Stock Markets

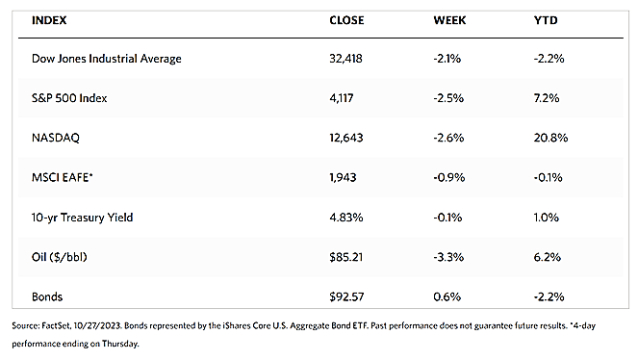

Stocks continued their slide this week to enter into correction territory, 10% down from their highest in late July. The Dow Jones Industrial Average (DJIA) lost 2.14% for the week while its Total Stock Market Index was not far behind with a loss of 2.60%. The broad-based S&P 500 Index is likewise down by 2.53% and the technology-heavy Nasdaq Stock Market plunged by 2.62%. The NYSE Composite fell by 2.38% while the Russell indexes all plummeted by approximately 2.60% for the week. The sell-down appears attributed to the renewed rise in long-term government bond yields as well as mixed earnings reports by large-cap technology counters.

Despite the pullback, the CBOE Volatility (VIX) risk perception indicator came down by 2.03%, signifying how investors retain confidence that the market is not once more turning bearish. The underlying optimism is driven by sentiment that inflationary headwinds are weakening and it is unlikely that the Federal Reserve will declare any further rate hikes. In the meantime, while the tech giants (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, Tesla) had been the major drivers since last year’s bear market low, their disappointing earnings reports have been the cause of market softness since mid-October. At present, however, the current slump appears to be merely a correction since the U-shaped recovery scenario remains in play. If the price action remains intact, the rounded bottom promises a more stable recovery than if a V-shaped reversal had taken place. Seasonal factors may improve the outlook for the coming two months.

U.S. Economy

Economic news released this week was spearheaded by a better-expected gross domestic product (GDP) report. The U.S. economy expanded in the third quarter by an annualized rate of 4.9% on the back of strong consumer spending. This was the fastest growth recorded since the end of 2021 and exceeded the level seen in the second quarter by more than twice. Home sales reached their highest level in 19 months and S&P Global’s flash U.S. Composite Purchasing Managers’ Index (PMI) inched upward from September, presenting an overall benign economic picture. The Fed’s preferred inflation gauge, the core personal consumption expenditure (PCE), showed a mixed indication as to whether inflation is moderating. Core PCE (excluding the volatile components, food and energy costs) increased to 0.3% in September on a monthly basis, from 0.1% in August. The year-over-year growth of core PCE, however, inched down to 3.7% in September from 3.8% in August. The latest data still showed that inflation remains well north of the Federal Reserve’s long-term target of 2%, but the central bank is nevertheless still expected to hold interest rates steady at its policy meeting scheduled for October 31-November 1.

In the meanwhile, the heightened geopolitical uncertainty briefly elevated WTI oil above $90 per barrel due to worries about possible disruption in the oil supply. However, prices have subsided slightly below that of last year, suggesting that energy will exert a neutral to slightly negative influence on the inflation reading for October.

Metals and Mining

Gold prices were once more propelled up to $2,000 per ounce as investors chased safe-haven assets in reaction to the chaos in the Middle East. The Israel-Hamas conflict that broke at the start of October seems headed for escalation, thus providing gold solid momentum. There is more, however, behind the flight to precious metals than just risk aversion to geopolitical uncertainties. While economic growth reported this week was better than expected, there remains a great deal of economic uncertainty, in the face of the core PCE index rising by 3.7% in the last 12 months. While inflation has indeed fallen to its lowest level since August 2021, it is still almost twice the Fed’s 2% target. Another yellow flag is the updated University of Michigan consumer survey released last Friday which showed a sharp rise in inflation expectations. Survey respondents see consumer prices rising by 4.2% 12 months hence, up from an initial estimate of 3.8%. In this environment, gold prices should be treading about $1,900, and yet it saw its highest weekly close on record at higher than $2,000 per ounce, demonstrating a nascent demand for the precious metal.

The spot prices of precious metals were generally up this week. Gold, coming from $1,981.40 last week, ended at $2,006.37 per troy ounce this week for an increase of 1.26%. Silver, previously at $23.37, ended this week at $23.12 per troy ounce, a loss of 1.07%. Platinum ended this week at $907.55 per troy ounce, an increase of 0.88% from the previous week’s close at $899.61. Palladium closed this week at $1,124.56, with a 2.11% gain over the previous week’s close at $1,101.28. The three-month LME prices of industrial metals also mostly went up. Copper, which closed a week ago at $7,948.50, ended this week at $8,099.00 per metric ton for a gain of $1.89%. Zinc, coming from $2,438.00 the previous week, closed this week at $2,471.50 per metric ton, rising by 1.37%. Aluminum ended this week at $2,220.00 per metric ton, gaining by 1.76% from the prior week’s close at $2,181.50. Tin closed this week at $24,902.00 per metric ton, for a slight loss of 0.33% from the previous week’s closing price of $24,985.00.

