Stock Markets

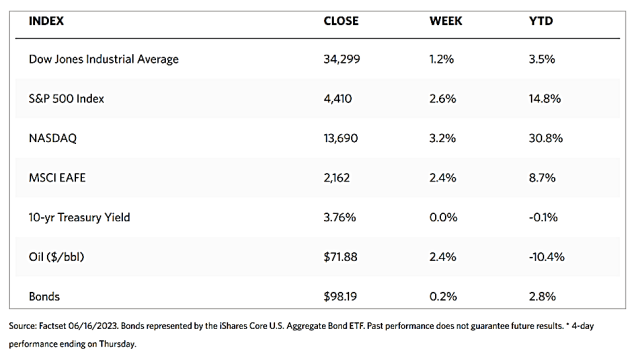

Indexes were up over the past week. The Dow Jones Industrial Average (DJIA) gained by 1.25% while the total stock market rose by 2.49%. The broad-based S&P 500 Index ascended by 2.58% and the technology-tracking Nasdaq Stock Market Composite Index overperformed with a gain of 3.25%. The NYSE Composite climbed by 1.90% and the CBOE Volatility, the indicator of investor risk perception, descended by 2.10%. The S&P 500 recorded its longest run of daily gains since November 2021. The market’s gains narrowed slightly, though, as seen in the renewed outperformance of growth stocks and large caps.

The key factor in the stock markets’ rally was the fact that the Federal Reserve kept interest rates unchanged during its meeting this week. This is the first time in more than a year that the Fed kept interest rates steady. The policy interest rate underwent 10 straight hikes totaling 5% over 14 months. The current pause in further interest rate movements is appropriate since inflation has halted its uptrend and has begun to move down. The rate increases may not be totally over, however, since the Fed remains committed to bringing inflation down to its 2% target.

U.S. Economy

The economy is arguably signaling the expansion of continued growth simultaneous with falling inflation. The Labor Department announced on Tuesday that the consumer price index had risen by 4% year-over-year, which is still 100% higher than the Fed’s target despite coming down from the 4.9% rate recorded in the previous month. This is the slowest pace since March 2021. On Thursday, the Labor Department announced that the producer prices in May had declined by 0.3%, the fourth decline over the past six months. A fall in producer prices is a sign of ongoing contraction in the manufacturing sector together with a significant drop in food and gasoline prices. On the consumer side, investors received optimistic news. Retail sales rose overall by 0.3% for the month and 1.6% over the past 12 months, the first year-on-year increase since January. Excluding the volatile auto and gasoline segments, the increase in sales measured 0.4% in May.

The University of Michigan’s gauge of consumer sentiment meanwhile rose by more than expected to its highest level in four months. Defying consensus expectations, the weekly jobless claims remained unchanged. It was anticipated to decline from the 20-month high recorded over the previous week. The cause for a pause in the Fed rate hikes appears justified. Core inflation (excluding volatile food and energy prices) continue to moderate, first heralded by declines in core services, and more recently due to the sharp decline in producer prices. Aside from moderating inflation, the manufacturing activity has been contracting for the past six months and business investment has materially declined, indicating that two drivers of the economy are losing steam. The CPI components that remain stubbornly unmoving are home prices and rents, although recent indicators suggest that shelter prices may soon be on the way down as well. While consumer spending may be the factor that will prevent a recession, the softening labor market is sufficient cause for the Fed to remain cautious.

Metals and Mining

Over the last two months, gold traded within a band between a high of $2,080 and a low of $1,950 per ounce. Gold appears to be set to continue trading within this narrow band, and while risks to the downside are growing such as the uncertain direction in the Fed’s policy, investors should not underestimate that there lies some underlying strength in the gold market. Even the recent pause by the central bank did not significantly impact the support that continued to solidify. Consistent with expectations, the rise in interest rates triggered some significant selling in gold, causing gold prices to soften because rising interest rates also raises the precious metal’s opportunity costs. Heading into the weekend, however, gold prices bounced back in the broader range to trade at $1,970 per ounce to end up relatively unchanged for the week.

The spot prices of precious metals were mixed for the week. Gold ended the week at $1,957.99 per troy ounce, down slightly by 0.16% from the last week’s close at $1,961.19. Silver also corrected downward by 0.37% from the previous week’s closing price of $24.29 to this week’s closing price of $24.20 per troy ounce. Platinum came from last week’s closing price of $1,011.70 to end this week down by 2.46% with a price of $986.84 per troy ounce. Palladium, which closed a week ago at $1,328.51, ended this week at $1,416.62 per troy ounce, up by 6.63%. The three-month LME prices for base metals were also mixed. Copper rose by 2.52% from its week-ago price of $8,347.50 to end this week at $8,558.00 per metric ton. Zinc gained by 2.99% from last week closing price of $2,408.50 to end this week at $2,480.50 per metric ton. Aluminum lost 0.22% of its value from last week’s close at $2,254.50 to end this week at $2,249.50 per metric ton. Tin gained by 5.45% from its previous price of $25,817.00 to this week’s closing price of $27,225.00 per metric ton.

