Gold dropped below $4,900 an ounce in thin trading, with much of Asia closed for the Lunar New Year. Silver also retreated.

Spot gold fell as much as 2.7% on Tuesday, reaching its lowest intraday level in more than a week. The move followed a 1% drop in the previous session, after the metal rallied briefly Friday when modest US inflation data boosted the case for the Federal Reserve to trim interest rates. Lower borrowing costs are a tailwind for non-yielding precious metals.

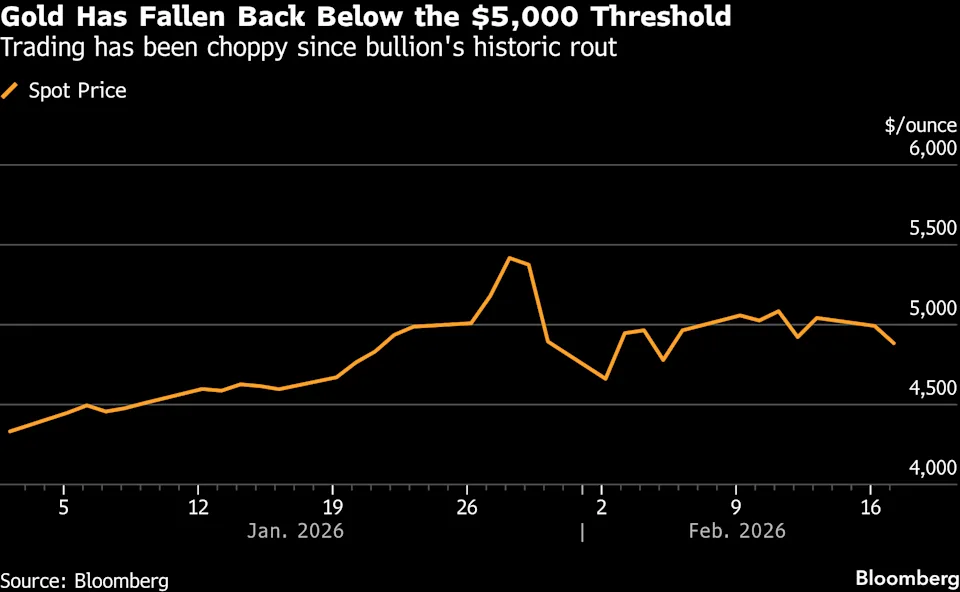

A wave of speculative buying pushed a multiyear rally to breaking point in late January. From a peak above $5,595 an ounce, bullion snapped back to near $4,400 in an abrupt, two-day rout at the turn of the month. Though it has since regained some losses, trading has remained choppy.

Many banks — including BNP Paribas SA, Deutsche Bank AG and Goldman Sachs Group Inc. — have forecast that prices will resume their upward trend, with the factors that underpinned gold’s steady ascent set to persist. These include heightened geopolitical tensions, questions over the Fed’s independence and a wider shift away from currencies and sovereign bonds.

“We continue to see two main supportive macro factors for gold: inflation and dollar debasement,” analysts at Jefferies including Fahad Tariq wrote in a note, raising their 2026 price forecast to $5,000 an ounce from $4,200. Investors and central banks concerned about these factors “have only really one option: hard assets,” they said.

In the near term, however, downside risk will increase the longer that bullion remains below $5,000, as this “would discourage bullish traders further in light of the recent volatility,” Fawad Razaqzada, an analyst at City Index, said in a note.

The US rate path remains in focus following the slower-than-expected inflation print on Friday. US markets will return later Tuesday after observing the Presidents’ Day holiday, and traders will be watching for the minutes of the Fed’s January meeting — due Wednesday — for a fresh read on the economy.

Silver, meanwhile, plunged as much as 5% on Tuesday before paring some losses. The white metal has always been subject to more violent swings than gold, due to its smaller market and lower liquidity, but recent moves – the most volatile since 1980 – have stood out for their scale and speed.

While silver supplies in China continue to be exceptionally tight – with strong demand both from investors and industrial users – there are “tentative indications that speculative intensity is moderating” on the Shanghai Futures Exchange, Marc Loeffert, a trader at Heraeus Precious Metals, wrote in a note Monday.

Spot gold fell 1.9% to $4,899.50 an ounce as of 2:20 p.m. in Singapore. Silver slipped 2.7% to $74.55 an ounce. Platinum and palladium both declined. The Bloomberg Dollar Spot Index, a gauge of the US currency, was little changed.