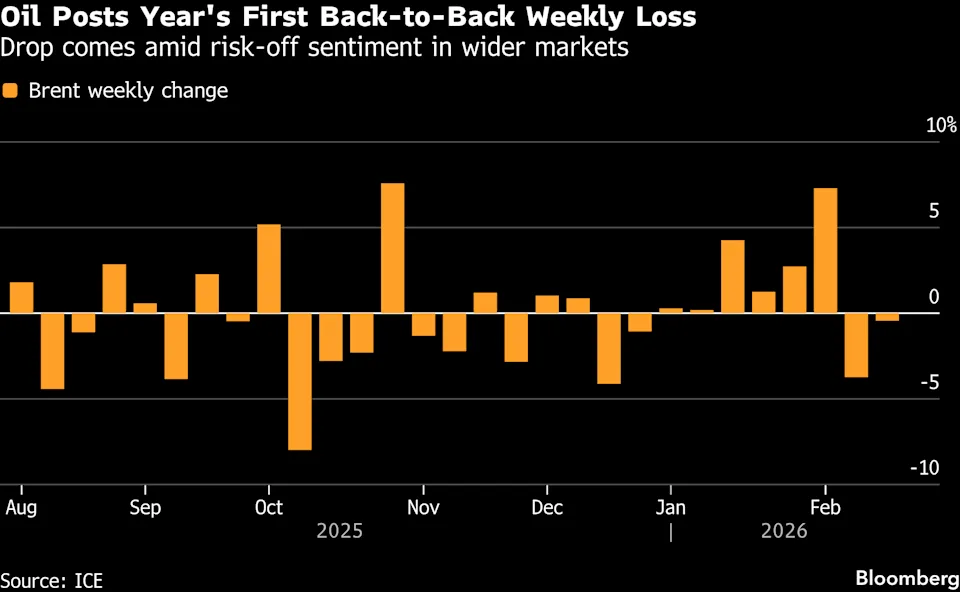

Oil notched its first back-to-back weekly drop this year as traders weighed the prospect of expanded OPEC+ supplies against US-Iran nuclear talks and recent weakness in wider markets.

West Texas Intermediate fell 1% for the week and ended the day little changed on Friday. President Donald Trump said the US deployed an additional aircraft carrier to the Middle East in case a nuclear deal isn’t reached with Iran. “If we don’t have a deal, we’ll need it,” Trump said at the White House. He added he thinks negotiations will ultimately be successful. Traders have been watching for any uptick in tensions between Washington and Tehran that could pose a threat to supply from the Middle East.

The commodity was down earlier as OPEC+ members see scope for output increases to resume in April, believing concerns about a glut are overblown, delegates said. The group hasn’t yet committed to any course of action or begun formal discussions for a March 1 meeting, they added.

A second weekly decline in the futures market stands to snap a long run of gains for early 2026, when recurrent bouts of geopolitical tension including the US stand-off with Iran supported oil prices.

At an energy conference in London this week, attendees flagged that they expect worldwide supplies to top demand this year, potentially feeding into higher inventories in the Atlantic basin, the region where global prices are set. Still, a pile-up of sanctioned oil coupled with supply disruptions in various nations has limited the impact thus far.

Trading may be thinner ahead of the Presidents’ Day holiday in the US, contributing to exaggerated price swings.