Stock Markets

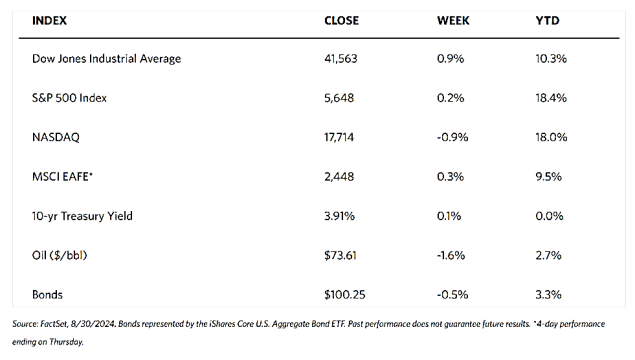

Most of the major indexes ended in positive territory. The Dow Jones Industrial Average (DJIA) gained modestly by 0.94% and the Total Stock Market Index gained by 0.21%. The S&P 500 Index inched up by 0.24% while the NYSE Composite rose by 1.04%. Among the major indexes, only the technology-heavy Nasdaq Stock Market Composite Index suffered a loss, although a modest one of 0.92%. The CBOE Volatility Index (VIX), the indicator of investors’ risk perception in the market, fell by 5.42%, suggesting that the market consolidation contributed to lower volatility risk in the market.

Trading this week was light ahead of the Labor Day holiday weekend. Fewer shares exchanged hands on Monday more than any other full trading day (excluding early closes) this year so far. The Nasdaq Composite underperformed the other major indexes, having been pulled lower partly by the chip company NVIDIA which lost $300 billion or 10% of its value at the stock’s lowest point on Thursday. Value stocks outperformed growth shares by the largest margin since late July. The market will remain closed on Monday in observance of the Labor Day holiday.

U.S. Economy

Playing a robust role in driving sentiment in the markets this week is the end of the earnings season and the week’s moderately busy economic calendar. The Labor Department’s release of its core personal consumption expenditure (PCE) price index on Friday morning was the most closely watched data point this week. The core PCE price index is the Federal Reserve’s preferred inflation gauge, and it showed that prices rose by 2% in July which aligned largely with expectations. The year-on-year price increase was a tick below the consensus of 2.6%, pleasing investors with the confirmation that inflation remained subdued and close to the Fed target. In particular, Nasdaq futures surged in the wake of the release.

On the back of improving inflation concerns, the housing sector appeared to be the weakest in the expanding economy. On Thursday, the National Association of Realtors reported that pending home sales had plummeted by 5.5% in July, the lowest level on record since 2001. The drop was attributed by the association’s chief economist to “affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election,” and the expectations by some buyers that mortgage rates will drop as the Fed eases policy.

Metals and Mining

Precious metals, particularly gold and silver, came under strong selling pressure ahead of the four-day Labor Day weekend. Understandably, some players may want to close their positions particularly facing a month-end and before a protracted holiday weekend, and while prices may have room to move lower, it retains a significant upward momentum. As gold reached its all-time highs above $2,500 per ounce last week, technical momentum indicators did not suggest that the market was close to overheating. Despite gold’s record highs, there is little of the euphoria that traditionally accompanies a market top in gold. Another indication is that while gold is not in overbought territory, the U.S. dollar is oversold and may be facing a potential bounce. The U.S. dollar index this week dropped to its lowest levels since mid-July 2023 and is testing support at 100.50. The dollar index measures the greenback against a basket of currencies. Interest rates may soon be coming down, and some volatility may be expected in the gold market as it reacts to forces such as the U.S. dollar, but the marketplace still affords some broad support.

The precious metals spot market entered a slight correction for the week. Gold, which ended at $2,512.59 last week, closed at $2,503.39 per troy ounce this week for a dip of 0.37%. Silver came from its close last week at $29.82 to end this week at $28.86 per troy ounce for a loss of 3.22%. Platinum descended from its close last week at $965.62 to close this week at $929.79 per troy ounce to register a loss of 3.71%. Palladium, which closed last week at $964.30, bucked the trend and ended at $969.63 per troy ounce for a gain of 0.55%. The three-month LME prices for industrial metals also registered a correction. Copper closed at $9,235.00 per metric ton this week for a loss of 0.58% from last week’s close of $9,288.50. Aluminum closed this week at $2,447.00 per metric ton, a decline of 3.74% from last week’s close at $2,542.00. Zinc slid by 0.52% from its close last week at $2,912.00 to close this week at $2,897.00 per metric ton. Tin dipped by 72% from its ending price last week of $32,912.00 to settle this week at $32,346.00 per metric ton.

Energy and Oil

Oil markets have undergone a volatile week due to Libya’s oil blockade that sent a supply shock through the markets, after which traders returned to focus their attention on China’s demand. Iraq has simultaneously exerted mounting pressure on Kurdish producers to reduce their output. Aftermarket reports indicated that output in the region is as high as 350,000 barrels per day (b/d), the federal Iraqi government sent an ultimatum to Kurdistan’s Regional Government to reduce its crude production. The move undermines Iraq’s commitments under the OPEC+ compensation plan. Meanwhile, the U.S. has released some constructive macroeconomic news. Oil prices swung back into the red early on Friday morning, with Brent trading at $78.54 and WTI below $75.

