNY 1.6. Over five years, its debt-to-equity ratio impressively decreased from a staggering 643% to just over 1%, highlighting effective financial management and positioning it well within the competitive Metals and Mining industry landscape where it outpaced average earnings growth rates significantly at over three times the industry pace.