Energy and Oil

News emanating from China has, for the first time in many weeks, pushed oil prices up. After the Fed hinted at further interest rate increases and inventory climbed, the timing could not have been better. This week, China issued higher oil import quotas as Beijing loosened its monetary policy. Authorities in Beijing have issued the third batch of 2023 crude oil import quotas for a total volume of 62.28 million tons. The issuance took this year’s total to 194.1 million tons, up 20% year-on-year and giving a new boost to private refineries’ buying in China. These twin developments should see higher activity from Chinese refiners that ought to provide much-needed demand upside for oil.

Natural Gas

Global trade in liquefied natural gas (LNG) increased by 2.6 billion cubic feet per day (Bcf/d), equivalent to 5% compared with 2021, according to data from CEDIGAZ. The growth in global LNG trade is attributable to additional liquefaction capacity primarily in the U.S. and increased LNG demand in Europe to substitute for displaced natural gas imports from Russia. LNG exports increased the most from the U.S., as well as from Malaysia, Norway, Trinidad and Tobago, Russia, Oman, and Equatorial Guinea. The largest increases in LNG imports were in Europe including Turkiye, while imports declined in Latin America and Asia, although Japan returned as the world’s largest LNG importer in 2022. Brazil had the largest decrease in LNG imports in Latin America.

For the week ending Wednesday, June 14, 2023, the Henry Hub spot price fell by $0.03 from $2.11 per million British thermal units (MMBtu) to $2.08/MMBtu. The price of the July 2023 NYMEX contract increased by $0.013, from $2.329/MMBtu at the start of the report week to $2.342/MMBtu at the end of the week. The price of the 12-month strip averaging July 2023 through June 2024 futures contracts declined by $0.016 to $3.023/MMBtu.

Also, this report week, international natural gas futures prices increased. The weekly average front-month futures prices for LNG cargoes in East Asia increased by $0.03 to a weekly average of $9.29/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, rose by $2.45 to a weekly average of $10.40/MMBtu. In the corresponding week last year (i.e., the week ending June 15, 2022) the price were $23.19/MMBtu and $28.76/MMBtu in Asia and at the TTF, respectively.

World Markets

Stocks in Europe rose this week in reaction to the decision of the U.S. Federal Reserve to pause its interest rate hikes this month. The pan-European STOXX Europe 600 Index rallied by 1.47% in local currency terms. Also lifting investor sentiments was the hope that China might implement stimulus measures. The major equity indexes also gained in trading this week. Italy’s FTSE MIB advanced by 2.58%, followed by Germany’s DAX which rose by 2.56%, and France’s CAC 40 Index which gained by 2.43%. The UK’s FTSE 100 Index tacked on and added 1.06%. The 10-year German government bond yield ascended above 2.5% subsequent to the announcement by the European Central Bank (ECB) that it would raise interest rates, thus signaling more policy tightening ahead. Also headed higher were Swiss and French yields. Short-end UK gilt yields climbed to their highest levels since 2008 in reaction to UK wages rising more than expected in April, fueling expectations of a further increase in borrowing costs.

Japan stock markets surged for the week as the Nikkei 225 Index rose by 4.5% and the broader TOPIX Index ended higher by 3.4%. The markets’ rally to their highest levels in more than thirty years was fueled by the decision by the Bank of Japan (BoJ) to maintain its ultra-loose monetary policy, as was widely expected. Also boosting market sentiment was the stronger-than-expected Japanese export and machinery order data. Investors remained wary, however, after the U.S. hinted that more rate hikes were likely despite the pause in increases for this month. The yield on the 10-year Japanese government bond (JGB) fell to 0.41% from 0.43% at the end of the previous week. The yen softened to about JPY 141.0 from a prior JPY 139.4 against the U.S. dollar. The currency is at tis lowest level in seven months on the expectation of continued divergence in monetary policies between the BoJ and the Fed.

Chinese stocks rose after the central bank cut several interest rates. The move raised hopes for more upcoming stimulus to industries that have been slowing amid the fading post-pandemic recovery. The Shanghai Stock Exchange Index rose by 1.3% while the blue-chip CSI 300 surged by 3.3%. Hong Kong’s benchmark Hang Seng Index soared by 3.35%. On Thursday, in its first reduction since last August, the People’s Bank of China (PBOC) reduced its medium-term lending facility rate by 10 basis points to 2.65%. Market participants largely anticipated the move after the PBOC suddenly lowered the seven-day reverse repurchase rate, a short-term policy rate, by a similar amount earlier in the week. As Beijing steps up measures to bolster the recovery effort, the central bank’s pivot toward stimulus may lead to targeted support for some industries.

The Week Ahea

Major economic reports to be released in the coming week include manufacturing and services activity data, the U.S. current account data, and leading economic indicators.

Key Topics to Watch

- Home builder confidence index

- Housing starts

- New York Fed President John Williams speaks

- Fed Chair Powell testifies to House panel

- Senate nomination hearing for Fed Govs. Jefferson and Cook and nominee Kugler

- Initial jobless claims

- U.S. current account

- Existing home sales

- Fed Chair Powell testifies to Senate panel

- U.S. leading economic indicators

- S&P flash U.S. services PMI

- S&P flash U.S. manufacturing PMI

Markets Index Wrap Up