Following a series of recent glitches affecting banks’ ability to release customer funds, the UK retail space has been hit with contactless payment issues

In the UK, a nationwide issue has been reported with thousands of customers unable to make contactless or mobile payments at the nation’s leading retailers.

Across social media, hundreds of morning shoppers (on July 11), have flagged issues with Visa and Mastercard not completing contactless or card payments.

The result is that leading UK retailers have had to resort to cash-only payments. A sign in one Sainsbury’s store requested customers to pay for their shopping in cash.

On social media, the supermarket said it had been aware of a “nationwide issue” with card payments.

Asda also confirmed it was aware of an issue and was working to get it fixed.

On Down Detector, more than 600 people flagged an issue with Visa while over 100 reported issues with completing payments via Mastercard.

A spokesperson from Mastercard has said: “We are aware of some payment transaction issues at select merchants in the UK… There is no current indication these issues are related to our network.”

Will payments in the digital age be subject to more outages?

The confirmed payment outages at several of the UK’s largest retailers follow glitches at leading UK banks from the end of June – resulting in delays to customers receiving their pensions and people’s payday being delayed.

Banking customers of Nationwide, HSBC and Virgin Money were all affected by problems affecting their banking services. For many, this seriously affected personal finances.

At the time, Nationwide, HSBC and Virgin Money all released statements saying they were aware of issues affecting their online and mobile banking platforms.

This event followed a four-hour outage affecting NatWest banking services in May.

These issues, whether in payments or financial services, tend to spring up randomly and without warning, and there will certainly be more like it in the future.

The real issue is not so much the impact of the outages – which are usually swiftly resolved – but the effect this has on consumer trust in digital payments and modern financial services.

Affecting consumer trust in digital financial services

Indeed, consumer trust in digital payments and digital financial services has grown markedly throughout the past few years, spurred in part by its necessity following the COVID-19 pandemic.

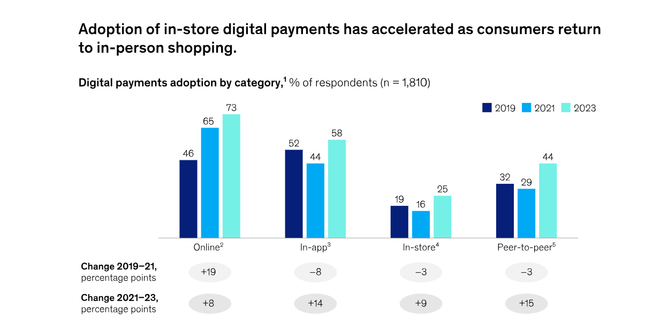

McKinsey & Co.’s 2023 consumer digital payments report revealed that in-store digital payments rose to 25% that year from 16% the previous year.

McKinsey & Co. report

Elsewhere, a PCI Pal report made in conjunction with Worldpay found that 9 out of 10 shoppers were satisfied with the overall digital payments experience in-store.

Two-thirds of respondents in the US (63%) and the UK (68%) found digital wallet solutions attractive due to their speed and simplified checkout process, while nearly half of UK shoppers (49%) believe it is easier than entering payment card numbers with traditional card payment methods.

However, outages like these – particularly if they continue – will impact consumer trust. And with a lack of trust comes customer mistrust, particularly for the retailers who place their faith in third-party payment providers.

Head of Transact & Infrastructure products at IR, David Guiver, highlights the importance of real-time transaction monitoring to mitigate the effects of outages and provide swifter fixes.

He says in his blog: “No other industry is as complex as today’s payments industry, so it’s crucial to monitor your entire payments ecosystem in real-time. Without stringent monitoring, financial institutions are open to frequent payment failure, resulting in crippling downtime.”

“With our payment monitoring solution, IR Transact, we manage 600 million transactions daily. With specifically programmed alerts in place, our customers report that they experience a significant improvement in problem detection and resolution time.”