Stock Markets

This trading week, major stock indexes are down except for the Nasdaq Stock Market Composite which managed to rise by 0.40%. Data from the Wall Street Journal (WSJ) Markets report show the Dow Jones Industrial Average (DJIA) falling by 11.1% while the total stock market lost by 0.11%. The broad-based S&P 500 receded by 0.29% and the NYSE Composite Index slid by 0.87%. The CBOE Volatility Index, which serves as the indicator of investors’ risk perception of the market, dipped by 0.93%. Investors’ risk perception may be abating due to some encouraging news on inflation released during the week.

There was some trading incentive during the week as the flow of first-quarter earnings reports neared its end. The outperformance of the technology-heavy Nasdaq Composite was helped by a buying surge in Alphabet, Google’s parent company, in reaction to the unveiling of its new artificial intelligence (AI)-based platform. The lag in the narrowly-focused DJIA could be attributed to the reported decline in subscribers to Disney’s streaming platform, Disney+. Furthermore, the financial sector underperformed, being weighed down by concerns over the challenges facing regional banks in general. Trading volumes remained thin and neared their lowest level of the year. While the week’s economic calendar provided little trading motivation, it did include the highly anticipated inflation data released on Wednesday. After the Labor Department reported that headline consumer prices rose 4.9% over the year ended in April, the S&P 500 Index jumped by 1% in premarket trading. The inflation reading was slightly below consensus expectations and amounted to the slowest pace n two years.

U.S. Economy

The April consumer price index (CPI) announced on Wednesday was slightly cooler than the 5.0% consensus expectation and below last month’s 5.0% reading. It was the smallest increase since April 2021 and continued the disinflation trend, being the 10th consecutive month of improvement since June of last year when inflation peaked at 9.1%. While gasoline prices rose month-on-month, this was offset by a fall in food prices. Food inflation is still high at an annual 7.1%, however, it is down from 13.5% in August.

Core inflation, which excludes food and energy, inched down to 5.5% from 5.6%. Although core inflation met expectations, the price increase was partially driven by a sudden increase in used car prices which is seen as a temporary development and is not likely to persist. As with previous months, the single largest contributor to inflation was housing. However, we may start to see shelter inflation come down in the summer months based on the historical lag between when inflation of newly signed rental contracts falls and when it shows up in the official data.

The most encouraging news on the reports is possibly that core services inflation excluding shelter (a function of the labor market) improved significantly. This is the measure that the Fed has been highlighting as the basis for its restrictive monetary policy in recent months. Core services inflation was reported to have risen at the slowest pace in nine months. It appears that the labor market tightness is starting to ease, suggested by the fact that jobless claims over the past month rose to a one-year high, which should help cool wage growth. Thus, consumer inflation remains on its downward trajectory. The pace and duration of declines in inflation once it has peaked have been historically symmetrical to its way up. If this holds, inflation may fall toward 3% by the end of 2023, which would be a significant development, considering the height of the peak. The Federal Reserve may have room to pause its rate hikes, which is good news for the markets.

Metals and Mining

Since prices remain well below last week’s test of its all-time high above $2,080 per ounce, it appears that the gold market may be losing some of its bullish momentum, Nevertheless, the yellow precious metal continues to attract much investor attention. Several experts continue to speculate that there may be a hard landing ahead for the U.S. economy, which is historically not favorable for gold and silver. However, geopolitical uncertainty and the growing de-dollarization trend are seen to continue to support precious metals. In any case, there is one thing that continues to drive interest in gold, and that is central bank demand which is seen to continuously persist. Last week, the World Gold Council revealed that in the first quarter, central banks bought 228 tonnes of gold, which is a record start for the year.

During the trading week just ended, there has been some correction in the spot prices of precious metals. Gold, which closed a week ago at $2,016.79, ended this week at $2,010.77 per troy ounce, for a slight reduction of 0.30%. Silver ended this week at $23.97 per troy ounce, representing a 6.62% drop from its previous week’s close at $25.67. Platinum closed this week at $1,053.04 per troy ounce, 0.89% lower than the previous week’s close at $1,062.52. Palladium bucked the trend and closed this week at $1,512.77 per troy ounce, an increase of 1.17% over its previous week’s close at $1,495.31. The three-month LME prices of basic metals were generally lower this week compared to the previous week. Copper ended at $8,253.00 per metric tonne this week, down by 3.83% over the previous week’s close at $8,581.50. Zinc ended this week at $2,549.00 per metric tonne, down by 5.12% over the prior week’s close at $2,686.50. Aluminum closed at $2,211.00 per metric tonne this week, down by 4.64% from its price last week at $2,318.50. Tin ended this week at $25,308.00 per metric tonne, down by 2.90% from its week-ago close at $26,064.00.

Energy and Oil

The slide in oil prices continues this week as fears of a recession were aggravated by a reversal in crude inventory draws. The Department of Energy (DOE), in a carefully-worded announcement, declared that they may start refilling SPRs. This week, U.S. Energy Secretary Jennifer Granholm informed Congress that the DOE could start repurchasing crude for the Strategic Petroleum Reserve as soon as the currently ongoing congressionally mandated sales are concluded. The announcement, however, failed to spark a sustainable price recovery. OPEC sought to intervene with its monthly report, increasing Chinese demand growth this year to 800,000 barrels per day (b/d). Nevertheless, these attempts at altering the broader narrative are failing to incentivize higher prices in the market.

