Bitcoin’s (BTC) year-to-date rally of 63% may be the first milestone in its upward journey.

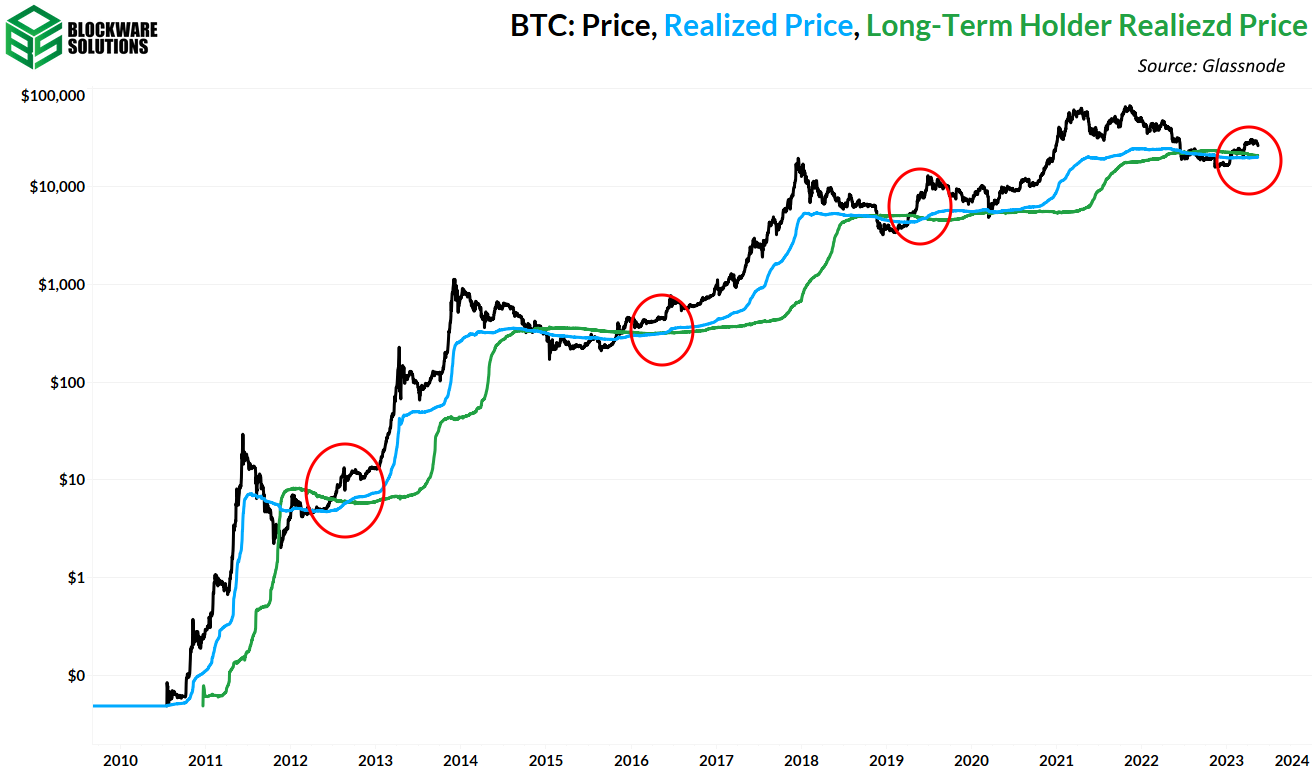

That’s the message from bitcoin’s realized price, which appears on track to exceed the realized price of long-term holders. Historically, this so-called bull cross has marked the end of bear markets and the onset of major price rallies.

Bitcoin’s realized price is the average value of bitcoin supply calculated at the price at which coins were last moved on-chain. The long-term holder (LTH) realized price reflects the average on-chain acquisition price for coins held outside centralized exchanges and not moved for at least 155 days.

At press time, bitcoin realized price was $20,129, or just 3.5% short of the LTH’s realized price of $20,845, which has been steadily falling since November, according to data tracked by blockchain analytics firm Glassnode.

“Looking at long-term holder realized price as well as realized price (aggregate cost basis of all market participants), they are nearing a bullish cross which has accurately signaled previous bear market bottoms,” Blockware Solution’s weekly newsletter dated May 12 said.

The chart shows the blue line representing the realized price could soon cross above the green line representing the LTH realized price.

Previous crossovers of the two, dated June 2019, May 2016 and Sept. 2012 paved the way for multi-year bull runs.