Natural Gas

For the report week from Wednesday, August 21, to Wednesday, August 28, 2024, the Henry Hub spot price fell by $0.23 from $2.12 per million British thermal units (MMBtu) to $1.89/MMBtu. Regarding Henry Hub futures, the September 2024 NYMEX contract expired at the end of this report week at $1.930/MMBtu, down by $0.25 from the start of the report week. The October 2024 NYMEX contract price decreased to $2.097/MMBtu, down by $0.22 from the start to the end of the report week. The price of the 12-month strip averaging October 2024 through September 2025 futures contracts declined by $0.11 to $2.957/MMBtu.

At all major pricing locations this report week, natural gas spot prices fell. Price declines range from $2.83 at the Waha hub in West Texas to $0.01 at the Eastern Gas South. Regarding the international natural gas futures, price changes were mixed during the report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia were unchanged this week at $13.90/MMBtu. Natural gas futures for delivery at the Title Transfer Facility in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.28 to a weekly average of $12.32/MMBtu. In the week last year corresponding to this report week, (from August 23 to August 30, 2023), the prices were $13.33/MMBtu in East Asia and $11.22/MMBtu at the TTF.

World Markets

European stock indexes ended higher for the week in a rally for the fourth week in response to sharply slower inflation. The pan-European STOXX Europe 600 Index gained 1.34% as it rose to a record high. The significant slowdown in inflation supports the case for the European Central Bank (ECB) to cut interest rates in September. Major stock indexes reflected this rally. France’s CAC 40 Index added 0.71%, Germany’s DAX registered a new peak as it accelerated by 1.47%, and Italy’s FTSE MIB surged by 2.15%. The UK’s FTSE 100 Index gained by 0.59%. The Eurozone headline inflation dropped to 2.2% in August from 2.6% in July, closer to the 2% target set by the European Central Bank (ECB), although some policymakers still urge caution. The August inflation figure is the lowest level in three years. Responsible for the decline are higher energy costs a year ago. Core inflation (excluding volatile food and energy costs) was measured at 2.9%. Services inflation, however, quickened from 4.0 to 4.2%, and it is a closely watched indicator by policymakers. The economic sentiment indicator for the euro area climbed from 96 in July to 96.6 in August, the strongest in more than a year. Although consumers were gloomier, confidence improved in the services sector. On the contrary, the business climate index for Germany as measured by the Ifo Institute dropped more than expected to 86.6 in August, its lowest level since February. Companies in Germany appear to be growing more pessimistic, prompting Ifo President Clemens Fuest to say, “The German economy is increasingly falling into crisis.”

Japanese stocks rose over this week, wrapping up a volatile month. The Nikkei 225 Index gained 0.7% while the broader TOPIX Index added 1.0%. Both the indexes lost in the steep sell-off around the start of the month, grounds which they mostly recovered by the month’s end. The deep dive was caused by the late July interest rate hike by the Bank of Japan (BoJ) and was further driven by renewed U.S. growth fears and the speedy unwinding of the yen carry trade. The latest inflation data reinforced a hawkish outlook on the BoJ’s monetary policy. A leading indicator of nationwide trends, the Tokyo-area core consumer price index (CPI) rose by 2.4% year-on-year in August, versus the consensus 2.2% and the highest since March. As the central bank gained confidence that the economy would stably achieve 2% inflation, BoJ Governor Kazuo Ueda reiterated that it would continue to normalize its monetary policy. This is an indication that the central bank is willing to raise interest rates again if its projections for the economy and prices materialize. BoJ Deputy Governor Ryozo Himino further stated that the baseline scenario for the future remains that growth and inflation will develop in line with the BoJ’s outlook. The yield on the 10-year Japanese government bond remained broadly unchanged at about 0.9%. The yen weakened to the high end of the JPY 144 against the USD range from JPY 144.35 at the end of the previous week.

China stocks fell over the week on the back of a series of disappointing corporate earnings reports that fell below expectations and dampened buying sentiment. The blue-chip CSI 300 lost 0.17% while the Shanghai Composite Index fell by 0.43%. The Hong Kong benchmark Hang Seng Index, on the other hand, gained by 2.14%. The country continued to deal with a prolonged property sector slump and weak domestic demand prompting some Chinese economists to reduce their 2024 growth forecasts. A key consumption indicator, retail sales, is estimated to grow by 4% this year, lower than the July estimate of 4.5%. Expected fixed asset investment, estimated during the prior month at 4.4%, is now projected to grow at 4.2%. The estimated consumer price index forecast previously at 0.6% has been trimmed to 0.5%. This sober outlook for China has raised the probability that the country may fall short of its official growth target of 5% in 2024. Speculations were also raised that the central bank may loosen its policy further in the short term, together with additional interest rate cuts. The reserve requirement ratio for domestic lenders may also be reduced.

The Week Ahead

The ISM Manufacturing PMI, job openings for July, and the nonfarm payrolls report for August are among the important economic releases expected in the coming week.

Key Topics to Watch

- S&P final U.S. manufacturing PMI for Aug.

- Construction spending for July

- ISM manufacturing for Aug.

- U.S. trade deficit for July

- Job openings for July

- Factory orders for July

- Fed Beige Book

- Auto sales for Aug.

- ADP employment for July

- Initial jobless claims for Aug. 31

- U.S. productivity (revision) for Q2

- S&P final U.S. services PMI for Aug.

- ISM services for Aug.

- U.S. employment report for Aug.

- U.S. unemployment rate for Aug.

- U.S. hourly wages for Aug.

- Hourly wages year over year

- New York Fed President Williams speaks (Sept, 6)

- Fed Gov. Christopher Waller speaks (Sept. 6)

Markets Index Wrap-Up