Natural Gas

For the report week from Wednesday, May 3, to Wednesday, May 10, 2023, the Henry Hub spot price rose by $0.09 from $2.03 per million British thermal units (MMBtu) at the start of the week to $2.12/MMBtu by the week’s end. The price of the June 2023 NYMEX contract increased by $0.021, from $2.170/MMBtu on May 3 to $2.191/MMBtu on May 10. The price of the 12-month strip averaging June 2023 through May 2024 futures contracts fell by $0.025 to $2.917/MMBtu. International natural gas futures prices decreased for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.26 to a weekly average of $11.28/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, fell by $0.71 to a weekly average of $11.61/MMBtu. In the corresponding week last year, the week ending May 11, 2022, the prices were $23.54/MMBtu and $30.59/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stocks moved sideways for the week due to a lack of major news that would move the markets. The pan-European STOXX Europe 600 Index ended the week virtually unchanged in local currency terms, despite strong gains early in the week that dissipated as the market discounted the likelihood of further rate increases from the European Central Bank (ECB). Major stock indexes posted mixed results. Germany’s DAX slipped by 0.30%, while France’s CAC 40 Index dipped by 0.24%. The UK’s FTSE 100 Index ended marginally lower by 0.31%. ECB President Christine Lagarde stated in an interview that the central bank has so far moved deliberately and decisively to fight inflation, but that there remains more ground to cover. “There are factors that can induce significant upside risks to the inflation outlook” and that uncertainty regarding inflation remains high, demanding that the ECB pay close attention to the potential risks.

Japan’s stock markets charted gains over the week on the back of signs of strength in corporate earnings. The Nikkei 225 Index rose by 0.8% and the broader TOPIX Index climbed by 1.0% higher. Investor sentiment was tempered somewhat by concerns about China’s economic growth as well as the U.S. debt ceiling and potential default. Nevertheless, data released during the week showed that wage growth remained sluggish in March, which supported the Bank of Japan’s (BoJ) dovish stance. On the back of these developments, the yield on the 10-year Japanese government bond fell from 0.42% at the end of the previous week to 0.39% at the end of this week. The yen rose modestly to around JPY 134.75 against the dollar, from JPY 134. 85 the previous week.

Chinese stocks retreated during the first full week of trading after the five-day Labor Day holiday, due to investors’ concerns about the strength of the country’s recovery. The Shanghai Stock Exchange Index declined by 1.86% while the blue-chip CSI 300 dipped even lower, by 1.97% in local currency terms. Hong Kong’s benchmark Hang Seng Index descended by 2.11%. China’s consumer price index (CPI) inched up 0.1% in April from last year, down significantly from an increase of 0.7% in March. The most recent CPI is the lowest rate since February 2021 and missed economists’ forecasts. Core inflation (which excludes volatile food and energy prices) remained unchanged from the previous month, indicating little demand-driven inflation in the economy. The recent data suggests that China’s central bank may ease policy in the near term to support an economic recovery that is showing signs of losing momentum after the post-pandemic rebound. The yield on China’s 10-year government bond fell to the lowest level since November as traders priced in the possibility of further monetary easing.

The Week Ahead

In the coming week, important economic data scheduled for release include housing data, retail sales growth, industrial production, and capacity utilization.

Key Topics to Watch

- Empire State manufacturing survey

- Chicago Fed President Goolsbee on TV

- Minneapolis Fed President Kashkari speaks

- Cleveland Fed President Mester speaks

- U.S. retail sales

- Retail sales minus autos

- Industrial production

- Capacity utilization

- Business inventories

- Home builder confidence index

- Fed Vice Chair Barr testifies

- Richmond Fed President Barkin speaks

- New York Fed President Williams speaks

- Chicago Fed President Goolsbee on TV

- Atlanta Fed President Bostic and Chicago Fed President Goolsbee on panel

- Housing starts

- Building permits

- Philadelphia Fed factory survey

- Initial jobless claims

- Fed Gov. Philip Jefferson speaks

- Fed Vice Chair for Supervision Barr testifies

- Existing home sales

- U.S. leading economic indicators

- New York Fed President Williams speaks

- Fed Chairman Powell and former Fed Chairman Bernanke on panel

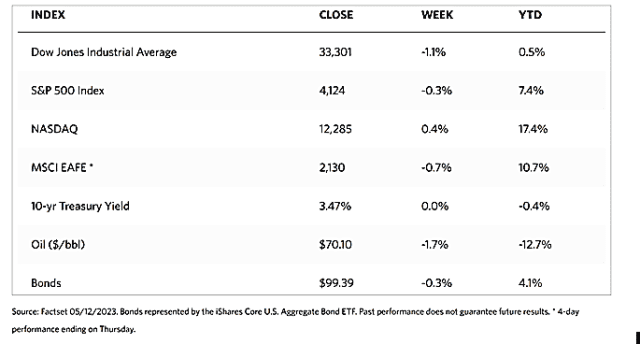

Markets Index Wrap Up