Berkshire Hathaway’s (BRK-A, BRK-B) first quarter earnings will be released on Saturday morning

The conglomerate overseen by billionaire investor Warren Buffett consists of companies that touch a broad array of industries, and so it’s arguably a reflection of the U.S. economy. And like the economy, it is getting disrupted by the coronavirus pandemic.

In late February, Buffett said “a very significant percentage of our businesses“ was getting affected.

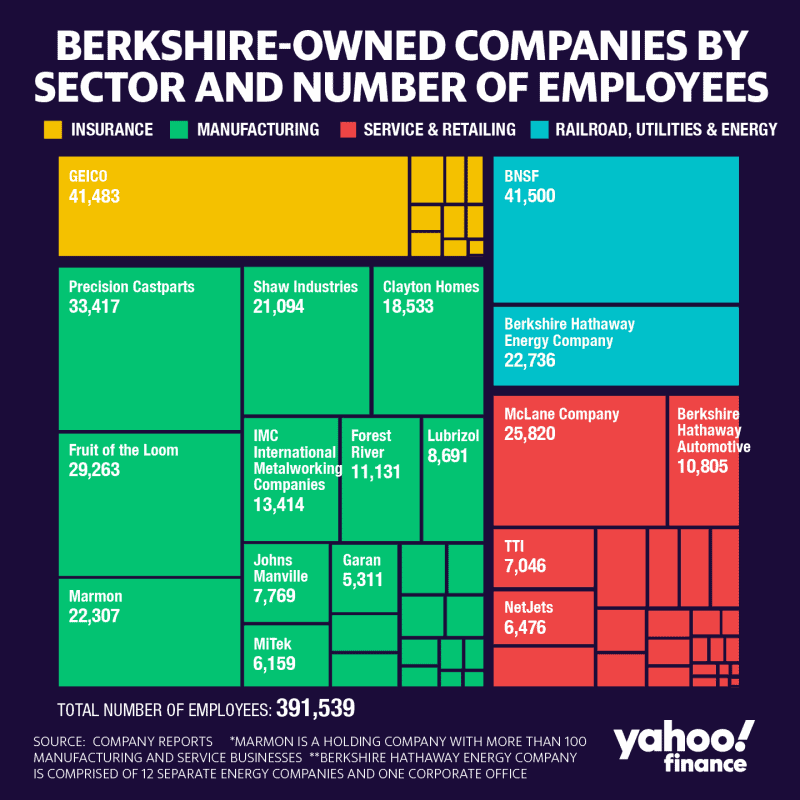

Geico, Berkshire’s auto insurance business, is expected to see a significant improvement in its profit margins as social distancing amid the coronavirus pandemic has kept drivers off the road. And so, fewer car accidents mean better loss ratios.

During an interview on March 10, Buffett told Yahoo Finance’s editor-in-chief Andy Serwer that the COVID-19 outbreak had caused GEICO to see fewer accidents.

“People just haven’t been driving as much,” Buffett said. “People have changed their behavior.”

It’s worth noting, however, GEICO has been offering insurance credit to policyholders.

Berkshire railroad operator, Burlington Northern, likely saw business drop off during the end of the quarter. According to the Association of American Railroads, March carloads were down 6% year-over-year.

Aerospace equipment maker Precision Castparts and chemicals supplier Lubrizol also likely suffered from the economic lockdowns.

And of course, there’s the performance of Berkshire Hathaway’s massive investment portfolio.

It’s safe to say the value of these positions suffered amid the fastest bear market in history. Stocks crashed further before bottoming in late March.

A recent change to generally accepted accounting principles (GAAP) by the Financial Accounting Standards Board (FASB) requires companies to account for short-term swings of their equity investments in their quarterly and annual earnings. These are known as unrealized gains and losses — unrealized because these are paper losses, not actual losses (or realized gains and losses) that come from the sales of these securities. Buffett and vice chair Charlie Munger voice their disdain for the rule with every earnings announcement.

The rule resulted in a $53.7 billion unrealized gain in the previous quarter. This time around, you can expect the opposite and then some.

“Over time, [vice chair Charlie Munger] and I expect our equity holdings – as a group – to deliver major gains, albeit in an unpredictable and highly irregular manner,” Buffett said in February.