Fourth-quarter earnings season is kicking into high gear, and at least one Wall Street strategist thinks there are a handful of names that could cause waves in the market when they report in the coming weeks.

Wall Street is still in the early stages of the quarter’s reporting period with just one-tenth of the S&P 500 index having released their financials so far. Of those, 79 percent have topped earnings estimates, and 87 percent revenue forecasts, according to Thomson Reuters.

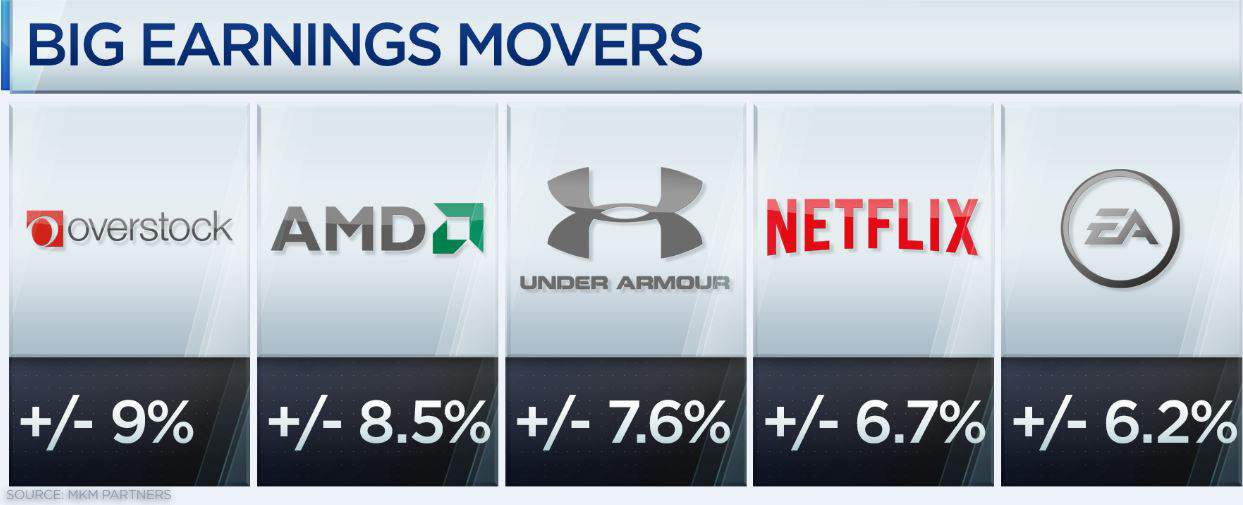

According to derivatives strategist Jim Strugger of MKM Partners, the options market is predicting big moves in the shares of major companies like Overstock — which could rise or fall by 9 percent; Advanced Micro, which may move more than 8 percent; while Under Armour and Netflix could each see a roughly 7 percent move in either direction; and Electronic Arts has an implied move of 6 percent.

Options traders calculate the implied move for equities by measuring the stock’s straddle — or at the money put and call. The amount of the straddle captures expectations for how much the underlying stock could move.

Strugger has his eye on two stocks in particular, the first being Netflix. The streaming media giant is expected to post a big increase in earnings, more than doubling to 41 cents a share in its fourth quarter, with sales forecast to jump 32 percent.

Analysts predict 6.3 million new subscribers in the fourth quarter, the majority of those in its international segment.

“This is a secular growth story on a global basis,” Strugger told CNBC’s “Trading Nation” last week. “It is our favorite among the large-cap internet companies in terms of the potential market-cap growth over the next several years.”

An earnings beat, and subsequent stock rally, would add to Netflix’s already strong start to 2018. Its shares have risen nearly 15 percent so far this year, and close to 60 percent over the past 12 months. Year to date, Netflix is the best performer of the so-called quintuplet of “FANG” stocks that include Facebook, Amazon, and Google-parent Alphabet.

Netflix is “an intimidating name to come into ahead of earnings,” Strugger added. “What we’d like to do is structure a nice position around this to express long directional exposure without putting a ton of capital at risk.”

Strugger also sees the likelihood of a big move in Electronic Arts when it reports earnings Jan. 30. Like Netflix, he sees a bigger chance of a rally than a sell-off.

“There has been a huge build in open interest, almost 4,000 [options] contracts over the last couple of months, and almost all of it biased to the call side,” he said. “The implied move could go either way but the read on the activity in the options market is unambiguously bullish.”

EA is one of the few stocks in this current bull market that has underperformed, said Strugger. The company’s shares came under pressure in late 2017 on bad publicity after video game players accused its “Star Wars Battlefront II” game of aggressive pay-to-play tactics. EA hit a seven-month low in early December, before clawing its way back to current levels.

EA’s earnings outlook, however, looks far less sunny than that of Netflix. EA is expected to post an earnings decline for its fiscal third quarter, dropping to $2.20 a share from $2.48 a year earlier. Sales are forecast to dip 2.6 percent, its first revenue decline since December-ended quarter in 2015.