After Beijing slammed them shut about a decade ago, the gates have flung open again for Chinese firms to go on overseas acquisition sprees.

In January alone, the volume of outbound mergers and acquisitions from Greater China approached $12 billion, the most for the first month of a year since 2017. The shopping list included high-profile names like German sports brand Puma SE and Canadian miner Allied Gold Corp.

The turnaround is gathering momentum after a prolonged lull that began in the mid to late 2010s, when China capped outbound investment to rein in exuberant spending. One particularly high-profile case was HNA Group Co., which went on a debt-fueled international binge into names such as Hilton Worldwide Holdings Inc. and Deutsche Bank AG before collapsing.

“We have seen a pickup in outbound M&A interest from China,” said Richard Griffiths, BNP Paribas SA’s head of M&A in Asia Pacific. “Many new situations are being evaluated at the moment and we expect more significant deals to be announced in 2026.”

Reasons for the shift include heightened competition and fewer opportunities at home, as well as renewed confidence and financial strength as local brands grow and Beijing gives its blessing to pursue strategic assets and M&A in key industries. Hurdles such as trade barriers still need to be negotiated though as some countries are more resistant and wary of Chinese investment.

“We expect to see more Chinese companies buying assets overseas in markets with lower regulatory hurdles and industries that are less sensitive, including consumer and retail,” said Nancy Zheng, a partner at Bain & Co. in Shanghai. Other countries in Asia, Canada, some European markets and Latin America have welcomed Chinese buyers, she said.

China has significant control over Chile’s electricity market, for example, with China Southern Power Grid Corp. and State Grid Corp. of China both owning stakes in major power companies. China Southern Power has been trying to increase its 28% stake in Transelec SA in a $4 billion deal, people familiar with the matter have said, though a final agreement hasn’t yet been reached.

On the consumer and retail side, Chinese market leader Luckin Coffee Inc., which has leapfrogged Starbucks Corp. at home, is considering acquisitions including Nestle SA’s Blue Bottle Coffee to elevate its international profile and expand in the premium coffee segment. The chain and its private equity owner Centurium Capital also contemplated a bid for Coca-Cola Co.’s Costa Coffee.

HSG, formerly Sequoia Capital China, is among a handful of bidders for Leica Camera AG, the German firm owned by Austrian billionaire Andreas Kaufmann and Blackstone Inc. Last year, HSG acquired Italian sneaker maker Golden Goose, as well as a majority stake in audio equipment maker Marshall Group AB. And FountainVest Partners bought a stake in Eurogroup Laminations SpA.

“Relatively better growth rates and consumer sentiment in markets outside of China over the past 18 months are making outbound M&A a more attractive proposition,” BNP’s Griffiths said.

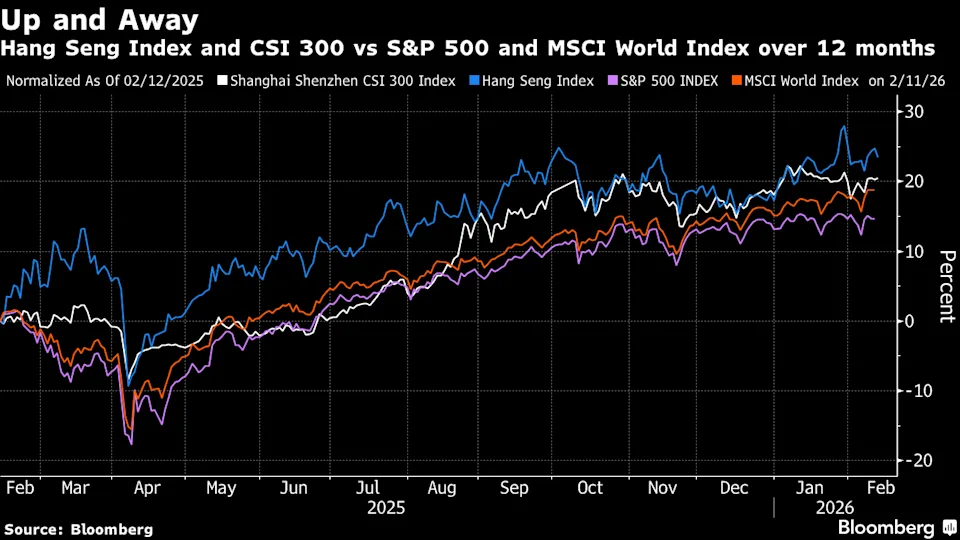

A strong stock market is giving corporate boards a confidence lift. Hong Kong’s Hang Seng Index rallied 28% in 2025 and 18% in 2024, and has pushed on in the 2026, hitting a four-and-half-year high in January. Meanwhile, the CSI 300 Index in mainland China has climbed 20% over the past 12 months.

As China Southern Power’s Chilean adventure shows, the appetite for overseas expansion reaches into sensitive areas too. That can cause complications, such as with Hong Kong tycoon Li Ka-shing’s attempt to sell CK Hutchison Holdings Ltd. ports in the Panama Canal and elsewhere. A sticking point is the role China Cosco Shipping Corp., the country’s biggest shipping company, might play.

Elsewhere in the Americas, Aluminum Corp. of China is acquiring a controlling interest in Cia. Brasileira de Alumínio, in a deal that also involves Rio Tinto Group. In the race to secure critical metals, CMOC Group recently acquired the Brazilian operations of Equinox Gold Corp., while Jiangxi Copper Co. agreed to buy miner SolGold Plc. Both are billion-dollar deals. There’s also hefty investment by electric-vehicle makers like BYD Co. and battery manufacturer Contemporary Amperex Technology Co. Ltd. in plants overseas.

“The China market is highly competitive, driving innovation and cost competitiveness which is positioning China companies well to move overseas,” Griffiths said. “Europe is of particular interest,” he added.

Outbound deals in regions such as Europe and Southeast Asia will strengthen Chinese supply chains and enhance companies’ competitiveness, according to Matthew Phillips, China financial services industry leader at PwC.

“Private companies are often sector leaders in the China market whose competitive edge has been honed and they have reached the scale and developed the capabilities they need to build their businesses in global markets,” Phillips said. “Some cases have outgrown their home market.”

Another area getting investors’ pulses racing is the fast-growing world of data centers and related infrastructure. DayOne Data Centers Ltd., which is backed by China’s GDS Holdings Ltd., is investing in facilities in places such as Southeast Asia and planning an initial public offering in the US. Elsewhere in tech, Tencent Holdings Ltd. has ramped up M&A particularly in Europe in recent years.

“We’re operating in a constructive M&A environment, and often the highly dynamic global backdrop can be a catalyst for cross-border activity,” said Richard Wong, head of APAC M&A at Morgan Stanley. “Boards and management teams are being proactive about advancing strategic priorities, and those ingredients together are supporting increased deal flow.”