Energy and Oil

Oil prices this week moved within a narrow range. ICE Brent was bound between $88 and $90 per barrel, moving in a seesaw pattern in day-to-day trading due to the ebb and flow of geopolitical concerns. The military airstrikes conducted by the U.S. on Syrian territory close to the week’s end pushed Brent above $90 per barrel on Friday’s trading before slightly receding. As Israel begins raids into Northern Gaza, market participants are anticipating a possible Iranian retaliation and possible escalation across the broader region. Despite the volatile situation, however, oil prices as expected to record their first week-on-week decline since early October.

Natural Gas

For the report week beginning Wednesday, October 18, to Wednesday, October 25, 2023, the Henry Hub spot price fell by $0.04 from $2.90 per million British thermal units (MMBtu) to $2.86/MMBtu. Regarding the Henry Hub futures, the price of the November 2023 NYMEX contract decreased by $0.046, from $3.056/MMBtu at the start of the report week to $3.010/MMBtu by the week’s end. The price of the 12-month strip averaging November 2023 through October 2024 futures contracts declined by $0.06 to $3.315/MMBtu. Across the United States, the natural gas spot prices declined modestly this report week, except for the West Coast where prices changed substantially.

The international natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $1.71 to a weekly average of $18.21/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.12 to a weekly average of $15.65/MMBtu. By comparison, during the week last year corresponding to this week (the week from October 19 to October 26, 2022), the prices were $31.52/MMBtu in East Asia and $31.61/MMBtu at the TTF.

World Markets

Amid uncertainty about the economy, inflation, rising interest rates, and the possible escalation of conflicts in the Middle East, the pan-European STOXX Europe 600 Index ended the week lower by 0.96%. Major stock indexes also descended – the U.K.’s FTSE 100 Index by 1.50%. Italy’s FTSE MIB slipped by 0.25%, France’s CAC 40 Index dipped by 0.31%, and Germany’s DAX eased by 0.75%. After the European Central Bank (ECB) kept short-term interest rates on hold, Eurozone government bond yields also moderated slightly, giving rise to speculations that rates in the eurozone have at last reached their peak. The 10-year Italian government bond fell to around 4.81% while the 10-year German bund slipped to around 2.84%. The ECB finally left its key deposit rate unchanged at 4.0% after increasing interest rates 10 consecutive times. The ECB reiterated that by maintaining this level for a long enough period, inflation would be brought down to its medium-term target of 2%. Previous tightening of monetary policy is already spreading into financial conditions and dampening demand, according to the Governing Council. The Eurozone is perceived to remain weak for the remainder of this year.

Japan’s stock markets calmed during the past week as the Nikkei 225 Index eased by 0.86% while the broader TOPIX Index moved sideways. Market sentiment was weighed down at the beginning of the week by rising bond yields and growing political tensions. However, it lifted slightly as a result of investor bottom-fishing at the lows, technology stocks rebounding, and a fresh injection of Chinese economic stimulus, allowing the local bourses to recoup their losses. A pickup in inflation and moves in the foreign exchange and bond markets somewhat drove speculation of potential intervention by the government and a likely adjustment to the yield curve control policy by the Bank of Japan (BoJ) in its upcoming meeting. The 10-year Japanese government bond’s yield rate climbed to a 10-year high of 0.87%, approaching the BoJ’s upper bound of 1.0% at the start of the week. The yen weakened past the closely monitored JPY 150 to the U.S. dollar but Finance Minister Shunichi Suzuki declined to comment as to whether the BoJ intervened.

In China, equities ascended in response to the improvement in industrial profits which suggests that the economy may be stabilizing. The blue-chip CSI 300 gained 1.48% while the Shanghai Composite Index climbed by 1.16%. The Hong Kong benchmark Hang Seng Index advanced by 1.32% during the holiday-shortened week as Hong Kong stock markets were closed on Monday for the Chung Yeung Festival. In September, profits at industrial firms in China increased by 11.9% year-on-year, marking the second consecutive monthly increase. However, it slowed from the 17.2% rise in August. Profits fell by 9% from a year ago for the first nine months of 2023, following a contraction of 11.7% recorded in the first eight months of this year. Demand improved during September, leading credence to the possibility that segments of China’s economy may have bottomed.

The Week Ahead

For the coming week, important economic data scheduled for release includes the FOMC meeting, labor market data, and the home price index.

Key Topics to Watch

- Employment cost index for Q3

- S&P Case-Shiller home price index (20 cities) of August

- Chicago Business Barometer for October

- Consumer confidence for October

- ADP employment for October

- S&P U.S. manufacturing PMI for October

- Job Openings for September

- ISM manufacturing for October

- Construction spending for September

- Federal Reserve decision on interest rates

- Fed Chairman Powell press conference

- Initial jobless claims for October 28, 2023

- U.S. productivity for Q3

- U.S. unit-labor costs for Q3

- Factory orders for September

- U.S. nonfarm payrolls for October

- U.S. unemployment rate for October

- U.S. hourly wages for October

- Hourly wages year-over-year

- S&P U.S. services PMI for October

- ISM services for October

Markets Index Wrap-Up