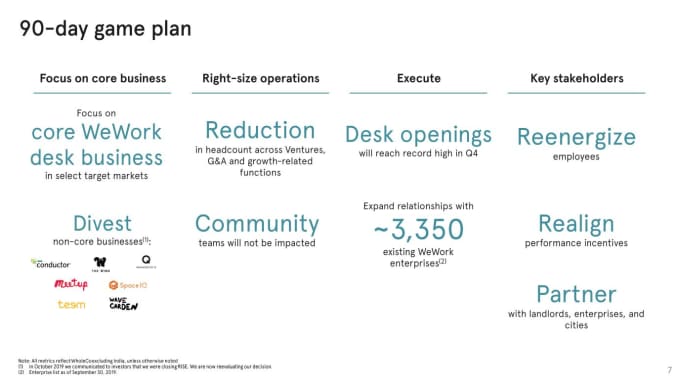

WeWork released Friday a “90-day game plan” that details sweeping changes to its businesses, including a divestiture of all “non-core businesses” and a reduction in headcount.

The changes are detailed in a nearly 50-page presentation, which was first put together in October as part of a pitch to investors, but was made public on Friday. WeWork said it plans to divest several of its side ventures, including content marketing platform Conductor, women-focused co-working start-up The Wing, office management platform Managed by Q, Meetup, real estate-focused start-up SpaceIQ, workplace software company Teem and Wave Garden, a maker of wave pools.

The company expects job cuts to occur across its ventures, G&A and growth-related functions, but said the community teams, which oversee WeWork’s physical locations, will not be impacted as a result of the move.

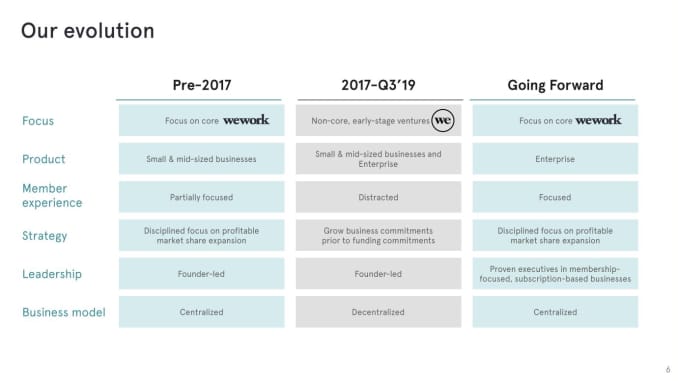

WeWork plans to focus on the core office-sharing desk business, in an effort to turn around the struggling company, as well as “re-energize employees” and “realign performance incentives.” Specifically, the company plans to turn its focus toward enterprise customers, rather than the small and mid-sized businesses, such as start-ups, that it offered leases to in the past.

In an apparent nod to former CEO Adam Neumann, WeWork stated that the company would be led by “proven executives in membership-focused, subscription-based businesses” moving forward, instead of being primarily “founder-led.” Co-CEOs Sebastian Gunningham and Artie Minson replaced Neumann in September following his departure.

WeWork’s occupancy rates in the first half of the year fell slightly from 2018, both in mature and non-mature locations, according to the presentation. Its average occupancy rate year to date is 81%, compared to an average of 84% in 2018.

The presentation comes after several tumultuous months for WeWork. In September, the company pulled its IPO filing after investors balked at its mounting losses and unusual corporate governance structure. WeWork was poised to run out of cash, but secured an eleventh-hour bailout deal from SoftBank.

Shortly after being installed as WeWork’s new chairman, SoftBank exec Marcelo Claure warned that layoffs would be on the way as the company works to cut costs. In a memo to employees obtained by CNBC, Claure attempted to reassure WeWork staff that employees who are impacted would be treated “with dignity and respect.”

“These are the toughest decisions we have to make, but the unfortunate reality is that we will have to complete layoffs in the next several weeks,” Claure said in the memo. “Our top priority is treating those who will ultimately leave us with dignity and respect including fair severance packages and continuation of benefits that allow them to transition to the next phase of their journey.”