U.S. stocks turned in a lackluster performance Wednesday, but this session goes down in the record books as the day that marked the longest bull market run in history.

The current bull market began on March 9, 2009, when the S&P 500 was at 676 points, hard hit by the Great Recession.

Nine and-a-half years later, and the S&P 500 has rallied about 323 percent. The tech-heavy Nasdaq Composite has been the biggest winner, with a 611 percent gain, a clear testament to the strength of the tech sector. The Dow Jones Industrial Average has appreciated about 300 percent.

What does this mean for investors? For those who invested when the market was at or near the bottom, their pocket books should be heavier. While the S&P 500 gained about 323 percent, the biggest gainers among current S&P 500 constituent stocks saw far larger gains. Top-ranked GGP returned over 7,000 percent, so far, in this bull run.

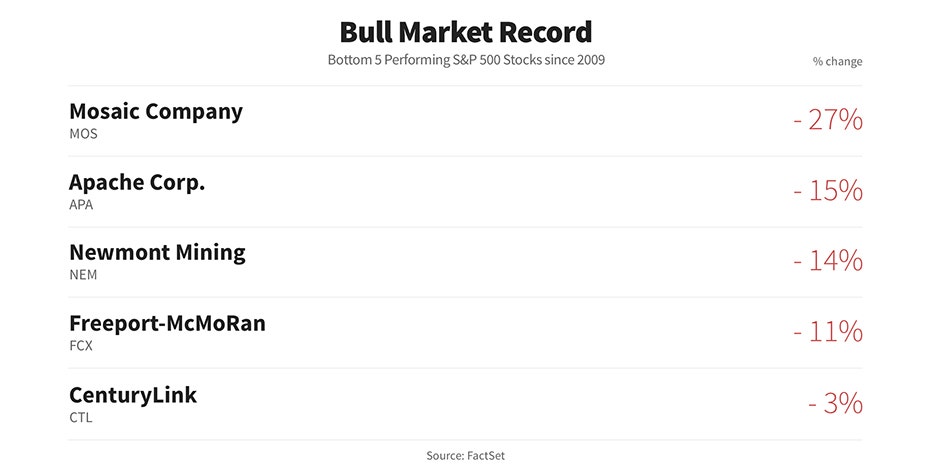

A look at the biggest losers paints a different picture. Over the period, the stock that experienced the biggest decline was Mosaic Co., whose shares fell 27 percent.

The recession that hit caused nervous consumers to crimp spending, but in this bull run, there has been a major behavior shift. As it has continued, consumers have become more confident and as consumers have opened their purse strings, consumer-focused companies have benefited. So far in this rally, consumer discretionary, goods and services that are non-essential but desired by consumers if they have the disposable income, have led the performance.

What happens from here? As the bull market has aged there have been some concerns that it would run out of steam. But, many believe it has plenty of room to run. Consumer spending makes up about two-thirds of U.S. economic growth, and economic data shows that consumers are confident in their finances. Just on Wednesday, when discussing the latest quarterly results, Target’s CEO Brian Cornell said, “we’re currently benefiting from a very strong consumer environment — perhaps the strongest I’ve seen in my career.”

Companies have been particulary positive about tax reform, which President Trump signed into law in late 2017.

As the bull market has aged, some have grown concerned that it’s only a matter of time until its momentum runs out.During an interview with FOX Business’ Neil Cavuto, Peter Eliades, editor of Stockmarket Cycles, said bear market indicators are evident in the markets, adding that he’d be “amazed” if the market moves above its current position 10 years from now.Other market experts are much more positive. Jeff Carbone, managing partner at Cornerstone Wealth, said in a statement, “While this bull may be showing some age, we still think there is plenty of room to run, and that stocks will again set all-time highs later this year.”